GEM Global invest $3.1 million in FYI via $80 million facility

Published 16-FEB-2021 10:17 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FYI Resources Ltd (ASX: FYI) has advised of an initial investment of more than $3 million by GEM Global Yield LLC SCS (GEM), an international group that intends to provide long term support and shareholder stability to FYI for the development of its high purity alumina (HPA) project.

GEM sees increasing shareholder value as FYI progresses the development of its HPA project strategy, and this has been evidenced by a particularly strong share price performance in recent months as the company has progressed HPA pilot trials in collaboration with Alcoa.

Between December and February, FYI’s shares increased 150%, and are currently trading at a premium of more than 100% relative to where they were less than two months ago.

The value of the placement announced today is $3.13 million, and this will be facilitated through the issue of 9.3 million shares under the company’s $80 million capital commitment facility with GEM.

This is the first draw-down on the GEM financing facility which has been in place since March last year.

The facility was specifically established to provide FYI with capital support for the development of its HPA project.

The company will issue 9.3 million fully paid ordinary shares at a price of 33.67 cents each calculated according to the terms of the capital commitment facility, under the ASX listing rule 7.1A placement capacity to raise gross proceeds of $3,131,310.

Proceeds from the share issue will be used to advance FYI's HPA project and costs of the issue.

Provides funding for further pilot plant refinement

As we reported last week, FYI released highly promising and commercially crucial analytical results from the recently completed HPA pilot plant trial conducted in collaboration with Alcoa Australia Limited (Alcoa).

Analytical results indicated more than 99.998% Al2O3 purity was consistently achieved with an average of 99.9986% Al2O3 purity surpassing expectations - just a whisker off the premium 5N product that has a grade of 99.999%.

The fact that some samples achieved results of 99.999% HPA is an outstanding outcome that surpassed both parties’ operational expectations, providing further validation of FYI’s innovative HPA flowsheet design.

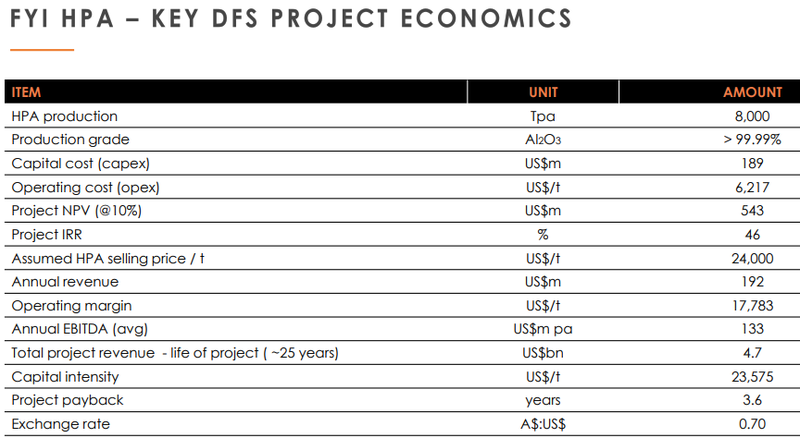

Importantly, FYI has already released its definitive feasibility study (DFS), underlining the strong financial metrics for production of 4N HPA as outlined below.

5N opens up new markets at double the price

HPA is increasingly becoming the primary sought-after input material for certain high-tech products principally for its unique properties, characteristics and chemical properties that address that applications high specification requirements such as LED’s and other sapphire glass products.

However, the longer-term driver for HPA, with forecasts of compound annual growth exceeding 17% is the outlook for the burgeoning electric vehicle and static energy storage markets where the primary function is in the use as a separator material between the anode and cathode in batteries to increase power, functionality and safety of the battery cells.

FYI is positioning itself to be a significant producer of 4N and 5N HPA in the rapidly developing high-tech product markets.

The 4N product fetches approximately US$25,000 per tonne, while customers in the electric vehicle and energy storage industries are paying in the vicinity of US$50,000 per tonne for 5N HPA.

Consequently, should ongoing pilot plant trials confirm that FYI can produce significant quantities of 5N this would provide a substantial uplift in the group’s valuation, and indeed its share price - this is obviously the outcome that GEM is banking on.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.