Crowdsourcing pioneer NWZ rejigs internal operations

Published 22-FEB-2016 14:14 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Newzulu (ASX:NWZ), a growing name in crowdsourcing news, has decided to undergo a wholesale restructuring focused on reducing costs and raising efficiency to improve future performance.

Newzulu is a crowd-sourced media provider, facilitating citizen journalists, photographers and videographers to submit news content. In NWZ’s own words, NWZ allows anybody, anywhere, with a mobile device and a story, to share news, get published and get paid.

Currently operating in half a dozen locations around the globe (New York, Paris, LA, Toronto, Sydney and London), NWZ has relocated its headquarters to New York as part of an efficiency drive aimed at reducing the company’s entire cost base, but also, to position itself in the most lucrative content market in the world: North America.

NWZ says that its revenues from major partnership agreements have commenced in the second half of 2015 which has enabled NWZ to report strong revenue growth in the first half of the 2016 financial year.

Operating revenues totalled $1.496 million for the 6-month period, representing a 518% increase on the previous comparative period (1H FY15: $0.242 million). Customer cash receipts rose strongly by 736%, year-on-year. Annual run rate revenue increased up to $4.9 million, 45% higher year-on-year.

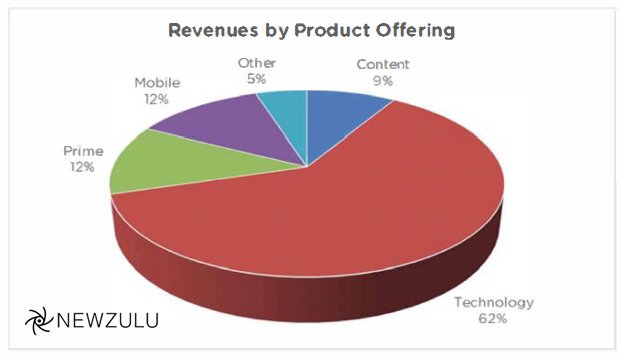

The key drivers of this solid uplift were the result of revenues generated by Newzulu Technology, which contributed 62% of revenues to the Group and by Filemobile Inc. and Octiplex SAS, businesses which were acquired last year.

In a regulatory filing, NWZ says it content marketing software unit Filemobile, generated $0.837 million in revenues in the second half of 2015.

Meanwhile, Newzulu Mobile which commenced operations in mid-2016, contributed 12% of revenues to the group in the second half of last year.

Given the upbeat nature of its sales and revenue metrics, NWZ is already looking forward to the expected growth in networked and mobile devices over the coming years (24.4 billion by 2019). “Newzulu Mobile is well positioned as the global leader in mobile applications design, development and deployment to service the growing demand for app development services”, according to NWZ.

Easy as ABC

With regards to NWZ’s content sharing trial with ABC News, dubbed ‘The Australia Day Project’, NWZ says it attracted over 1 million views and now “anticipates further commercial engagement and documentation to conclude during Q3 FY16”. ‘The Australia Day Project’ focused on gathering, producing and distributing content related to Australia Day on 26 January 2016, exclusively for ABC News viewers in Australia.

NWZ’s collaborative efforts with ABC News and its other partners acknowledges the growing trend toward greater personalization and control of television and channels therefore improving ease-of-access and choice for viewers. NWZ is implementing a strategy to produce crowd-sourced television and online video channels from user-generated content built on the Newzulu technology platform.

NWZ Cost & Revenue Analysis

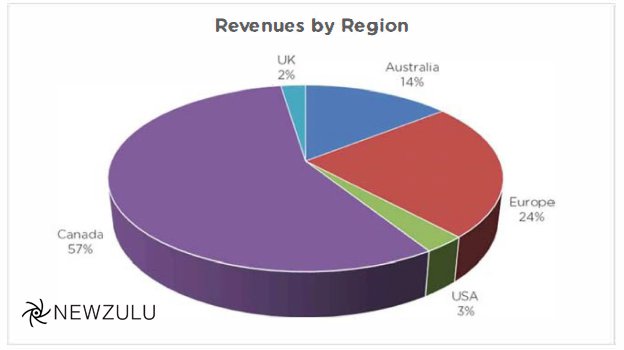

From a geographic perspective, 57% of NWZ’s revenues were generated in Canada. The strategic acquisition of Filemobile added significant value to NWZ and contributed materially to its financial performance. The European region contributed 24% towards total revenues.

Revenues in the USA did not contribute meaningfully to financial results although this is subject to change according to NWZ’s Management team.

According to an official announcement, “NWZ’s Management is confident that the relocation of headquarters and the Managing Director to New York, appointment of a US-based Chairman and focus on North America will grow client signings and revenues in the region”.

From a cost perspective, NWZ is slashing all unnecessary spending in order to streamline its entire business, making it more profitable in the long-term. In addition to a major relocation of its headquarters and CEO to NY, NWZ’s CEO Alexander Hartman has volunteered to reduce his overall remuneration package including a base salary cut and suspension of short term incentive cash payments.

During 1H FY16 NWZ says it “completed a range of cost containment initiatives in order to reduce cash burn” including bureau closures to centralize the company’s operations. “Further significant cost cuts exceeding $5 million per annum are being implemented by management” said NWZ, although “the full effect of these recent measures will not be realized until FY17”.

NWZ’s recent restructuring drive is expected to deliver estimated cash savings of over $5 million per annum, in addition to the $1.1 million per annum cash savings already implemented towards the end of last year. NWZ says it now expects to reach cash flow positive operations in “calendar year 2016”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.