CropLogic expansion lays foundation for $40M profit

Published 24-APR-2019 09:25 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Global agricultural technology group, CropLogic Ltd (ASX:CLI), informed the market on Wednesday morning that it had more than trebled the size of its Industrial Hemp Trial Farm in Central Oregon (US), a development that should result in a substantial increase in income and profits.

Based on current metrics, management suggested that profits of more than $30 million could be generated from potential sales of more than $40 million.

The land size has increased from 150 acres to 500 acres under lease, allowing the company to further vertically integrate its agronomy and agtech expertise.

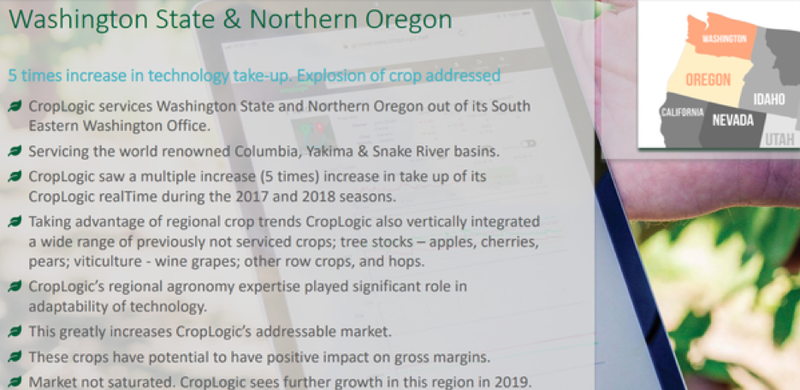

CropLogic has significant experience in the region having launched its product into Washington State, US in 2017, and expanded into North Oregon in 2018.

The company is servicing a significant portion of horticultural growers in this region, with a market share as high as 30% in some crops.

Vertically integrated model adaptable to multiple crops

In discussing the benefits of this development, James Cooper-Jones, CropLogic chief executive said, “Although this Trial Farm of 500 acres is modest when compared with the approximate 100,000 acres CropLogic services in Washington State each year, we feel the varying growing environments presents an opportunity for CropLogic to further vertically integrate its agronomy and agtech expertise, greatly enhancing our scientific knowledge of not only an emerging crop such as industrial hemp, but also generally.”

The increase in size will enable CropLogic to evaluate and produce reference data for different growing conditions such as soil types, land contours and elevations in order to optimise crop yields.

Discussions with local hemp growers confirmed the need for representative data across various conditions, and a variety of irrigation systems and genetics will also be used.

These elements enable CropLogic to validate its agronomy expertise and suite of ag-tech technologies in a variety of scenarios, adding greatly to the company’s proprietary scientific knowledge.

Management believes this knowledge can be applied to CropLogic’s customers not only in the US and Australia, but also in the emerging industrial hemp market outside these areas.

CropLogic’s drone technology will also be utilised this season at the Industrial Hemp Trial Farm.

Drone technology is particularly applicable to high value crops such as industrial hemp, but interest has also been shown by other CropLogic clients in the grape industry in Australia and the apple and row crop industry in Washington State.

Well-supported $3 million placement

Management expects production rates will be in a range between 800,000 and 1.1 million pounds of industrial hemp biomass for the total 500 acres.

The price of hemp biomass varies between grade and variety, but prices of US$35 and US$45 per pound were reported in CropLogic’s recent investigations into the industry.

The indicative cost to produce the Industrial Hemp Biomass is expected to be in a range between US$5.00 per pound and US$7.00 per pound.

This could generate Australian denominated profits in a range between $31 million and $58 million.

CropLogic has strengthened its balance sheet in order to fund production, raising $3.0 million through a placement at 4.0 cents per share and arranging a $2.8 million debt facility.

The placement price is in line with the company’s last closing price which was a near nine-month high.

This demonstrates strong support for the company’s business and management, suggesting that there is also reasonable confidence surrounding the income and profit guidance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.