3D printing and education: fast tracking the future of tomorrow

Published 26-MAY-2017 13:58 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

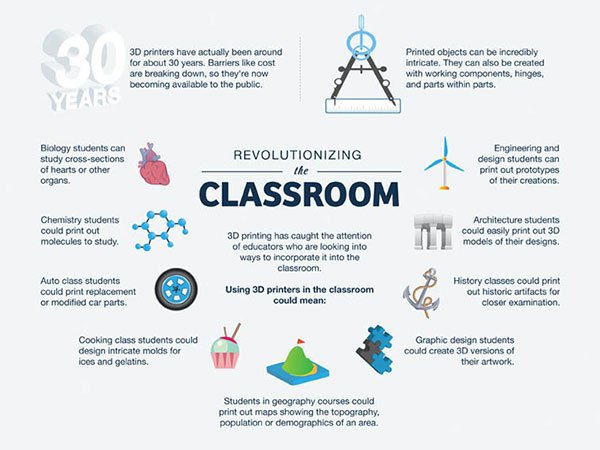

Innovative institutions ahead of the curve have taken advantage of the narrowing gap in cost between digital and 3D printers.

Thanks to software such as Computer Aided Design (CAD), 3D printing has regenerated the education sector, with some schools enrolling students as young as six into introductory 3D printing courses.

3D printing, otherwise known as additive manufacturing, is becoming a primary educational tool as schools across the globe adopt 3D learning models to cater to a growing demand in STEAM (science, technology, engineering, arts, mathematics) based curricula.

Government initiatives around the world are now putting 3D technology in the hands of students to provide skills for the future.

Education based interest in the 3D movement is, in part, responsible for the rapid growth of the market which was valued at around $3-$6 billion dollars in 2016, and has been projected to exceed $17 billion by 2020.

Whilst the benefits of 3D printers in education are numerous and substantial, such advancements could not be delivered in the absence of willing suppliers.

Thankfully, several companies have recognised the growing demand, and have looked to establish a foothold in what could become a lucrative market.

One such company is Robo 3D (ASX: RBO), who is tapping into the world of innovative education.

Before we go too far, we should note that this is an early stage tech stock, and investors should seek professional financial advice if considering for their portfolio.

Founded in 2012, the ASX listed company is bringing education to life in classrooms across the US, where it has already partnered with the world’s leading contract manufacturer for consumer electronics in Foxconn.

In addition, Robo 3D recently signed an agreement with WYNIT Distribution, a leading North American distributor of emerging technologies geared around educational curriculum.

With an unrivalled retail footprint in the US, Robo 3D is set to expand their reach into other countries, taking the advancements in education with them.

Over 800,000 units of its newest model, the Robo R-2, are already pre-ordered.

Robo 3D’s dedication to reworking the classroom is reflected in its business model, which takes into account the rapid rise in demand for STEAM.

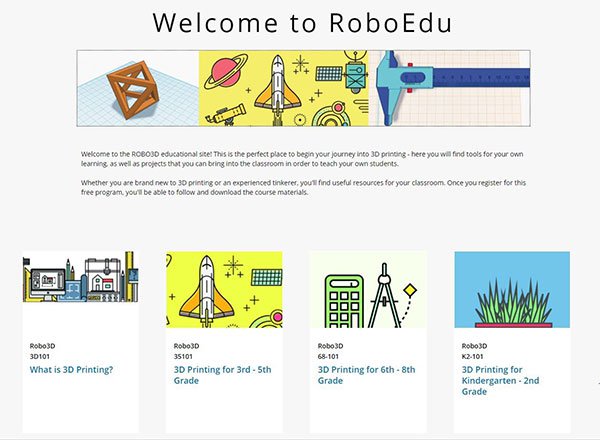

As government initiatives further encourage the implementation of 3D printing technology, the company continues to fortify its market position, recently launching an unparalleled education network, as seen below.

Offering exceptional support to teachers will enable more schools to introduce the world class technology, in a plan designed to make 3D printers an established asset in the classroom.

The outlook for education is therefore a very bright one.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.