Engage:BDR records strongest first half revenue since listing

Published 18-MAY-2020 11:33 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

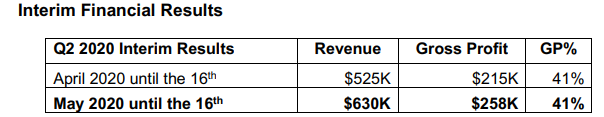

engage:BDR (ASX:EN1 and EN1O) has provided an interim trading update for May with commentary on the group’s financial performance measured against prior periods.

Revenue generated up to 16 May was $630,000, and during that period daily revenue improved 20% compared with April.

Management said that it expected sustained month-on-month improvements throughout the remainder of May.

May 2020 revenue started stronger than April, due to increasing advertiser demand, and management expects comparative revenues to be higher throughout the end of the second quarter before normalising over the balance of the month and into June.

Consistent with EN1’s 2019 performance, the advertising industry traditionally generates 65-70% of its revenues in the second half of the year (July - December).

EN1 experienced a 34%/66% split in 2019, and management expects 2020 to produce similar revenue seasonality.

Strongest first half revenue since listing

Highlighting EN1’s resilience and commenting on the state of play in the US, executive chairman and chief executive Ted Dhanik said, “We are seeing daily improvement across our key metrics, which is a strong indication that the worst of this global crisis could be behind us now.

‘’Large US states have opened, and many others are partially opening.

‘’I expect to see stronger demand in the coming weeks, which will translate to greater revenue for the company.

‘’Irrespective of the global crisis and impact to our business, the company has still had its strongest first half since listing.

‘’Prior to the global crisis, we had a stronger revenue trajectory, but we should still yield stronger first half revenue than any previous year since listing on the ASX.

‘’Advertising companies see their greatest revenue months after June, and we are approaching that time again this year and looking forward to seasonality working in our favour.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.