Gruden reports 28% revenue growth in FY2017

Published 03-AUG-2017 11:52 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Market leading provider of digital transformation services to the fintech and hospitality sectors, Gruden Group (ASX: GGL), released its quarterly result on Monday. The report covered several important developments that occurred in the three months to June 30, 2017.

Investors responded positively to the update with the company’s shares surging more than 30% under the highest volumes experienced in the last 12 months.

It should be noted however that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

It has been a busy period for GGL with Executive Director Todd Trevillion assuming the position of Chief Operating Officer, charged with the role of driving operational changes within the group.

A number of initiatives have been implemented within GGL to improve operational efficiencies, which should lead to increased margins across all sections of the business.

These initiatives, along with a focus on continuous improvement, should see further benefits realised for FY2018. To that end, there is already evidence of strong momentum within the business from an operational perspective.

Gruden delivers 28% year-on-year revenue growth

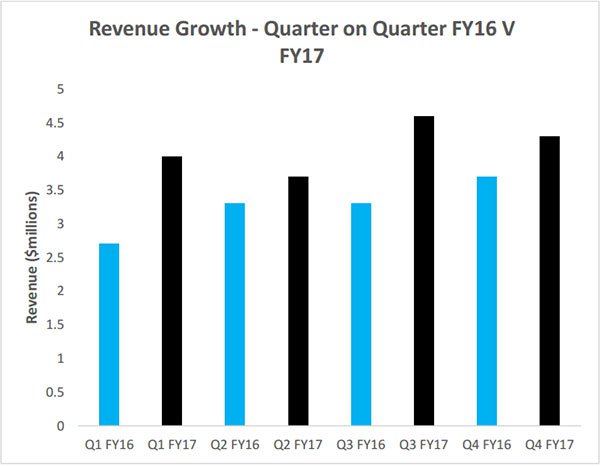

The company reported revenue of $4.26 million in the June quarter, representing an increase of 18% compared with the previous corresponding period. This also implied strong year-on-year growth with full-year revenues of $16.6 million reflecting a 28% increase on fiscal 2016 revenues of $13 million.

As can be seen below, in each of the last four quarters Gruden has outperformed compared with the previous corresponding period, including particularly strong revenue generation in the third and fourth quarters.

The company’s MobileDEN product is being continually enhanced through the addition of new features and capabilities. Management said its significant investment in MobileDEN is ongoing, ensuring it will deliver results for customers in a changing market.

Deal flow has certainly been strong during the quarter with MobileDEN entering into a strategic partnership with PayPal that not only incorporates PayPal’s payment capabilities, but sees MobileDEN become a Master Merchant with PayPal.

One of the key benefits of the relationship is the ability to expedite the on-boarding process for merchants, providing brands with a single transaction report across the whole brand and at the individual store level. The system consolidates all payment types and transactions carried out across the platform into one simple and accessible monthly report.

FY18 looking positive after signing The Coffee Club

Just as GGL ended fiscal 2017 on a strong note, it has also kicked off fiscal 2018 with a major win. In June, MobileDEN announced MadMex would be adopting its new MobileDEN “Connect” product for over 50 restaurants nationwide.

MobileDEN Connect leverages off the core platform and provides a digital loyalty solution with a best of breed customer facing mobile App. Significant research and development has been invested to ensure that an optimal user experience is provided, with relevant brand and marketing information presented in a new way that customers have not experienced before.

As a product, Connect is immediately available for customers who can then opt to further leverage features from the complete MobileDEN platform at a later stage. It provides a seamless, fast and effective means for businesses to launch digital loyalty Apps and build better customer relationships.

Given that the vast majority of quick service restaurants are planning to upgrade their loyalty programs in the near-term, from existing analogue methods (e.g. cards based), the launch of the MobileDEN Connect product is well timed.

MobileDEN has continued to illustrate impressive growth over the quarter with both transactional volume and associated transaction revenue, reporting record month-on-month growth across the platform. With the recent new client wins, MobileDEN has a solid base to generate continued growth in licensing and transactional revenues in fiscal 2018.

As mentioned, the company has started the new financial year in fine style, signing Australia’s leading Café group, The Coffee Club, to its MobileDEN platform. It is worth noting that MobileDEN also successfully launched the Red Rooster home delivery platform adopting the new Connect product.

Gruden’s Digital Services, Government Practice and Performance Marketing business units continue strong sales growth and have undergone cost and operational efficiency reviews in the June quarter. This should lead to improved margins in fiscal 2018, resulting in a greater proportion of revenues dropping to the bottom line.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.