Asia-Pacific Securities initiates coverage on Invigor

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Asia-Pacific Securities (APP) has initiated coverage of Invigor Group (ASX:IVO), a provider of big data products to major corporates, retailers and government instrumentalities.

IVO’s interconnected datasets enable enterprise clients including retailers, brands, shopping centres and government bodies to identify and better understand competitors, consumers, markets and demographics while providing the consumer with the best value for money.

APP analyst, Russell Wright is impressed with IVO’s growth to date as well as its prospects for growing revenues through leveraging both existing and new partnerships. The broker expects IVO to announce a number of key partnerships with market leading organisations that will significantly strengthen the distribution channels for both its Insights Visitor and SpotLite products.

Insights Retail revenue is expected to grow materially through the engagement with major retailer and brand groups, assisted also by entry into new market verticals and geographic regions.

Wright also noted that SpotLite had secured local partnerships with eBay and GoDaddy, which will also be leveraged internationally. This is likely to be the springboard for the establishment of other partnerships which are purportedly in the pipeline and should be finalised within the next few months.

Management points to robust tendering pipeline in a high demand environment

When findeed.com discussed Wright’s views on upcoming developments with the group’s Managing Director, Gary Cohen he confirmed the likelihood of new contracts being negotiated in the near term.

He also pointed to some of the drivers which are underpinning demand for IVO’s products in saying, “We are witnessing growing demand from companies wanting enhanced data and predictive analytics capabilities, especially from bricks and mortar retailers and shopping malls who need to combat the growing threat of online sales”.

Further to this, Cohen said, “Our tendering pipeline reflects this demand and we expect to see more contracts materialising shortly”. Given this backdrop Cohen said that he feels the valuation attributed to IVO by APP is well supported by the company’s growing and robust tendering pipeline.

APP valuation implies share price upside of 130%

APP has initiated coverage of IVO with a buy recommendation and a target price of 2.5 cents, representing upside of nearly 130% to Wednesday’s opening price of 1.1 cents.

However, it should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

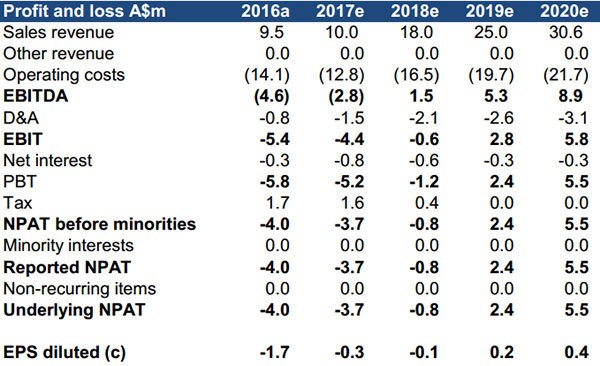

As indicated by APP’s projections outlined below, IVO is essentially a 2018/2019 story with revenues to grow on the back of acquisitions made in the last 12 months, as well as previously mentioned expansionary initiatives. This perhaps explains share price weakness as investors grapple with understanding how emerging technologies will gain traction in the medium term.

As indicated above, Wright is forecasting revenues to increase 150% from $10 million to $25 million between 2017 and 2019. In fiscal 2019 he is forecasting group EBITDA of $5.3 million and earnings per share of 0.2 cents. Based on IVO’s current share price this implies a PE multiple of 5.5.

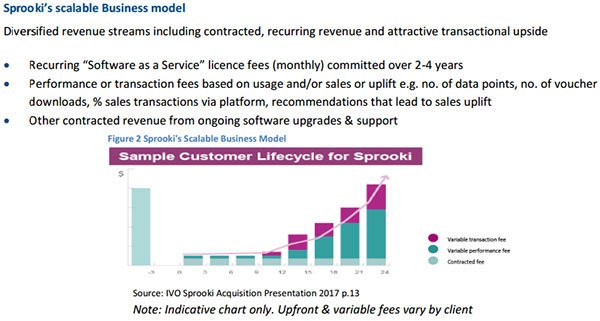

As well as being conservatively valued, the other key factor to bear in mind with IVO is its increasing levels of recurring income, providing earnings predictability which is important for smaller emerging companies.

This is particularly the case with IVO’s Sprooki business as indicated below.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.