EN1 expects strong first quarter results

Published 16-MAR-2020 11:00 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

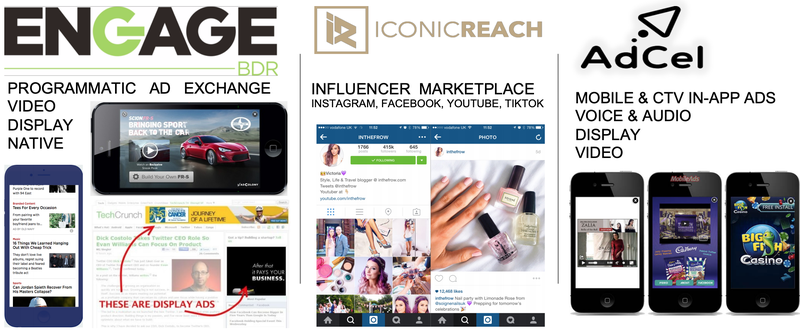

engage:BDR (ASX:EN1) has provided a promising trading update, including guidance for 2020 and operational commentary on current events and environmental challenges the world is facing.

Regarding the latter, management said that the company is unaffected by impacts of the coronavirus and has implemented work from home strategies and technologies with 95% of the group’s employees working remotely.

The entire infrastructure of the company’s platforms and technologies is cloud-based and management highlighted that the cloud is owned and operated by engage:BDR, not reliant on Amazon, Google, or other popular clouds.

To date, it has also been business as usual in relation to EN1’s clients with no cancellations or interruptions.

On this note, chief executive and executive chairman Ted Dhanik said, ‘’EN1’s business development and account management teams stay in very close contact with all clients, on a daily basis.

‘’No clients have reduced spends (throttled), cancelled campaigns or any negative impact in 2020.’’

The company provided a 2020 Operational Guidance video - Click here

First-quarter features strong revenue growth and profitability

Over the past seven days, daily revenue has increased 19% and in the past 24 hours revenue has grown 11%.

Ad inventory has grown 9% in the past 24 hours, highlighting the exponential increase in advertiser demand, as it is outpacing ad inventory growth.

This has positioned the company to generate substantially higher revenue compared with the previous corresponding period, which we will discuss in the context of broader guidance provided today.

Management expects ad inventory to continue to grow, specifically in the only two sectors EN1 operates in – mobile apps and CTV (connected television).

As more people work from home, management expects app and CTV traffic to grow at a very aggressive rate.

Advertiser demand has already increased within the e-commerce category, as consumer buying is significantly increasing online.

Management expects advertisers with e-commerce channels to ramp up spending and increase ad budgets as work from home strategies continue to be deployed.

While EN1 does not sell programmatic advertising directly to brands or their agencies, it supplies ad inventory to the world’s largest media buyer platforms that brands and agencies license – ‘trading desks’ and ‘demand-side platforms/DSP’.

As a result, EN1 does not see advertiser or sector-specific impact in categories such as travel and events.

Robust guidance for March quarter

Management expects to deliver continued monthly revenue growth in March, eclipsing February 2020’s result by $500,000, representing an uptick of 30%.

This will translate to a strong earnings performance with the group being EBITDA profitable.

Additionally, the company is on track to achieve nearly three times its March 2019 quarterly result in the first quarter of 2020, and importantly management expects that this run rate can be maintained throughout 2020.

Management is expecting consistent monthly revenue growth, coupled with quarterly revenue growth, which will enable continued significant year-on-year revenue increases in 2020.

Expenses have also been trimmed, and management is currently renegotiating contracts with infrastructure providers in order to achieve further cost reductions.

About $1.4 million of legacy debt (90 days+) remains on the balance sheet.

Management is not focused on settling these debts in the near-term, and as a result the company does not currently expect to issue shares to extinguish these liabilities. Exceptions to this would be settlement opportunities at significant discounts.

Refinancing could strengthen balance sheet

In addition, management is aggressively working to refinance the company’s convertible notes facility.

Should EN1 be able to refinance facility under better terms, it could result in a strengthening of the group’s balance sheet and reduce the necessity to issue shares.

On this note, Dhanik said, ‘’Due to significant interest rate reductions and EN1’s profitable 2019 result, management has received term sheets for debt refinancing.

‘’Management is working to refinance the current outstanding convertible notes, then terminate all convertible instruments.’’

A review that is being conducted regarding refinancing is expected to be completed in the coming weeks.

With regard to recent drawdowns, Dhanik said that NetZero demand has significantly increased incremental revenue, and at the same time, cash requirements.

The recent draw of $450,000 from the company’s existing ZCS facility was necessary to enable the $500,000 month on month revenue growth.

Management is focused on refinancing the facility now, but the company needed to enable the incremental revenue opportunity, which explains the draw.

There have been two total draws on the ZCS to date, the first in 2019 for $1.75 million, leaving a balance of about $1.1 million, followed by the recent draw of $450,000.

Challenges present opportunities

In summing up EN1’s position CEO and executive chairman Ted Dhanik said:

“engage:BDR was born in 2009 from extraordinary opportunity at the very bottom of the Great Recession (of 2008). We quickly learned, adapted nimbly and thrived when most were afraid. As the industry evolved, we were fearlessly first on the front line, adapting and influencing the change, controlling our destiny in the ecosystem.

“Today, we are faced with yet another episode of potential change; we have already discovered massive new opportunities to deliver immeasurable value to our clients and partners. I am confident the world will get through this quickly, but in the interim, we will demonstrate how well we perform in environments like these. Our thoughts and warm regards go out to those impacted by the current state of affairs. We will continue to update you on developments at the same frequency.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.