Cycliq delivers strong revenue growth in March quarter

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Impressive revenue growth figures released by Cycliq Group (ASX:CYQ) on Monday have come on the back of seven separate distribution agreements and/or launches announced in April.

CYQ is the leading brand in high definition camera and lighting combinations, delivering cycling safety and action camera solutions for commuters, mountain bikers, racers and professional cyclists alike. The company supplies its products to 48 countries worldwide, and this is quickly growing following the establishment of new distribution agreements in the last month.

However, given the company is only in the early stages of entering markets such as North America, Europe and the Asia-Pacific investors should seek professional financial advice if considering this stock for their portfolio.

CYQ’s intended markets have total cyclist numbers of about 260 million, which means there is substantial scope for sustainable long-term growth.

On that note, it was clearly evident in the company’s results for the three months to March 31, 2017, a period in which there was no benefit from the April distribution agreements negotiated, that there is substantial upside on the horizon.

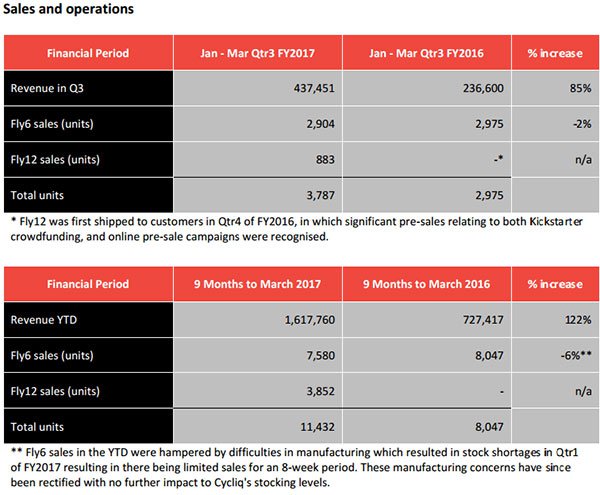

Third quarter revenues were $437,451, representing a year-on-year increase of 85%. Year-to-date revenue is an impressive $1.6 million, an increase of 122%.

Fly12 to assist in maintaining strong sales momentum in 2017

CYQ’s highly sought after Fly12 front facing products only became commercially available in the fourth quarter of 2016, and company chairman Chris Singleton noted that this product had been a key driver of the substantial increase in year-to-date revenue growth.

Having only listed on the ASX in December 2016, the progress the company has made in such a short period of time is not just financially impressive, but it is arguably indicative of the quality of its cycling accessory products which not only feature clever technology but also offer riders safety benefits not previously achievable.

In terms of the March quarter performance it should also be noted that this is traditionally a weaker sales period as it coincides with the post-Christmas lull in consumer spending. More specifically, from a cycling perspective cold and wet weather conditions in many European countries which represent a large portion of the company’s market, are not all that conducive to cycling and outdoor activities.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.