Gruden Group boosts revenues with important government contract

Published 06-DEC-2016 13:36 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Gruden Group (ASX: GGL) announced on Tuesday morning that it had been selected by the New South Wales Small Business Commissioner (OSBC) to deliver an integrated digital solution to enable it to interact more efficiently and effectively with small businesses. This represents a relatively large client base with approximately 700,000 small businesses operating in New South Wales.

This development is positive from a number of perspectives in that the $2.93 million contract will immediately generate revenue in fiscal 2017, and out to 2019 with the prospect of a further two 12 month extensions beyond 2019.

However, as the New South Wales government is already one of GGL’s clients it also serves as an endorsement of the company’s effectiveness in assisting enterprises including government instrumentalities to operate efficiently in a digital environment.

On this note, GGL’s Chief Executive Tim Parker said, “Our technical expertise and capabilities have been proven time and time again and this is yet another example of where we excel in this space”.

Another factor to bear in mind is that this comes on the back of other successes in the government arena including a recent agreement inked with the Public Records Office of Victoria.

Looking at GGL’s overall business, the Gruden Government division accounted for 30% of revenue in fiscal 2016 with Performance Marketing being the largest income generator with 36%.

Consequently, this contract supports an important part of the company’s business, particularly given the division also counts the Australian Government as one of its clients.

Importantly, contracts such as this also assist GGL in enhancing its own product offerings and areas of expertise with Parker saying, “The agreement also provides the opportunity for Gruden to work closely with OSBC in scaling the solution to suit other government and commercial requirements”.

However, how rapidly this coms to bear remains to be seen, and as such this is a speculative investment. Investors should seek professional financial advice if considering making an investment.

Gruden boasts blue-chip client base

As can be seen from the snapshot of GGL’s four divisions there are a number of blue-chip clients as well as major enterprises, including global entities.

Established partnerships with global digital players assists in winning new business

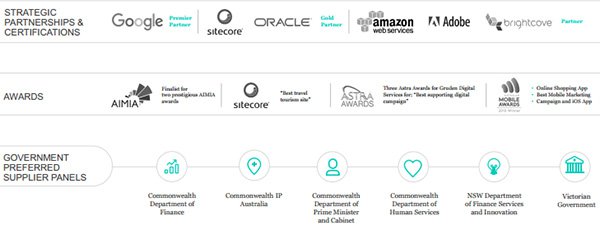

GGL has also forged strong strategic partnerships along the way with major global players in the digital IT space.

As can be seen below, these along with the group’s status as preferred supplier across several government departments leave it well-positioned to successfully tender for new work.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.