FGR to Gain Controlling Interest in New Energy Storage Technology

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

First Graphite Limited (ASX:FGR), on Thursday announced an exciting partnership in pursuit of supercapacitor technology commercialisation.

First Graphite, an innovative $34 million ASX-listed company, entered into a binding Heads of Agreement Kremford Pty Ltd, providing FGR with the opportunity to own a controlling interest in the private company.

Kremford Pty is working with Swinburne University of Technology to advance a new energy storage technology, the Bolt Electricity Storage Technology Battery (BEST Battery).

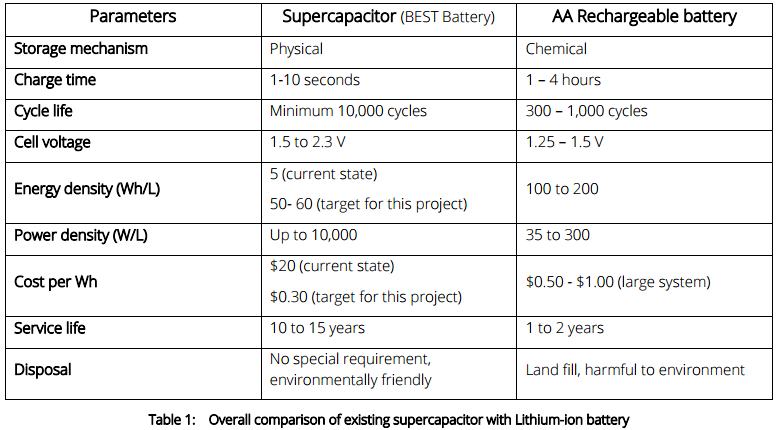

The BEST Battery is a grapheneoxide based supercapacitor offering high performance and low cost energy storage. The patent pending technology, developed by Swinburne has number of advantages over existing supercapacitors which have energy density limitations. It offers advantages that come with physical storage of energy as opposed to chemical storage.

The ultra-thin and ultra-light battery provides ten times better energy density and ten times faster charge/ discharge rates than competing devices, and is capable of 10,000 charge/discharge cycles. It is also highly flexible and integratable, while being environmentally friendly thanks to the absence of chemicals used in the technology.

Other highlights of technology are the efficiencies offered through the use of laser printing technology and graphene oxide to create an ultra-efficient energy storage medium in a greatly simplified process. Plus the innovative inter-digital design provides for a much shorter ionic path to maximise energy and power density.

Here is a comparison of what the BEST Battery could achieve compared to the standard lithium-ion battery, based on laboratory test work undertaken to date:

It should be noted that FGR is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

The current proof-of-concept device has performed slightly higher than current batteries. The University believes that with additional product development and up-scaling the BEST Battery can be taken from a laboratory success to a commercial prototype within the period of the Agreement.

FGR is to underwrite the spending of $2m over a two year period to earn a 60% interest in the company that holds the technology’s international licence. It involves two stages of commitment.

The first is an initial $700,000 commitment from FGR to earn a 30% stake in Kremford. The second stage involves the option for FGR to increase its equity to 60% by committing a further $1.3 million within two years of the Research and Licence Agreements being signed. The agreement involved a few other share issuances and options, as detailed in the announcement.

There was also talk that FGR should be able to increase its interest in Kremford to 100% at some point in the future.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.