Flamingo AI updates market on client progress, new product

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Flamingo AI Limited (ASX:FGO), AI company and provider of Cognitive Virtual Assistant and Unsupervised Machine Learning technologies, has today provided a comprehensive business update.

Overall, FGO reported it is well funded to deliver against its current goals and “remains highly confident in being able to deliver significant value to its clients, their end customers and investors”.

Across the US, Australia and Asia, the small cap has 10 clients progressing through paid trials or software and services contracts.

The current focus for FGO is predominantly on large insurance enterprises, with its sights set on three Fortune 100 firms in the US. The company also reports it has made early inroads into the telecommunications sector.

Client progress updates

Across FGO’s 10 clients currently using the company’s Virtual Assistants, all but one client is using the Virtual Sales Assistant; the remaining client is instead deploying the Virtual Service Assistant.

FGO provided an update on the progress of several of its existing US and Australasian based clients, as follows.

FGO’s client Nationwide Financial Services, Inc. has recently conducted a review of the Flamingo AI Virtual Assistant at the six-month mark and made the decision to extend its engagement with the company, continuing on a Monthly Recurring Revenue (MRR) basis.

Nationwide went live with the platform in November 2017, which means it has been engaged with FGO’s product for over six months. Given the long timeframe, the small cap views Nationwide’s decision to extend the MRR agreement as highly encouraging.

FGO has two clients in ‘live-evaluation’ mode — Liberty Mutual and AMP — where end-customers are interacting with their AI Cognitive Virtual Assistants. Positively for the company, both clients have negotiated extensions of the contracted trial period to further test the longer-term automation continuum of the platform.

This stage involves transitioning from HAVA, Human Assisted Virtual Assistant, to fully automated AI-driven Virtual Assistants, meaning no human involvement.

FGO’s clients CHUBB, CUA and WISR are moving through the trial phases towards User Acceptance Testing (UAT) preparing for live evaluation mode where the client’s end customers will interact with Flamingo AI’s Virtual Assistants.

The small cap is progressing discussions with MetLife Asia (Singapore) in further scoping the Use Case for the trial of the Virtual Assistant.

Two new clients are progressing through early stages of trial implementation. At this stage, these contracts do not have a material impact on FGO’s cash flow.

It should be noted however that this remains a speculative stock and investors should seek professional financial advice if considering this stock for your portfolio.

Tellingly, five out of the current ten engagements has involved the client requested additional proposals from FGO.

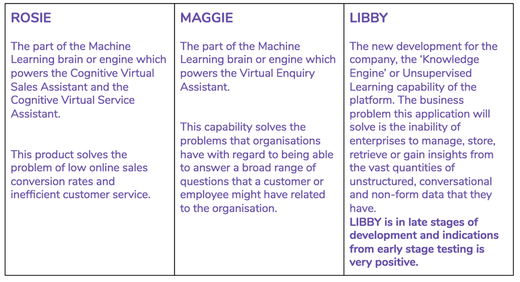

Proposals will explore the applicability of either the MAGGIE capability, the Virtual Enquiry Assistant, or the LIBBY capability, which is the Knowledge Engine. It is worth pointing out that both MAGGIE and LIBBY have the potential (though not certainty) to generate additional revenue streams over and above the existing ROSIE product.

Which industries are using FGO’s AI tech currently?

Currently, FGO’s AI tech is being applied in the following industries:

- Auto Insurance Quote to Bind and Payment, Life Insurance Quotation, Retirement Product application and account set up;

- Superannuation and Life Insurance application, Travel Insurance application; Health Insurance application;

- Personal Loan application;

- Change of Plan customer service, Home and Contents application.

As at the date of the announcement, FGO noted that revenue received from clients undertaking trials is non-recurring and as such does not have a material impact on its cash flow. It does, however, have an aforementioned MRR engagement with Nationwide Financial Services.

Product development, IP & security

FGO has three products in various stages of maturity; ROSIE, MAGGIE and LIBBY.

LIBBY is FGO’s new development, and the company has received significant interest from the market for this type of ‘Knowledge Engine’ product.

The company has developed all its own unique Machine Learning and Customer Journey technologies and related Intellectual Property in-house. At present, seven patents are pending, progressing or are due to be submitted.

As far as the company’s security-related developments go, FGO has achieved important, globally recognised security certification credentials: PCI (Payment Card Industry Data Security Standard) Compliance and SOC2 (Service Organization Control 2) Type 1 Certification.

PCI is a set of security standards to ensure that those companies which accept, process, store or transmit credit card information maintain a secure environment. With the company now PCI compliant, it has both the underlying technology to securely handle credit card transactions and card holder information, as well as the practices and procedures to support a secure environment.

The criteria for SOC2 Type 1 certification focuses on managing customer data based on five “trust service principles”— security, availability, processing integrity, confidentiality and privacy. A company which receives SOC2 Type 1 Certification is determined to have comprehensive security practices and procedures.

Cash receipts & sales

While the majority of FGO’s revenue is currently generated from paid trial contracts, the company expects to see additional conversions of clients to MRR over the next six months.

All in all, it is achieving incremental cash receipt growth quarter to quarter.

With regard to sales, a number of new client opportunities in the US and Australia are currently being progressed, and the company’s overall sales pipeline of opportunities has doubled in the last six months.

FGO has recently employed four sales team members across the US and Australia, as well as a product owner — responsible for ensuring the commercial applicability of the product.

Of particular interest is the fact the company has identified a growing interest in its technology and similar products coming from C-suite Executives, in particular for the Unsupervised Machine Learning (LIBBY) capability that the company is currently developing.

In parallel, the company has determined marketing and go-to-market strategies and is in the implementation stages.

Progress on partnerships

FGO’s partnership with EXL Service Holdings, Inc. (NASDAQ: EXLS), based in the US, is progressing very positively according to the small cap.

EXL has selected FGO as “an industry leader and innovator” in the field of Cognitive Virtual Sales and Service Assistants, amongst a select group of world-class peers. EXL will act as lead generation, integration and technology support for the company, thereby increasing market reach.

The Clarion Group partnership in the US market remains strong, with Clarion actively introducing FGO to prospective clients.

FGO is also exploring partnerships with several large Contact Centre technology vendors.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.