Invigor leveraging WeChat to sell Aussie wine to Chinese consumers

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Invigor Group Limited (ASX:IVO) today confirmed that it is establishing a wine sales platform to sell Australian wine to Chinese domestic consumers and Chinese within Australia.

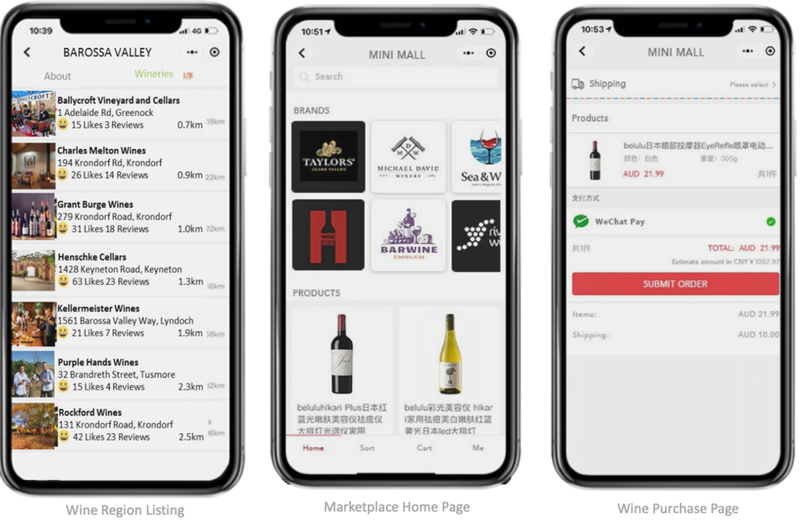

The company is launching a dedicated WeChat-powered online community to market and sell Australian wine, leveraging its WeChat Pay and associated social marketing platform to drive sales.

Invigor will initially target Chinese Australians that visit cellar doors and wine regions and exoand from there to allow Chinese tourists to purchase at cellar door with direct shipment to home address.

Invigor’s now has an immediate distribution channel in China via its partnership with Winning Group with its network of EasyGo stores being a potential retail channel available for product sales.

To assist with pricing and analytics, Invigor’s shopper insights, loyalty and pricing software — which has had extensive take-up among large alcohol beverage companies and retailers in Australia — will be integrated into the WeChat platform.

Utilising the joint venture with Enring, a ‘Mini-Mall’ shop within the WeChat ecosystem, Invigor will provide a safe, secure and trusted online destination for Chinese consumers to see product reviews, check pricing, make notes on tastings, take advantage of promotions, access customer support and execute sales.

Invigor is tapping into a very large industry sector that contributes over $40 billion annually to the Australian economy.

China represents the largest export sector for Australian wine with an estimated $1 billion in annual sales, while Chinese now are the most significant foreign visitors to Australian wineries.

The recent addition of Sun Asia Group to Invigor also enables the company to build on this initiative.

The China-Australia Free Trade Agreement offers Invigor has a competitive advantage. There are zero tariffs on its imports, versus 14% for France. Plus, US wines are now subject to 54% import duty due to US-China trade war.

Invigor’s CEO, Gary Cohen said, “This is another step in Invigor capitalising on its growing WeChat Pay operations, the Smart Farm initiative and our relationships within the beverage sector in Australia. Invigor and Enring have the capability, technology platforms, export licenses and relationships in place to generate sales relatively quickly.”

This is the second announcement from the company this week, after Invigor yesterday reported that its Shopper Insights and Loyalty solution has been selected as the product of choice by several large multi-national groups and nationwide retailers.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.