Dotz technological breakthrough helps secure $500,000 transport contract

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Dotz Nano Limited (ASX:DTZ) announced today that it has entered into a $500,000 conditional agreement for a recurring order of ValidotzTM polymer security markers.

The agreement is with a leading East-European transportation and logistics company.

Given the nature of the international anti-counterfeiting deal, Dotz is unable to publicly identify its new partner, however the deal is testament to DTZ’s breakthrough, cost effective tagging technology, which has been verified by independent laboratories.

Dotz develops, manufactures and commercialises tagging, tracing and verification solutions. The current agreement is for the cost-effective tagging of highly pigmented polymer systems that allows for container contents to remain uncompromised.

The agreement will see Dotz insert the ValiDotzTM solution into hundreds of thousands of transportation containers throughout the customer’s Transport network, which will allow for individual batch marking and tracking to address counterfeiting across international borders.

The ValidotzTM security markers utilise microscopic molecular, non-toxic, carbon-based security tagging materials that can be directly embedded during the production process to impart a non-reversible, product-specific code.

This ValidotzTM code can be easily authenticated on-site and in real-time, to protect manufacturers from counterfeiting.

“Securing a significant order with a world-class transportation and logistics company is a testament to the quality of our Validotz solution," CEO of Dotz, Uzi Breier said. "This contract allows Dotz to leverage ourselves into the manufacturing industry and sets a standard for future deals. We are delighted to be working with this customer and look forward to meeting their product security needs.”

The following video explains how the technology works:

The order comprises two stages

The first stage of the new agreement is a testing stage to be fully funded by the customer. This stage is expected to occur between September and December 2019 and will determine and validate the appropriate resin and compound solution formulation especially for the customer and the types of products it will be transporting.

Stage two is the commercial implementation stage that consists of annual orders. This will begin in January 2020 and will confirm annual volume commitments, expected cost and supply provisions. The first year’s order is expected to be about A$500,000 of ValiDotzTM product.

Regular updates with regard to the testing stage will be released to market as they come to hand.

InspecTM semi-forensic detection devices that allow for validation in the field will also be added to this annual total. InspecTM-SF is an affordable mobile phone coupled detector that can decode invisible ValiDotzTM emended in bulk polymers or on printed samples.

According to Breier, this agreement is a hard endorsement of Dotz’ market leadership.

“This is a further example of Dotz’s market leadership in the brand protection and counterfeiting market with an industry-leading transport logistics company across Europe. Declining trust is a major reputational issue for manufacturers looking to sustain their positions in the market and protect their brands and products from cheap imitations. Our Validotz technology is a crucial element to supply chain logistics and highly valuable to protecting and proving brand integrity.”

A spokesperson for the transport and logistics company is looking forward to being able to improve its security.

“We are excited to be partnering with Dotz to utilise their unique solution to counterfeiting. Our business is increasingly dependent on the ability to provide proof of security throughout the supply and logistics chain. Dotz helping us provide a guaranteed level of assurance to our clients so they can be confident that their customers are receiving their high-quality and authentic products,” the spokeseperson said.

Further deals in the piepline

The agreement with the transport company comes just days after Dotz signed a deal to deliver anti-counterfeit technology to the Canadian cannabis market.

DTZ has partnered with Slalom Capital Inc., which focuses on commercialising cannabis-related solutions. Slalom will pay a non-refundable one-time payment of A$296,000 within 60 days, to finalise the development of DTZ’s BioDotzTM technology on cannabis plants over the next nine months.

The company is already immersed in the cannabis space via its partnership with licenced Israeli medicinal cannabis producer Seàch Medical Cannabis Group.

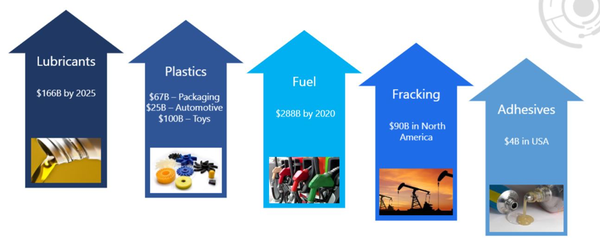

Dotz is targeting large global markets including:

The company is hard at work product testing with prospective customers to build sales activity in new markets and have an impact against the $2.2 trillion of products being counterfeited.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.