Focus to turn to Simble’s recurring revenues

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

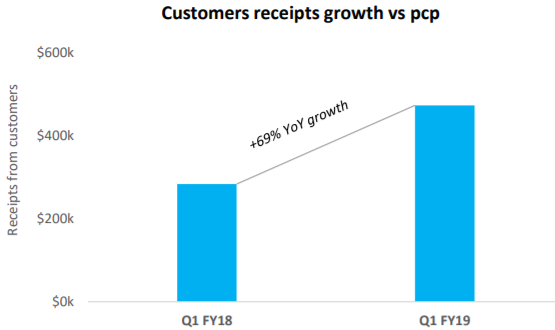

Despite the March quarter traditionally being a quite one for Simble Solutions (ASX:SIS), a provider of software solutions for essential services such as energy management, the company delivered year-on-year sales growth of 67%.

Equally impressive was Simble’s ability to substantially trim costs, a result better than that flagged in management’s prior guidance.

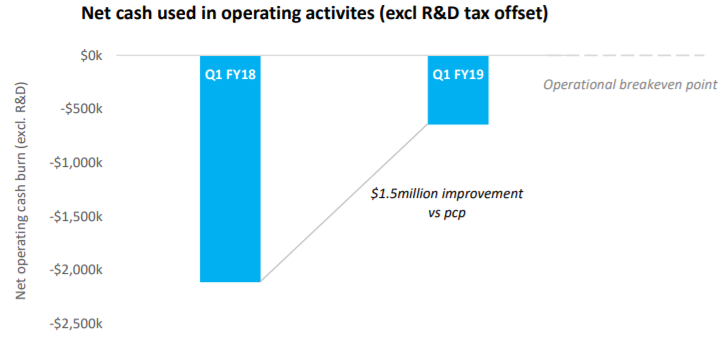

For smaller companies in the tech sector, controlling expenditure is often difficult, but the company appears to have reached a stage now where this has stabilised, evidenced by the sharp decline in net operating cash burn from $1.47 million to $650,000.

Management expects sales growth to continue in the June quarter of fiscal 2019, assisted by revenue generation from some material contracts that were negotiated in the March quarter.

Long-term partnerships key to future

In February, Simble announced a strategic long-term partnership with its first energy broker in the UK, UCR Consultants.

UCR subsequently committed to invest $500,000 by way of an unsecured convertible note at a conversion price of 15 cents per share.

In terms of the agreement, UCR Consultants has become a licensed reseller of Simble’s energy and Internet of Things (IoT) energy analytics product suites and will target up to 60,000 meters for deployment.

Pricing is based on a minimum commitment of 10,000 meters to be deployed at UCR’s discretion.

The group intends to target ‘smart meter ready’ customers with software-only platform SimbleSenseLite, as well as large multisite customers Simble Energy Platform, a bundled premium solution.

The deal is the first breakthrough in smart metering market where the UK government has mandated deployment of 53 million smart meters across all residential households and small businesses.

Simble targets this growth opportunity in partnership with Accel-KKR backed Utiligroup which will service an estimated 80% of this market.

Making inroads in Australia

The company has also had success in Australia, securing Banyule City Council in partnership with BidEnergy.

During the quarter Simble entered into marketing partnership agreement with BidEnergy Ltd (ASX:BID) to commercialise a bundled technology solution comprising combined IP, and this quickfire contract award validates the collaborative merits of the partnership.

The company appears poised to continue its strong performance in the June quarter with chief executive Fadi Geha saying, “Based on the traction we have witnessed to date and contract visibility we expect this growth trend to continue for the June quarter as we capture opportunities with key partners in Australia and the UK.

“We have invested heavily in R&D (research and development) and sales infrastructure over the past year, driving innovation and expanding our solution suites to scale and diversify the company’s revenue streams.”

Income predictability a key attribute

Geha also underlined the company’s business model and its ability to grow recurring revenues, a factor that is normally well received by the investment community as it provides earnings predictability.

The benefits from this model aren’t always obvious at an early stage as cash generation builds over a period of time.

However, history shows that once there is recognition of consistent growth in recurring revenue businesses such as these can experience significant share price momentum.

This is particularly the case for a company such as Simble, given that there is already reasonable predictability surrounding its revenue streams because of its exposure to essential services such as energy usage.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.