Consumer wearable app deal sees CardieX shares surge 40%

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

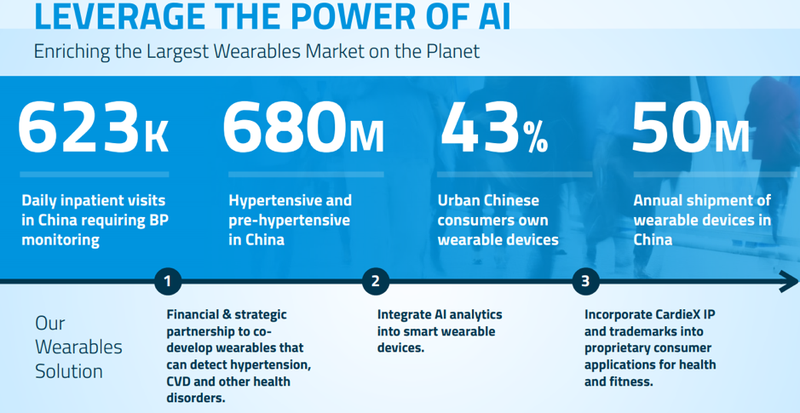

CardieX Ltd (ASX:CDX) has entered into a JV with the largest Google wearable platform partner in China. This extremely promising news regarding the co-development of its consumer wearable applications saw its shares surge 40% when it recommenced trading on Wednesday last week.

The company has entered into a multi-year agreement with Mobvoi Information Technology Co. Ltd, Google’s official operating partner in China for the development of smart-wearable solutions for Google’s Wear OS platform.

Under the terms of the agreement, CardieX will be Mobvoi’s exclusive partner with regard to the development of applications and features related to “smart heart health” and associated functions that can be derived specifically from CardieX’s unique algorithms.

All development activities and commercial execution of the agreement will be undertaken by CardieX’s 100% subsidiary ATCOR Medical Pty Ltd based on ATCOR’s SphygmoCor® cardiovascular and hypertension algorithms and patents.

Mobvoi is one of the fastest growing artificial intelligence (AI) and consumer electronics companies in China in the smart wearable segment and is Google’s official partner in China for Google’s Wear OS platform.

Wear OS is a version of Google's Android operating system designed specifically for smart-watches and other wearables.

Combining algorithms, software and sensor technology

Co-development activities will combine the algorithms and software of CardieX’s subsidiary ATCOR and Mobvoi’s sensor technology into a unique and market leading wearable consumer health platform on Google’s Wear OS platform.

ATCOR will be responsible for developing a set of algorithms specifically for implementation in Mobvoi smart-watches, and it will also be charged with the task of developing the accompanying apps on the smart-watch and smart-phone that form the smart heart health ecosystem.

Mobvoi will be responsible for creating a next generation smart-watch to integrate algorithms specifically designed for Mobvoi by ATCOR.

The group will also be responsible for integrating the Mobvoi-specific algorithm set developed by ATCOR.

The eventual commercial objective is for Mobvoi to sell their new smart-watches that are “powered by ATCOR” into their existing e-commerce and physical retail channels, thereby establishing a worldwide installed base of CardieX/ATCOR apps for smart-watches and smart-phones.

Million-dollar royalties followed by exponential growth

Commercially, management expects that the partnership would result in a seven-figure royalty for the initial 12 months of sales commencing fiscal 2021 on launch of the first Mobvoi wearable device “powered by ATCOR”.

This factors in a single device integration at launch, however there is potentially much more to the story than one application.

Assuming both growth in unit sales of the smart-watch as well as the expansion of “powered by ATCOR” into other lines of smart-watches and other wearable devices, such as smart earbuds, management believes a conservative annual growth rate in a range between 20% and 30% for the following four years is a reasonable expectation for royalty payments.

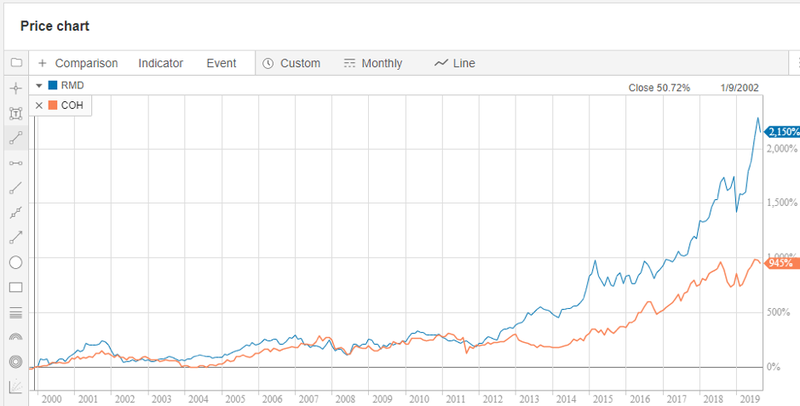

This type of growth trajectory is reminiscent of that achieved by the likes of ground-breaking proprietary device developers, ResMed (ASX:RMD) and Cochlear (ASX:COH) as they expanded off relatively immature bases.

Step back to the early stages in ResMed (ASX:RMD) and Cochlear’s (ASX:COH) history as ASX listed companies and you will see that they traded on price-earnings multiples between 20 and 30, reflecting their potential to deliver sustainable earnings growth well ahead of the broader market.

It was this outstanding earnings growth that contributed to share price increases of 2,150% and 945%, respectively, over the last 20 years.

As you can see in the following chart, not only have the two companies delivered substantial share price growth, but they have been consistent performers with their share prices barely missing a beat since 2000.

Recurring revenues provide earnings predictability

A successful commercial launch with Mobvoi could enable CardieX to replicate the same type of technology partnership model with other OEMs (original equipment manufacturers) of PPG-based consumer wearables.

PPG is a non-invasive method for the detection of heart rate and is connected with the optical properties of vascular tissue using a probe, usually LEDs.

Chief executive, Craig Cooper suggested that a reasonable assumption would be one to two technology partnerships per year, resulting in incremental revenue streams from royalty payments starting between 12 to 24 months after technology partnerships are launched.

The magnitude of royalty payments depends on ASP (average selling price) of the wearable device, but he expects they will be in a range between 3% and 5% of ASP based on current commercial discussions.

Importantly, the agreement also provides CardieX with access and integration to the Wear OS global operating and software partner network, positioning the company as the “Intel Inside” for a significant wearable device ecosystem.

However, one of the most compelling features of this development is its material validation of CardieX’s technology, as well as the company’s strategy to transition from a pure medical device business to a multi-platform provider of consumer and medical device and software/SaaS based solutions through its unique, market leading, and patented software algorithms.

Given that the business model, revenues, and commercialisation under the agreement will be driven by a combination of licensing, royalty, and subscription services, CardieX should be generating a significant proportion of recurring income, providing earnings predictability.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.