eSense teams up with Wise Wine to target sanitiser market

Published 18-JUN-2020 10:48 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

eSense-Lab Limited (ASX:ESE) has entered into a binding joint venture with West Australian wine maker and distiller, Sassey Pty Ltd, the owner of the Wise Winery, a family-owned wine company.

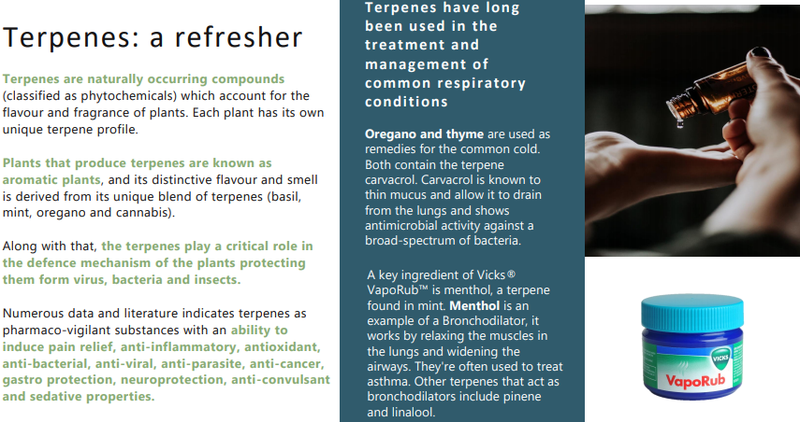

The deal will see Wise broaden its sanitiser product offering to include sanitiser infused with eSense’s unique terpenes.

This follows news on 15 June regarding a joint venture agreement between ESE and ANC Enterprises, a manufacturer and wholesaler of high quality Australian made cosmeceutical products, spanning areas such as skin care, hair care and hand sanitisers.

As a backdrop, the Wise Gin Distillery is the only Margaret River distillery distilling its own chardonnay and other grape varieties on-site as the base for spirits and its sanitisers.

In order to meet demand in Western Australia, some three months ago the distillery at Wise Wine transitioned to 24-hour production of hand sanitiser made from ethanol originally earmarked for gin.

Harking back to this agreement, eSense will provide its proprietary terpene mixes specifically chosen for their anti-viral qualities and Wise will produce, sell and distribute its 70% ethanol sanitiser product.

The JV will place an initial order of 2 million units of terpenes for infusion into the hand sanitiser products (equivalent to US$600,000 in value). It is anticipated that this order will only be partially funded upfront to an amount of $150,000 to $200,000 and the balance of the order will be paid for from the proceeds of products sales.

The JV company will be owned 50% by eSense and 50% by Wise; and the deal will see the new products widely available through Wise’s global distribution network via its online store.

Under the terms of the agreement, it will run for a 10 year period with initial orders of 2 million units and manufacturing to be done exclusively by Wise.

eSense will provide its proprietary terpene mixes to the JV, specifically chosen for their anti-viral qualities, and a cash contribution of up to $200,000 for JV operational expenses and Wise will contribute up to $200,000 of sanitiser ingredients (base alcohol sanitiser and packaging) to the JV.

The product will also carry Wise’s premium recognisable branding, as well as being distributed exclusively by the group.

e-Sense benefits from Wise’s strong brand power

Wise has been producing and selling wine for over 28 years, and its existing brand, proven sales strategy and channels means its product is ideally positioned within the growing sanitiser market.

Wise’s general manager, Greg Garnish, sees the addition of eSense’s terpenes to create a broader range of products as an effective marketing and sales strategy.

Wise’s current product has seen ongoing demand since production started in March.

While highlighting the obvious commercial benefits, Itzik Mizrahi, chief executive of eSense also noted that it represented a validation of the group’s business model in saying, “We are so pleased to be working with Wise Wines, a household brand and name in Australia to produce sanitiser products.

‘’The joint venture agreement validates eSense’s updated commercialisation model as well as the growing recognition of terpenes and their unique and varied qualities.

‘’This binding agreement will see eSense’s terpenes used in a premium product to be delivered straight to consumers.”

eSense’s laboratory continues researching and testing its gel-based, alcohol-free sanitiser with promising results of terpene’s anti-viral synergistic effects.

Discussions are ongoing with several universities, hospitals and virology labs to establish further testing and research into the exact nature of terpenes as an anti-viral agent.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.