Institutional investors likely to chase FYI after MSCI inclusion

Published 17-MAY-2021 14:38 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a development that highlights FYI Resources Ltd (ASX:FYI; OTCQB:FYIRF; FSE:SDL) significant discount to fair value, the company has been added to the MSCI Australia Micro Cap Index which is designed to measure the performance of the microcap segment of companies traded on the Australian Securities Exchange.

Investors were quick to pick up on the group’s inclusion which was announced this morning with its shares rallying 6%.

MSCI is a leading provider of investment services such as research, data and technology to the global investment community, enabling clients to better understand and analyse key drivers of risk and return and build more effective investment portfolios.

Importantly, in terms of FYI receiving recognition for the advanced nature of its High Purity Alumina Project, as well as the group’s intellectual property, high-tech commodity exposure and multinational affiliations, inclusion in the MSCI will provide increased exposure to global institutions and investment markets and the potential for liquidity to increase, providing better access to capital sources and the ability to negotiate finance on competitive terms.

A $170 million company with a US$1.3 billion project

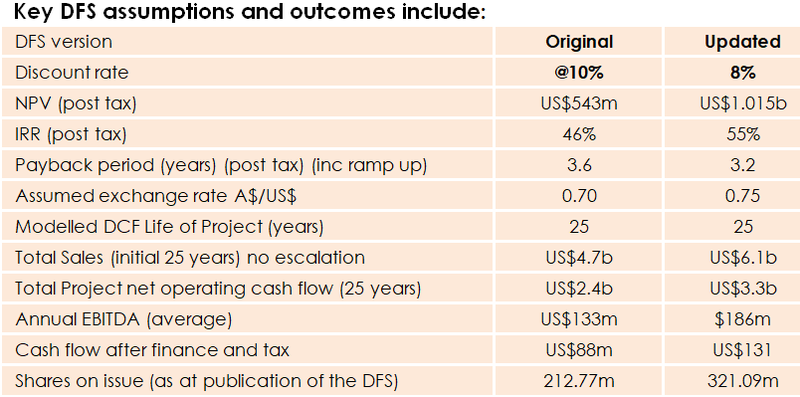

FYI is certainly punching above its weight with its market capitalisation of approximately $170 million far from reflecting the value of its High Purity Alumina Project as outlined in the recently released definitive feasibility study (DFS).

With a proposed production rate of 10,000 tonnes per annum of HPA and generating peak annual EBITDA of $250 million, the project has a net present value of more than $1.3 billion.

Such is the quality of this project that multi-billion dollar, multinational vertically integrated commodities miner, refiner and distributor Alcoa has been working hand-in-hand with FYI through the pilot planning stages and less than a fortnight ago FYI and Alcoa entered a 90 day exclusive period for joint venture discussions.

Should a joint venture agreement be formalised following these discussions, or developments such as offtake agreements emerge with Alcoa or other parties who have already demonstrated their interest in FYI’s product, one would expect a significant rerating.

It could be argued that the likely quantum of such a rerating has increased substantially through the group’s inclusion in the MSCI with much more attention likely to come from institutional investors.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.