Foster Stockbroking share price target implies upside of 170% for 1stAvailable

Published 03-NOV-2016 14:56 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FinFeed suggested last week that a robust first quarter result from 1stAvailable (ASX: 1ST) provided a strong platform for a promising first half performance, as well as indicating the company was on track to generate substantial year-on-year growth in fiscal 2017.

The group’s shares responded accordingly, rallying 10% from the previous day’s close of 5 cents to hit an intraday high of 5.5 cents. While they have retraced slightly since then it has been under low volumes and a report released today by Foster Stockbroking suggests that its current price of 5.2 cents (closing price Nov 2) is well below market value.

However, in the case of 1ST there is a yawning gap between its current trading range and broker valuations. Foster’s Darren Odell has a speculative buy recommendation on the stock with a 12 month price target of 14 cents. He is forecasting sales growth of 71% and 130% in 2017 and 2018 respectively.

Odell expects 1ST to deliver a maiden EBITDA of $1.4 million in fiscal 2018 with impressive margins of 18%.

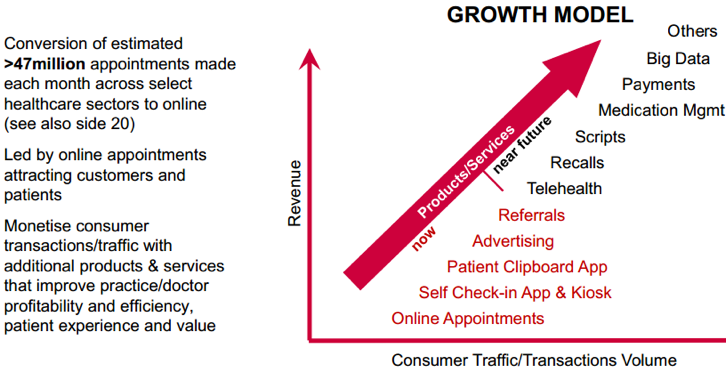

To provide some background, 1ST is an Australian online healthcare portal that simplifies and facilitates digital interaction between health services and consumers using cloud-based solutions including online search and appointment booking services.

The three months to September 30, 2016 featured a 400% increase in new consumer registrations, a factor that will be significant in terms of laying the foundation for recurring income.

It is still early days in the life of this company, however, and thus professional financial advice should be sought of considering this stock for your portfolio.

Increases market sharing dental and expand into optical

While 1ST has demonstrated it can generate strong organic growth, management’s decision to diversify its revenue streams, particularly into the dental and optical sectors is viewed as a particularly astute move given it provides additional revenue streams and softens potential volatility that can occur when over reliant on any one sector.

Odell touched on this factor when reaffirming his buy recommendation saying, “The securing of 150 new optical stores in the quarter and the addition of another large dental corporate points to developing momentum in these segments”.

Transition to online appointment booking represents open invitation with 97% untapped

He also highlighted the fact that less than 3% of Australian healthcare providers are utilising an online appointment booking system, suggesting 1ST and other providers are tasked with increasing the online booking penetration rate closer to circa 60%.

Odell sees the nascent market as there for the taking, estimating the market opportunity as more than $300 million based on an assumption of 30% market share. He also noted that further opportunities could emerge in optical and dental, while its technology could be just as easily adopted by vets and pharmacies.

Historical share price trading patterns are not necessarily an indicator of future performance and those considering this stock should not use this as a basis for an investment decision. Investors considering this stock should also note that broker forecasts may not be met and independent financial advice should be sought before investing in this company.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.