engage:BDR expands to video sharing app, TikTok

Published 23-APR-2019 10:28 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in engage:BDR (ASX:EN1) opened at 5.0 cents after the company announced on Tuesday morning that IconicReach has expanded its influencer marketing to the video sharing app, TikTok.

This represents a near three-fold gain over the last five weeks as the company continued to release promising developments regarding its position in influencer marketing, progress that was reflected in a strong financial performance in the first quarter of 2019 when revenues grew by 320%.

IconicReach will be starting its first TikTok campaign with influencers in the music space, with the intent of creating a viral dance contest by well-known artists.

Campaigns on TikTok will be readily available for all new brands joining IconicReach, broadening IconicReach’s ability to incrementally increase revenue and contribute to profitability.

As a backdrop, TikTok is a social video app owned by Chinese startup, ByteDance.

The lip-sync app was originally known as Musical.ly, until August 2018, when ByteDance bought the app and merged it with TikTok.

Today, the app has well over 150 million daily active users, 500 million monthly active users and is among the most popular social platforms, behind Facebook, Instagram, and YouTube.

The app has experienced rapid growth, particularly in the US, as it allows users to record, watch and share 15 second videos, usually lip syncing to popular soundtracks, dancing, or creating comedy skits.

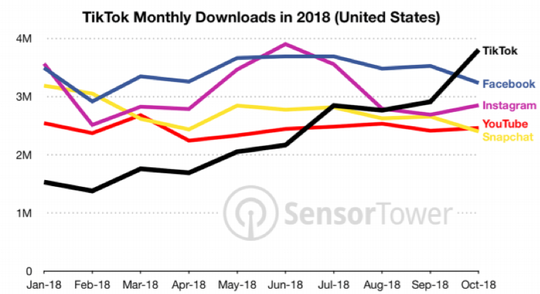

The following shows its growth trajectory compared with other popular social media platforms such as Facebook, Instagram, YouTube and Snapchat.

The video clips can be edited to add special effects and colour-changing lenses.

Users can also browse and interact with the content of other users, including liking, commenting and sharing videos.

Consequently, the addition of TikTok to Iconic Reach’s influencer market portfolio is strategically important for the broader engage:BDR group.

Tapping into a new demographic

TikTok is currently represented by many media authorities as the next Instagram and SnapChat, but specifically for Generation Z.

Its unique interface links popular trending music and influencer content in a comprehensive video format, creating branding opportunities.

Many prominent influencers on TikTok are not prominent on other social platforms, making this a unique and incremental marketplace revenue opportunity for early adopters.

Brands are aggressively looking to run successful challenges and contests on TikTok, leveraging popular hashtags and collaborating with TikTok influencers, at this early stage.

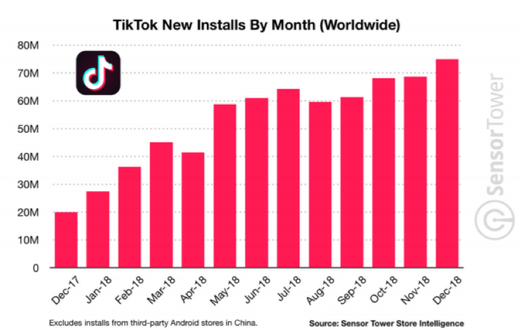

As the app continues to grow and gain more users as indicated below, it may create more opportunities for the company to capitalise on user-brand integrations.

Growth outstrips management’s expectations

The company also provided a positive trading update in relation to the programmatic advertising product.

Revenue has been tracking potentially better than expected and management noted that the first 22 days of April have yielded the strongest revenue for start of a month and a quarter in the company’s history.

Gross profit margins have been sustained in the vicinity of 40% and EN1’s proprietary yield management artificial intelligence has not been deployed as of yet, but is planned to be live this quarter, providing further scope to accelerate revenue growth.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.