Adtech play Engage:BDR poised to deliver strong revenue growth

Published 30-JAN-2019 12:18 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Diversified media group, engage:BDR (ASX:EN1), has amended its convertible securities agreement with CST Investment Fund to provide for raising up to US$5.8 million ($7 million) on top of the US$750,000 already raised.

The revised terms provide immediate funding of an additional US$800,000, which would immediately increase EN1’s revenue through additional publisher payments for incremental revenue growth.

This is a significant development for the group as its strategy is geared towards expanding its publisher network.

For the specifics of the proposed agreement, see EN1’s announcement this morning.

By way of background, EN1 is a cross-device advertising solution company, consistently recognised for powering integrated display and video ad experiences. The world’s top advertisers and comScore top 1000 publishers depend on its innovative advertising and managed service solutions to drive towards individualised KPIs.

EN1’s technology was built with the publisher in mind, and management believes that this accounts for the company’s achievements in maintaining and growing its relationships over the years.

Through its range of brands, EN1 assists in developing and delivering valuable advertising strategies by establishing direct publisher relationships, results-driven buying and optimisation, efficient targeting, cross-device and channel capabilities, and insightful post-campaign support.

Risk-free model provides revenue predictability

On a programmatic basis, EN1’s artificial intelligence (AI) algorithms identify valuable advertising inventory and predict what the market is willing to pay for inventory in real-time.

Part of the service is to highlight a product’s value, enhancing returns for the seller, while also improving its own margins.

As indicated below, the model is relatively simple as engage:BDR buys the inventory on a risk-free basis and sells it immediately to the highest bidder, as identified by its advertising program.

Shares surge on back of new programmatic partnerships

Just last week, EN1 informed the market that two recently signed integrations have gone live, including connected television leader, ThirdPresence.

Prominent Canadian programmatic platform, AcuityAds, also went live in January, and both are now generating income.

Combined with existing revenues from integrations executed in September and October last year, EN1 is poised to generate strong revenue growth in fiscal 2019.

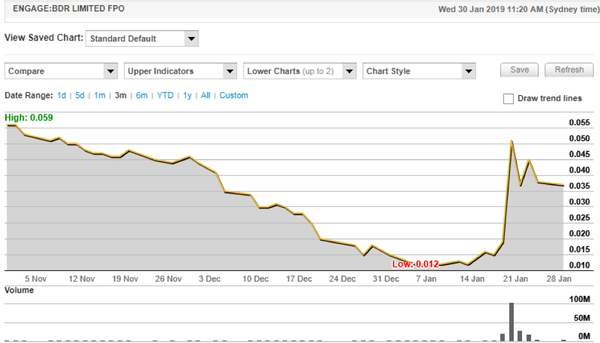

In an environment where emerging tech stocks often struggle to generate revenues, it wasn’t surprising to see EN1 shares take off on the back of this news.

Shares in the group increased from 1.9 cents on the day prior to the announcement to hit a high of 5.4 cents, representing an increase of 185%, and pushing up towards its three month high.

While there appeared to be some profit-taking towards the end of trading on that day, the company’s shares are still up approximately 100% since the news was announced, suggesting that EN1 is more than just a speculative play.

Industry conditions support growth

In the US, connected television is a prominent emerging sector into which video marketing budgets are being funnelled.

ThirdPresence is an important integration for EN1 because of its experience, knowledge and expansive reach within the connected television space.

Over 90% of EN1’s revenue is currently flowing from the US. However, as the company continues to grow, management expects the possibilities of expanding internationally will be more prominent.

AcuityAds has introduced high-profile brands, as well as offering digital advertising expertise across multiple media formats.

Prominent brands include Nike, MasterCard, Mazda, RBC Royal Bank, Nestle, Amazon, and Warner Brother Pictures.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.