GGL delivers strong revenue growth and flags robust fiscal 2017 result

Published 28-APR-2017 15:50 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

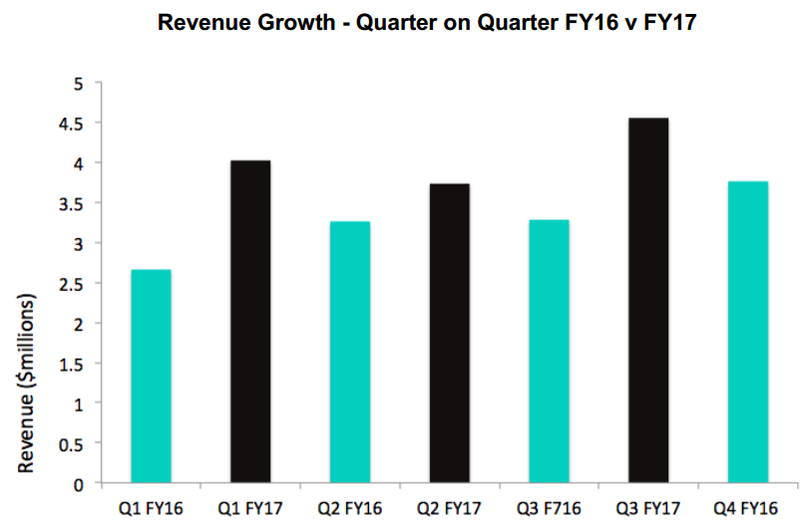

Shares in market leading technology agency, The Gruden Group (ASX: GGL) surged nearly 20% on Friday after the company provided an impressive quarterly update for the three months to March 31, 2017, which featured quarter on quarter revenue growth of 22% and $1.8 million in annualised cost reductions.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. GGL is an early stage play so seek professional financial advice if considering this stock for your portfolio.

Total revenues for the nine months to March 31, 2017 were $12.3 million, well in excess of the previous corresponding period and not far short of fiscal 2016 full-year income of $13 million.

The uptick in revenues were driven by contracts won in the first half of fiscal 2017, and the fact that GGL has gone on to secure further contracts with blue-chip clients in the first four months of 2017 suggests the company is poised to deliver strong year-on-year revenue growth.

The following graph demonstrates the incremental revenue growth that has occurred in the first quarter of fiscal 2016.

Putting a finer point on revenue sources, GGL’s Chief Executive Tim Parker said that contracts with the New South Wales Small Business Commissioner (OSBC), a re-contract with the New South Wales Department of Finance, Services and Innovation, as well as the provision of services to the Public Records Office of Victoria (PROV) made solid contributions, which in most cases should continue out to at least fiscal 2018.

Cash outflows related to operating activities decreased in the December quarter, a result of increased cash receipts from customers. GGL noted that its investment into mobileDEN had continued at circa $200,000 per month as it continued to enhance the platform by offering new features and capabilities.

It appears that this is already paying dividends with clients such as Red Rooster, Starbucks, Oporto, and Mad Mex coming on board. The mobileDEN ordering and payments platform was adopted by Red Rooster as it embarked on a substantial store rollout program in June last year. The platform is now in use at over 250 sites nationally, delivering licensing and transactional revenue.

The high profile partnership with Red Rooster’s owner, Quick Service Restaurant Holdings (QSRH) will see GGL continuing to drive innovation within the online ordering channel, particularly given that it has other fast food businesses operating under its banner.

It may also be significant that an ASX listing could be imminent which would effectively provide the company with greater access to capital and potentially fast track the group’s store expansion strategy.

Management is confident of further contract success, particularly given the company’s high profile standing with accolades such as Premier Google Partner, Sitecore Gold Implementations partner and Oracle Gold Partner.

Commenting on the company’s outlook for the remainder of fiscal 2017, Parker said, “Gruden continues to experience strong demand and recognition for its market leading Digital Transformation services, and our reputation and ability to secure new clients are driving the growth of the business in the second half of the financial year and beyond”.

Parker also noted that historically the second half of the financial year is usually stronger, and this trend is expected to be replicated in fiscal 2017.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.