Engage:BDR launches phase 1 of Facebook paid social ads

Published 17-APR-2019 11:00 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Engage:BDR (ASX:EN1) has deployed Facebook advertising as part of its paid social strategy. Ads on Facebook utilise users’ unique profiles as targeting metrics allows brands to reach their most appropriate potential customers.

Initially, as announced by the company on 11 February this year, the targeted launch date of this product was not until Q3 2019. Due to high customer demand, the first phase of this offering is now live, significantly ahead of schedule.

Product and revenue related objectives this year to date have seen significant achievements. Currently EN1 is comprised of only 15 full time staff, who each has a personal goal of generating at least US$1M in revenue for 2019.

About Facebook ads

EN1’s history with Facebook dates all the way back to 2010. Initially the company was a certified ad provider for the social network’s app developers (such as Canvas Apps). Subsequently, EN1 became a top inventory provider on Facebook’s video ad exchange, LiveRail.

Until now, EN1 has not sold Facebook’s core advertising product.

Unsurprisingly, Facebook is one of the world’s leading social media platforms, with over 2.3 billion unique monthly users. This large pool allows advertisers to reach their most appropriate audience, no matter the niche.

There are five main advertising mediums: newsfeed on desktop, newsfeed on mobile, sidebar on desktop, network on mobile and Instagram.

These ads can target users based on location, age, gender, interests, connections, relationship status and so on. Ads allow advertisers to improve and enhance brand awareness, traffic to site, store visits and conversions (as well as app installs and engagement).

Lead generation and retargeting are two common ad methodologies that allow these ads to reach a maximum number of people at a low cost.

EN1’s paid social strategy

EN1’s new offering will allow clients to target extremely niche audiences, otherwise nearly impossible to reach. Facebook’s advertising technology helps new and emerging brands to drive awareness, while simultaneously driving traffic to the brand’s site and storefront.

EN1’s technique of consistent optimisations and refreshing ad set creatives allows it to generate exceptional ROAS (return on ad sets) and scalability for the client. The company is upbeat about this method’s approach and will begin cross-selling the offering immediately.

With Facebook’s popularity highly unlikely to decline in the near future, it’s a highly viable channel to engage with.

In addition, EN1 also offers paid social plans on SnapChat, Instagram, YouTube, TikTok, Linkedin and more.

Over the course of 2019, the company expects to deploy several other paid social platforms, including tech to manage and integrate with the existing media channels EN1 owns.

Its IconicReach platform has direct and immediate synergy with the new paid social strategy. IconicReach clients have requested to add paid social to their campaigns as soon as possible.

EN1 will update the market on future phases of the strategy as well as an overall perspective when applicable.

Trifecta

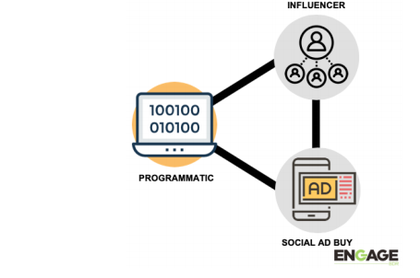

Top 100 US marketers focus their budgets on three main areas: programmatic advertising, influencer marketing and paid social.

EN1 is a strong leader in two of these areas (programmatic and influencer marketing), and now, with this latest announcement, has strong foundations in each pillar.

EN1 explored the acquisition of a paid social firm in late 2018, but due to concerns around dilution it opted against the plan. Management has since decided to postpone this opportunity until its market cap and share price support such activities.

More recently the company has looked into the acquisition of a thriving Australian based paid social business. Such an arrangement would see EN1 gain tangible exposure with local clients and a team familiar with the local landscape and trends.

EN1 will update the market if and when the above becomes a reality.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.