DateTix continues client growth & surpasses Tinder in Hong Kong

Published 11-MAR-2016 14:50 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Love is in the air for DateTix Group (ASX:DTX).

The recently ASX-listed online matchmaker has seen its popularity flourish to over 7000 downloads and 3000 hosted dates in Hong Kong since the start of February when DTX launched apps on both the Apple and Google marketplaces.

DTX launched its iOS app in Hong Kong on 5th February 2016, and followed up with a parallel Android version soon after. The Android app in particular was a key milestone as it provides access to 90% of potential smartphone users in Hong Kong given the strong preference of Android over Apple in the region.

Less than 1 month on, DTX has now surpassed Tinder on the Hong Kong iOS download charts, consistently ranked in the top 5 over the course of February.

Tinder is one of the leading online dating apps in the world, currently used by over 50 million people globally. Tinder’s parent company Match Group (NASDAQ:MTCH) completed its US$400 million initial public offering (IPO) in the US last November.

DTX’s dating app differs to the majority of its rivals because it focuses on detailed matchmaking and serious intentions, not just dating. DTX has developed a proprietary matchmaking engine which algorithmically scores, ranks and matches people based on multiple dimensions of compatibility, including physical attributes, personality traits and date preferences. Members can meet new people for casual dating, serious relationships, business networking or activity partners at nearby establishments for meals, drinks and other activities.

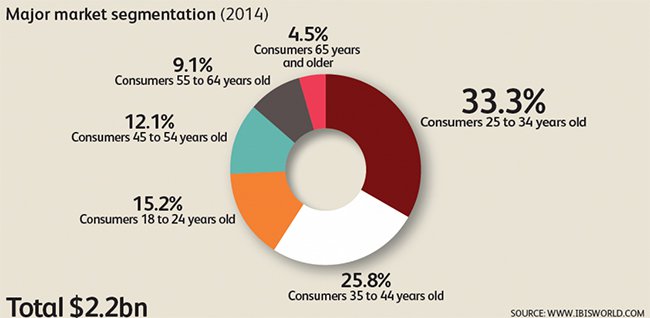

The demographics of internet dating

DTX is confident that by going the extra mile in its matchmaking, it can generate a far more boutique dating service that can command higher subscription fees.

Its premium matchmaking service provides clients with a highly curated and personalised experience, “typically guaranteeing a minimum of five handpicked dates over a 12-month period” the company says. These services are priced at approximately A$3000 per client and represent an early source of revenue for DTX in monetizing its growing user base.

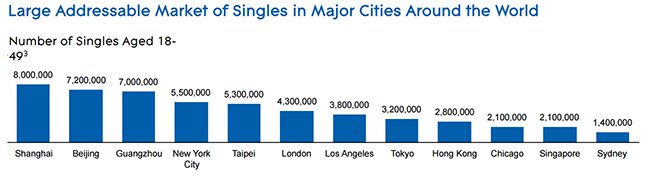

With an initial focus on major Asian cities, DateTix plans to build, grow and cultivate leading local mobile marketplaces for in person and on-demand dates in major cities around the world.

In response to today’s news, DTX Founder & CEO Michael Ye said, “We are incredibly excited by the initial reception and growth momentum that DateTix has achieved so far in the Hong Kong market. The DateTix platform has been designed from the ground up to help users connect and meet in real life, which we believe to be a much more valuable experience than just on line chatting, which has been the focus of most other online dating apps”.

“The encouraging early results we have achieved in Hong Kong bodes well for our upcoming global expansion” he added.

China-bound

DTX’s strategy is establish a presence in Hong Kong before moving into the far larger mainland China market where there are an estimated 200 million singles and a fast-growing online dating market that is expected to reach US$1.6bn by the end of this year.

China’s major cities have 20 million + singles (and growing)

In preparation for its regional expansion, DTX reports that it’s in the final stages of developing local customisations having recently strengthened its China-based R&D team.

In a further boost to its early-stage development, DTX says that its “average user acquisition costs in the city [Hong Kong] has been decreasing” following an increase in brand awareness and popularity amongst internet savvy young adults.

As part of its commitment to generating grass-roots support and viral popularity, DTX partnered with Launchpilots in December 2015 in order to gain access to over 100,000 young adult users.

DateTix also reports that it has successfully upgraded its back-end cloud infrastructure to support the large increase in the number of concurrent users on its platform.

“The DateTix technology platform is globally scalable and our business model is asset light, which enables us to rapidly roll out DateTix to multiple markets around the world in a relatively short period of time. Once market leadership and user density has been achieved in a target market, our focus will turn to monetisation of our user base through a combination of online and offline revenue streams” said Mr. Ye.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.