Etherstack signs important new contract with Ergon Energy

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Etherstack plc (ASX: ESK), a specialist in wireless communication technologies has signed a US$2.6 million contract with Ergon Energy involving the provision of support services to their P25 digital radio network over the next five years.

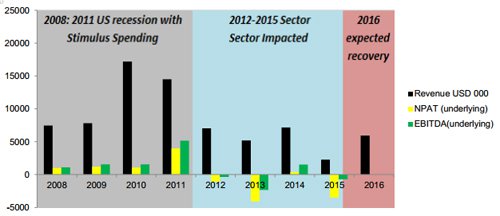

This is an important development from a number of perspectives. Given management recently provided revenue guidance for the 12 months to December 31, 2016 in a range between US$5.8 million and US$6.1 million, this contract represents a significant revenue source.

From an operational point of view the Ergon contract is also encouraging given the group is currently deploying a 13 county network for US utility, Jersey Central Power and Light (JCP&L), of a similar type to the Ergon Energy solution.

The particular network was designed and manufactured by ESK and is one of numerous large-scale electric utility and public safety radio networks that the company has deployed and supports around the world.

The Ergon Energy solution was initially commissioned in 2011, and the signing of a follow-up contract should be viewed as a vote of confidence in the company’s technologies and operational ability.

Although it is still early stages in this company’s turnaround, so seek professional financial advice if considering this stock for your portfolio.

In relation to this most recent development and the nature of contracts usually negotiated by ESK, Chief Executive, David Deacon said, “The deployment of these networks typically incorporate long-term support agreements over the operational life of the networks which often exceed 15 years in length”.

As ESK establishes more mission-critical radio networks globally, Deacon anticipates growth in recurring revenues through support and maintenance agreements with its expanding customer base.

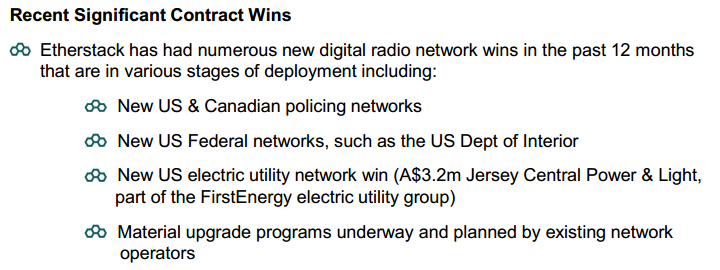

On this note, the company referred to a number of new contract wins already achieved in 2016 when delivering its interim result at the end of August.

The group has a relatively diversified revenue base, generating income from the defence, utilities, transportation and resources sectors.

While it could be argued that the ESK’s share price doesn’t truly reflect the achievements of the company over the last 12 months, it is worth noting that its shares are thinly traded and this tends to make for lumpy share price activity.

However, a sharp spike from its 12 month low of 9 cents in early September to an intraday high of 16 cents last week could be recognition of the company’s merits.

The current share price of 15 cents is only just shy of the 12 month high of 17 cents, but prospective investors need to take account of the fact that ESK’s low liquidity can make entering and exiting the stock somewhat difficult.

Consequently, it should be viewed as a speculative investment and past share price performances are not indicative of future trading patterns, and as such should not provide the basis for an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.