Contract signings deliver strong quarter for Alcidion

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Healthcare informatics solutions provider, Alcidion Group Limited (ASX:ALC) today reported that it had achieved positive cash flow and boosted its cash position during the third quarter ending 31 March 2019.

The company’s performance is something that has not gone unnoticed by investors, with the share price gaining more than 40% over the quarter.

The company highlighted in its Appendix 4C quarterly cash flow statement that net operating cash surplus was $1.3 million in the quarter off the back of $6.2 million cash receipts, up from $4.1 million in the second quarter.

Receipts were boosted by a $880,000 payment in advance against a new UK contract, the related revenue to be recognised over the five year term of the contract. Adjusting for this, underlying operational cash flows still generated a surplus of $450,000 for the quarter. Management expects a similarly positive operational cash flow in the fourth quarter.

Alcidion’s available cash reserves as were $2.9 million at quarter end, compared to $1.5 million three months prior.

Management expects Alcidion’s cash position will continue to improve over the fourth quarter and confirmed that it will not need to consider a capital raising to restore working capital.

This comes as the group signed or renewed a total of 24 contracts for its products (Miya, Patientrack and Smartpage) and specialist IT services, with a Total Contract Value (TCV) of $5.3 million.

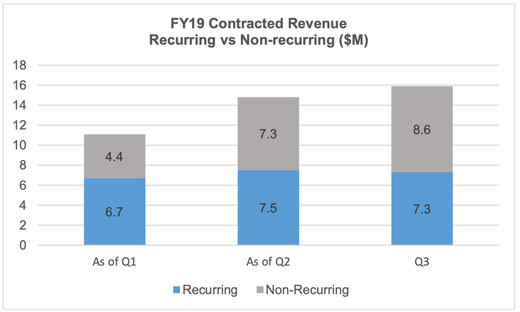

At the quarter’s end, the contracted revenue to be recognised during the year had risen to $15.9 million, up from $14.8 million at the end of the prior quarter. This contracted revenue includes service and product related fees, with $7.3 million being recurring revenue and $8.6 million non-recurring revenue.

Recurring revenue includes revenues derived from Alcidion’s SaaS subscription revenue, product licence fees (payable annually), product support and maintenance fees (payable annually) and recurring multi-year service contracts.

While non-recurring revenues include revenues from upfront product licence fees and non-recurring services such as product implementation and commissioning services as well as fixed term professional services projects.

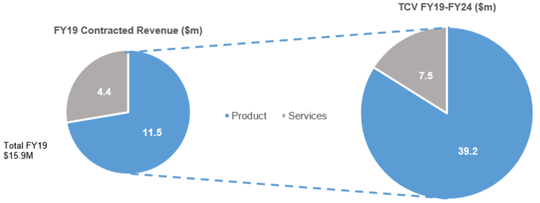

A further $30.8 million of contracted revenue will be recognised over the next five years from these contracts.

The graph below shows contracted revenue that’s expected to be recognised in FY19 as well as the Total Contract Value (TCV) of customer contracts through to 2024, broken down by product revenue and service revenue.

Material contract wins announced to the market during the quarter were with Dartford & Gravesham NHS Trust (UK), Brighton & Sussex University Hospital NHS Trust (UK), and ACT Health.

- Dartford & Gravesham NHS Trust (UK): 5-year contract worth £1.16 million (∼$2.1 million) in respect of Alcidion’s total product suite (Miya, Patientrack and Smartpage). This will represent the first integrated installation of Alcidion’s core three products outside Australia.

- Brighton & Sussex University Hospital NHS Trust (UK): 5-year contract worth £574,000 ($1.03 million) to implement Patientrack across four hospital sites.

- ACT Health: 2.5 year contract extension for Patientrack with ACT Health to further extend the use of the technology across the ACT. Contract worth $0.7 million.

Post-acquisition transition

ALC continues its program to transition post-acquisition and aims to effectively operate as “one company” by the end of Q1 FY2020, with the investment in this program having mostly been already incurred and is reducing each quarter.

Ms Kate Quirke, ALC Managing Director said, “I am very pleased with the progress Alcidion has made this quarter, particularly delivering strategic contract wins in both the UK and ANZ. The contract wins during the quarter continue to demonstrate the progress our sales and marketing team is making in cross-selling the enlarged product portfolio of Miya, Patientrack and Smartpage across the larger international customer base.”

“While we are still in the process of making the necessary investments to finalise the business and technology integration of the MKM Health and Patientrack businesses, and further expand our sales and marketing capability, we expect the integration program to be substantially complete by the end of Q1 FY2020 This will provide a solid platform for further growth in revenues and profitability next financial year.”

“In the meantime, we remain firmly focused on rebuilding our cash reserves following completion of the acquisitions. We expect to do this from operating cash surpluses without needing to resort to a capital raising to boost working capital. We expect to continue to generate positive operating cash flows next quarter and beyond.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.