Analyst sees share price upside for UltraCharge

Published 11-OCT-2017 11:51 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

TMT Analytics analyst, Marc Kennis, has initiated coverage on battery technology company, UltraCharge (ASX:UTR) with a buy recommendation and a price target of 9 cents per share, implying upside of 180 per cent to this morning’s opening price of 3.2 cents.

Kennis highlighted the well-documented industry dynamics that are currently driving demand for power storage devices and made the point that this will only accelerate in coming years as the number of electric vehicles increases markedly.

The other aspect he noted was that batteries being used in standard devices such as phones already appear to be outgrowing the necessary capacity required to handle the wide range of uses, effectively necessitating frequent charging which is taking all too long for the average consumer.

Such are the problems being faced by manufacturers of smart technology that even a big player in Samsung had catastrophic outcomes from the explosion of batteries used in its Galaxy Note 7.

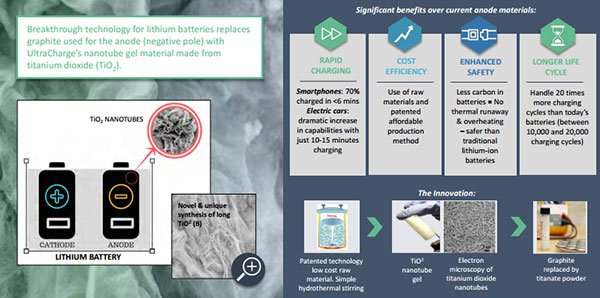

UTR’s technology will replace graphite in anodes (negative pole) with a nanotube gel material made from titanium dioxide in lithium batteries. Management believes this has the potential to revolutionise the market for lithium batteries by producing a battery that is safe, fast charging and has a longer lifetime.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

The company is well on the way to developing this technology having established a laboratory facility in Israel to conduct nanotube synthesis and fabrication of the nanotube anode. Furthermore, it is discussing supply options with end users in the global battery market.

The recent acquisition of new cathode intellectual property from Israeli company ETV Energy should provide a wider product offering that will open new market opportunities and revenue streams while enhancing UTR’s existing anode solution.

UltraCharge shaping up as an IP licensing play

It would appear that this trend is set to continue as Kennis sees UTR as an aggregator of IP around rechargeable battery technology. This includes current IP around anode technology, but could include other technologies as well.

Commercialisation of UTR’s IP will be focused on value-added licensing of this technology. Kennis expects the company to provide clients with a license to use its technology as well as bringing its electrochemistry process know-how to the table, assisting licensees in bringing UTR’s technology to market quickly.

Given its industry network, UTR would be in an ideal position to provide its licensees with access to potential customers such as electronic vehicle manufacturers, as well as laptop and mobile phone companies.

This would see UTR generating multiple income streams and being just as much a services company as an innovative developer and manufacturer.

Should management be able to position UTR in such a way, it is likely to gain substantial investor support as it serves to partly de-risk the capital intensive technology development side of the business, while generating predictable recurring income from licensing and ongoing services agreements.

Numerous near-term share price catalysts

Kennis said near-term share price catalysts included the execution of commercial deals and agreements with suppliers to the lithium-ion battery industry as well as with battery manufacturers directly.

He also sees the production scale up of titanium dioxide nanotube test materials as enabling UTR to have more prospects testing the technology, effectively expediting the commercial rollout. Kennis anticipates news flow around volume scale up to occur in the ‘next several months’, which is relatively near-term in the tech industry.

He noted that a joint venture agreement with one of the large titanium dioxide manufacturers which would potentially start joint nanotube manufacturing is actively being pursued. One would expect that if UTR could seal such a deal it could be the catalyst for a significant share price rerating.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.