EN1 grows programmatic ad business, plans acquisitions

Published 26-APR-2018 14:00 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

engage:BDR (ASX:EN1) has today provided an update on the progress of its programmatic advertising business in Q1 2018. CY2018 has so far brought rapid growth for EN1’s programmatic advertising platform, which it expects to be profitable and cash flow positive by the close of the FY2018.

The company has processed 86 client integrations to date, with a further 15 clients expected to be integrated by end of Q2 2018.

Of those integrations, 18 were completed this calendar year — two of these new clients are described below:

In regards to ‘client integrations’, the process involves connecting the client’s systems to engage:BDR’s systems to ensure that both systems are communicating with each other effectively.

This is a complex and time consuming process, taking between three weeks to six months to complete and 80+ man-hours involving several team members from both companies.

Given this investment of time, EN1’s customer retention rates should be bolstered, as once a client is on the engage:BDR platform they are unlikely to leave and go through the entire process again with another company.

Yet EN1 does remain a speculative investment and investors should take a cautious approach to any investment decision made with regard to this stock.

In January 2018 the programmatic advertising division of EN1’s business was “280% higher than the corresponding month in 2017 and the February 2018 programmatic advertising was 310% higher than the corresponding month in 2017”.

EN1 advises that it expects this high growth rate to continue for the remainder of the 2018 calendar year. Incidentally, the second half of the calendar year is considered the busiest in the advertising industry due to advertisers increasing their spending around key dates such as Halloween, Thanksgiving and Christmas.

engage:BDR recently reported that it expects its annual revenues to grow to between A$24 million to A$24.5 million in 2018.

Programmatic advertising in a nutshell

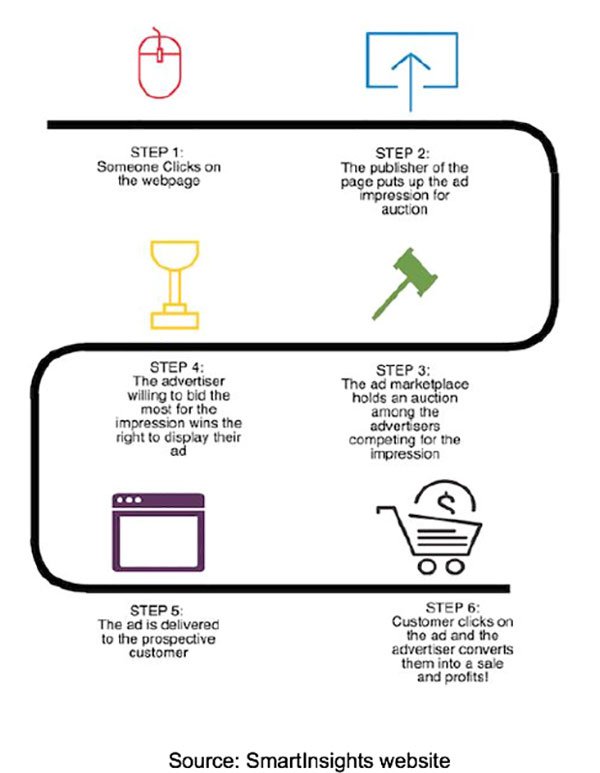

Programmatic advertising utilises software or platforms to buy and sell digital advertising space. During this process, platforms automate the buying, placement, and optimisation of advertising inventory through an online bidding system.

Internet users will have experienced programmatic advertising presented to them via ‘Cookies’. Advertisers use ‘Cookies’ to collect information about a website’s visitors, using it to put together user profiles so they can display advertisements most relevant to the individual.

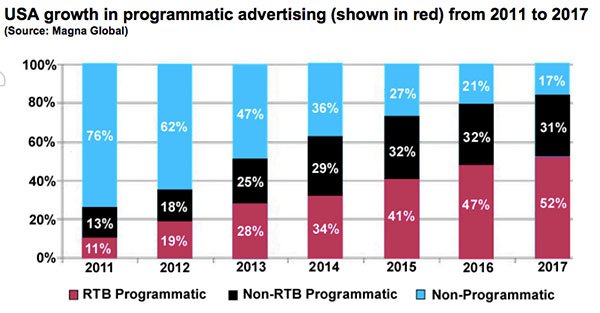

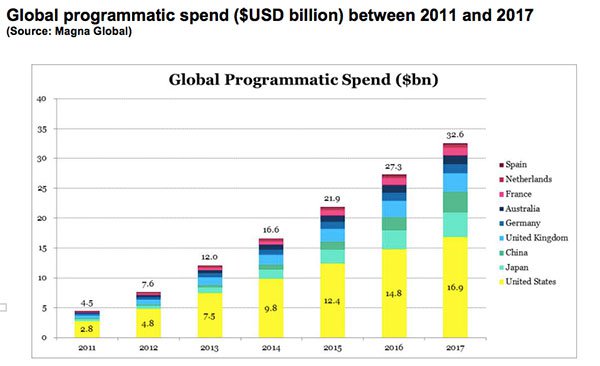

The below graphs clearly demonstrate the current largescale growth of the programmatic advertising industry:

New product development

EN1 recently developed a new 100% viewable proprietary display slider ad unit for its programmatic advertising platform. This allows the advertisement to be viewable even when the user is scrolling down the webpage, enabling visibility at all times while the client is engaging with EN1’s platform.

Typically, digital advertising is static on the webpage, and as such is not viewable when a user is looking or scrolling to another part of the page.

EN1’s latest feature is currently being beta tested, and is expected to deliver significant benefits for advertisers willing to pay a premium.

Update on EN1’s acquisition growth strategy

As previously announced, EN1 is considering several potential strategic acquisitions in the near term.

If EN1 makes an acquisition of another similar business in the digital advertising space and migrates that company’s clients onto its own platform, it believes that the majority of the revenue will be converted to its bottom line.

Further, the company has indicated that once a publisher is set up on the engage:BDR platform there is a multiplier effect, which could reach up to four times the current revenue of the acquired company.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.