Alexium and Colinton streamlining efficiencies and optimising growth

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

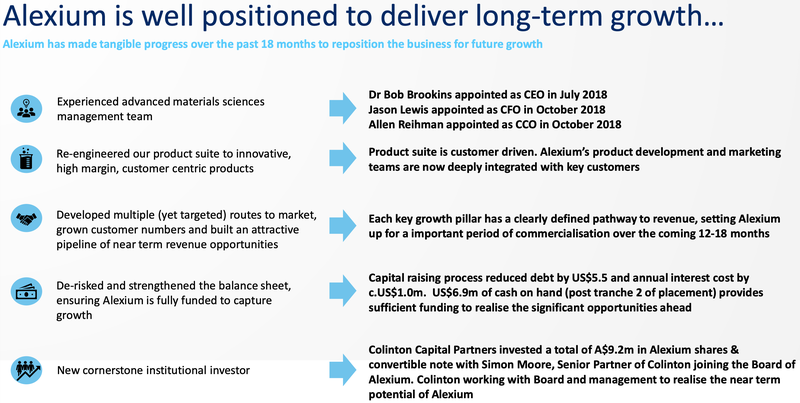

Shares in Alexium International Group Limited (ASX: AJX) have increased 50% since June, buoyed by promising operational news flow in the preceding months, culminating in a strengthening of the company’s board and the entry of an institutional investor in Colinton Capital Partners, headed up by Simon Moore one of Australia’s leading entrepreneurs.

Moore was managing director and global partner of The Carlyle Group between 2005 and 2016 where he was involved with shaping the strategy of many corporations, leading significant turnarounds, and managing numerous corporate transactions across small and large companies.

Finfeed's Damian Hajda had the opportunity to catch up with Moore last week, and he provided some valuable insights into what it takes to succeed as an investor that partners with business owners and senior management with a view to unlocking the growth potential of emerging businesses.

In a nutshell, Colinton is a constructive investor, leveraging its collective experience and that of its broader networks in order to add value to the businesses it partners with.

As a general rule, Colinton invests in growing businesses with strong market positions, positive earnings and enterprise values from $20 million to $200 million.

The group specialises in providing flexible capital solutions for expansion, succession planning, management buy-outs/buy-ins, public-to-private transactions and active minority public positions, an ideal partner for Alexium in terms of negotiating the corporate world.

All creatures great and small

During Moore’s time at Carlyle, the group was an early stage investor in what is now a major logistics enterprise in QUBE Holdings (ASX: QUB), taking it from a market capitalisation of about $300 million to $500 million.

He was also involved with the privatisation of Coates Hire following its successful stint as an ASX-listed equipment hire company.

Moore also has plenty of experience with early stage enterprises, and on this note he oversaw Megaport’s transition from a private company to a circa $2 billion diversified telco.

This is the experience he brings to Colinton Capital Partners, and the group’s investment in Alexium International (ASX:AJX) should be seen as a positive endorsement of the business, as well as offering an injection of strategic guidance in terms of negotiating what can sometimes be a challenging path for smaller companies.

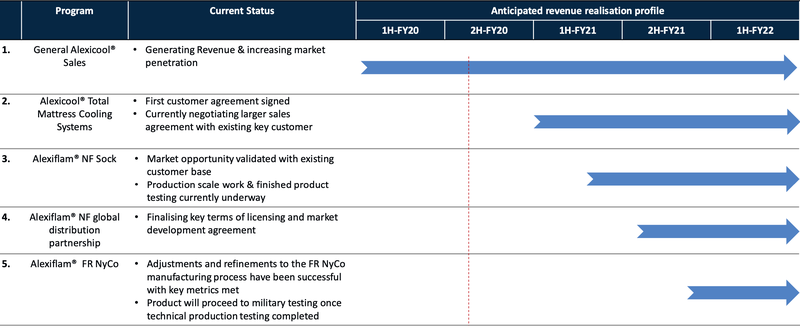

Alexium is a performance chemicals provider for advanced materials applications with a focus on flame retardancy and thermal management.

Key markets for Alexium are military uniforms, workwear, and bedding products with its brands including Alexicool® and Alexiflam®.

Colinton’s investment in Alexium appears perfectly timed with the group having battled through the difficult phase of research and development, launching new products and establishing robust relationships with clients/distributors, including the US Defence Force.

In commenting on the progress Alexium has made across these areas, Moore told Hajda, “From our perspective we (Alexium and Colinton collectively) don’t have to establish ourselves from ground zero.

"We have established clients and such a credible market presence that when we say our products work or we can get this, we are already a known and trusted commodity.

"Indeed, one of the factors that really sold us (Colinton) regarding the company’s potential was that it had two proven products, but having established goodwill and credibility you’ve also got a running start in terms of having credibility with customers on each side of the business.

"Especially with big customers like these big suppliers and some of the defence uniform stuff, it can be difficult to build that level of trust.’’

Responding to challenges

Moore’s experience will come to the fore as the group transitions to profitability, accelerates growth, expands its product range, broadens its portfolio of clients and enters new geographic regions.

Accelerated growth and expansion invariably throw up their own challenges with the need to streamline efficiencies and manage costs while also being cognisant of investing for improvement and scale in order to maintain a competitive advantage and optimise margins.

Retaining its competitive position is important as Alexium’s proprietary technology offers a point of difference between it and other industry players, providing decided barriers to entry across its core industries.

It is worth taking a step back to when Colinton first ran the ruler across Alexium and subsequently completed its due diligence to gain an understanding of how it can assist the group in managing the challenges while making the most of upcoming opportunities.

When Moore first decided to have a look at the business he and one of his partners, Jason Phillips, went to the US and met with Alexium’s management as well as a number of suppliers and customers.

Having been impressed with what they saw it was time to invest their money and gain board representation in order to work with management in executing a sound business plan.

On this note Moore said, “One of the things that we identified in diligence was that the company would benefit from was the addition of an expert from the chemicals industry who had considerable experience in the US in very relevant areas within chemicals and had travelled a similar commercialisation life pathway to what lay ahead for Alexium.

“So I revisited my old network as I'd lived in the States for nearly 15 years doing private equity over there.

“And through my friends and from my old working days over there, we identified a small group of potential candidates, and we interviewed them, and the one that stood out to us and we eventually put on the board was Paul Stenson.

“He’s got an excellent background, relevant skill set, the ability to deal and work with management and lengthy experience in working for big chemical companies similar to ICL, enabling him to understand all facets of Alexium’s business.’’

Alexium has made significant progress of recent times and on this note Moore said, “One of the things you're seeing now is a lot of work in progress being made around application of the fire retardant to the mattress sock or a mattress cover if you want to think of it that way.

“That in itself is like, well, we've got great relationships in the mattress industry and we're seen as an innovator in that category, but it's on the cooling agent side it's not on fire retardant, but we're dealing with very similar people.

‘’And our reputation and effectively our goodwill that we've established in the eyes of a customer such as Simmons Serta, and also Simmons SSB is already there.’’

Bear in mind Colinton is a long-term investor (at least four years), and for Alexium to have made as much ground as it has in collaboration with Colinton, the investment group has gone a long way to meeting its charter of being ‘’a constructive investor, leveraging its collective experience and that of its broader networks in order to add value.”

If what Alexium has been able to achieve in a relatively short period of time is a guide to what can be expected in the medium to long-term it is quite likely that the group will be one of Colinton’s ‘brag book’ investments.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.