Etherstack’s improved results return it to profitability

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Wireless technology specialist Etherstack (ASX:ESK) this week released significantly improved financial results for FY18, with strong revenue growth, positive EBITDA and positive operating cashflow.

Revenues increased by 26.6% in 2018 to US$5.36 million, whilst the company delivered positive EBITDA of US$1.86 million, versus FY2017 EBITDA of US$92,000.

Etherstack, which specialises in developing, manufacturing and licensing mission critical radio technologies for wireless equipment manufacturers and network operators, has turned its operating cashflow around by in excess of US$2.1 million during FY2018 and the strong operating cashflow has continued into FY2019, with the company reporting US$1 million in cash receipts in January this year.

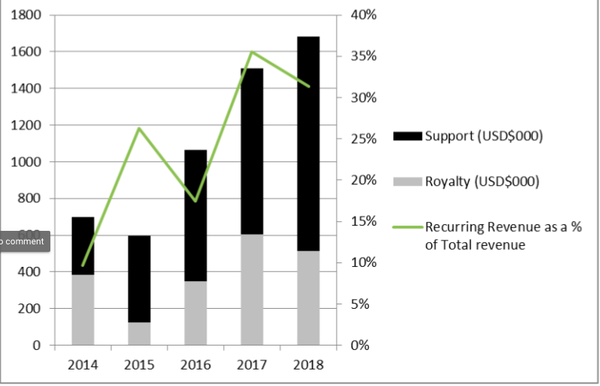

The company is also working hard to further reduce its debt, which will be helped by increasing recurring revenues due to long term support contracts on deployed networks, as well as increased royalty payments from licensee manufacturers of both P25 and DMR radio equipment.

Recurring revenues will also be boosted by new US Government orders and two sector contracts totalling US$2.1 million announced in mid-2018, which have been substantially completed.

Etherstack was on a roll last year, winning new contracts with various government agencies including its first US Customs & Border Patrol (CBP) order, which was successfully delivered just two months ago.

According to the company, it has entered 2019 with a strong order book and new leads from State and Federal public safety agencies in North America and Australia with further awards expected in the next 90 days.

“Our North American and Australian government customer footprint continues to expand through the delivery of leading fixed and tactical communications solutions. We are expecting a significantly stronger 2019 based on orders in hand and negotiations currently underway,” Etherstack CEO, David Deacon said.

Here are the FY18 highlights:

- Revenue of US$5.366 million is an increase of US$1.127 million from 2017 revenues of US$4.239 million, primarily due to continued growth of the recurring revenue streams and project activity on major contracts

- Return to profitability: small NPAT (net profit after tax) of US$53,000 is a significant improvement over 2017 NPAT loss of US$1.546 million

- EBITDA has significantly improved to US$1.863 million from US$0.92 million in 2017

- 11.5% increase in recurring revenues driven by cumulative long-term support contracts

- First sales of the ground-breaking in vehicle repeater product, IVX, and a healthy pipeline of opportunities for this new product

- Operating cash inflow of US$1.528 million during 2018 compared to an outflow of US$0.599 million in 2017

- Significantly increased R&D investment and expenditure particularly in the areas of defence and satellite communications

- Reduction in long-term debt through loan repayments

Successful delivery of:

- A$1 million order announced in November 2017 for the Australian Government

- Stage 2 of the Canadian utility project completed in January 2018

- Two new defence sector wins totalling US$2.1 million were substantially completed in 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.