Invigor selected as Tencent partner to expand WeChat Pay

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Leading data and analytics solutions company, Invigor Group (ASX:IVO), has executed a pivotal MoU (memorandum of understanding) with China’s Winning Group Holdings — a global solutions provider for WeChat international services, including mobile payments, applications, development and other related services.

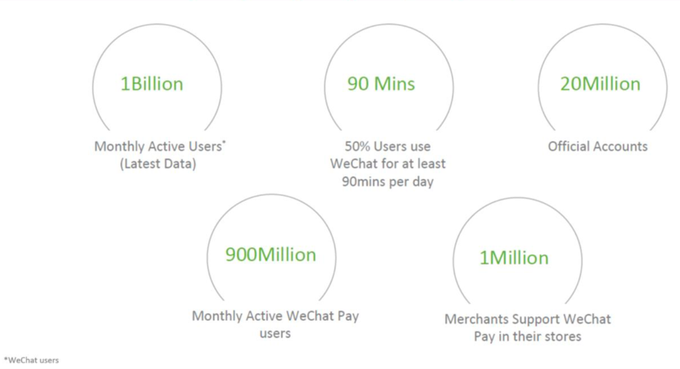

WeChat is owned by China-based heavyweight, Tencent Holding (HKG:0700), which has over 1 billion users, with 900 million using WeChat Pay, most of whom are based in China. WeChat Pay is the preferred payment platform used by Chinese travellers overseas.

Under the terms of the MoU, IVO will partner with Winning Group to market and enhance WeChat Services, including WeChat Pay to the South-East Asian market, initially in Singapore and Hong Kong.

This deal aligns with Tencent’s strategy to rigorously expand the WeChat Smart ecosystem outside of China into the global market, where there is growing demand.

WeChat Pay at a glance:

The agreement also covers the integration of IVO’s proprietary loyalty solution into the WeChat platform, creating a more compelling proposition for merchants that use WeChat Pay, targeting China and other markets where WeChat Pay is present.

Winning Group reaps substantial benefits from IVO’s Loyalty solution and its ability to be integrated into WeChat’s established payments and multi-transaction offering. Merchants — including bricks and mortar retailers, online stores, shopping malls, hotels, restaurants, booking agents and service provider — will also benefit from the enhanced WeChat Pay with embedded Invigor technology.

The MoU covers a 36-month term, and an initial project will be implemented during the next three months in the Singapore and Hong Kong markets.

IVO has a solid footprint of large shopping malls and merchants that are seeking ways to deliver a better shopping experience. These include local shoppers and inbound Chinese tourists that are all avid users of the WeChat ecosystem. IVO will use its established operations in Asia to introduce new merchants to WeChat Pay.

IVO said it intends to work with its customers to offer the benefits of WeChat services.

Under the MoU, IVO will earn revenue in three ways:

- A percentage of transaction revenue (currently estimated at 0.5%) from merchants using WeChat Pay when introduced/acquired by IVO

- Advertising revenue when either party initiates a marketing/promotional campaign with a merchant

- Transaction fees from merchants based on sales revenue when IVO’s Loyalty solution is deployed.

It should be noted, however, that IVO is an early stage tech company and success is no guarantee. Investors should seek professional financial advice before making an investment.

IVO CEO, Gary Cohen, commented: “There can be absolutely no doubt that this MoU is ground-breaking for Invigor and integrates our highly regarded Loyalty solution into one of the world’s fastest growing and most recognised global payment and transaction platforms. Today, there are over 900 million users on the WeChat Pay platform.”

“Invigor can now position its solutions with a global company with tremendous scale and reach. This is truly a unique and an exceptional opportunity to grow our revenue on the back of the many millions of users that WeChat and Tencent will provide us.”

“Our technology can be integrated seamlessly into the WeChat ecosystem which gives us a walk-up start to the potential of millions of users of the WeChat platform in South-East Asia.”

“The revenue-sharing model is well understood and simply defined. Our goal during this initial three-month period is to secure merchant agreements, initially in Singapore and Hong Kong, that recognise the obvious benefits of being part of the WeChat ecosystem. We have a large footprint of merchants and relationships in Asia that we are now approaching,” Cohen said.

“This is a huge endorsement for our company and our solutions and validates the investment we have been making in our Loyalty product set appealing to the likes of global providers such as Tencent.”

“We have established an excellent working relationship with the team at Winning Group and we are now focused on a very quick deployment,” added Cohen.

Cohen noted that IVO would make regular updates on the MoU’s progress.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.