Is the 30% fall in Altium a buying opportunity?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Electronic design software company Altium Limited (ASX:ALU) has confirmed its strong operational and market position in the new COVID-19 environment.

Notwithstanding the robust operational outlook, given the evolving nature of COVID-19 and uncertainty regarding its direction, management has taken a measured approach and withdrawn its earnings guidance.

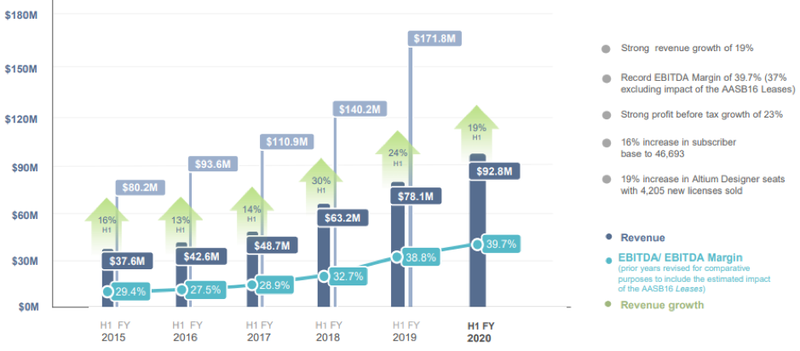

Altium reaffirmed its long established aspirational market leadership target of US$200 million for fiscal 2020.

Given this backdrop, one has to question whether the sell down in its shares from more than $42.00 in February to a low of about $23.00 was warranted.

Perhaps the answer to that lies in the surge in its share price over the last two days which has seen it increase from approximately $27.00 to yesterday’s closing price of $30.45.

As a guide to fair value, a consensus of eight brokers attributed a valuation of $37.04.

Despite the uncertainty surrounding COVID-19, Altium is operationally and commercially well positioned, with electronic design anticipated to be relatively resilient to weather the prevailing and unfolding market conditions.

Equipping the workplace for COVID-19 situations

While acknowledging the COVID-19 environment is a fluid and evolving situation, Altium’s chief executive Mr Aram Mirkazemi said, “As a high-tech company, Altium’s global workforce is geared to work digitally and for the past two months we have greatly increased our focus on driving productivity in this new operating environment.

‘’We are fortunate that our operating model is robust and highly adaptable to the new global conditions, as our marketing and direct selling are conducted through the Internet and via telephone.

“Moreover, we are well diversified across industry segments and regions worldwide.

“At an industry level, electronic design is holding up relatively well in the new environment as engineers use excess time and capacity from the slowdown in manufacturing and supply chain to revert back to prototype designs.”

This sounds like a company that is set to rebound from the downturn bigger and better than ever, particularly given that its proprietary products have market leading positions across extremely robust and resilient industries.

Altium 365 the next big thing

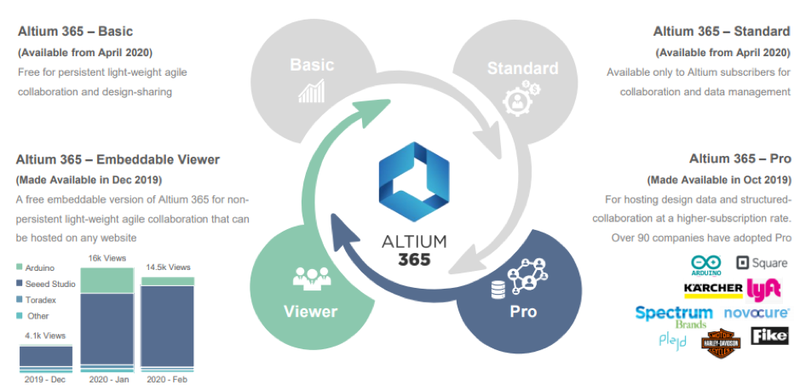

Altium is accelerating the rollout of its cloud platform Altium 365, as worldwide demand is growing rapidly for cloud-based collaborative tools across all sectors and regions, a trend which may accelerate as workplaces gear up for further COVID-19 type challenges that necessitate remote working arrangements.

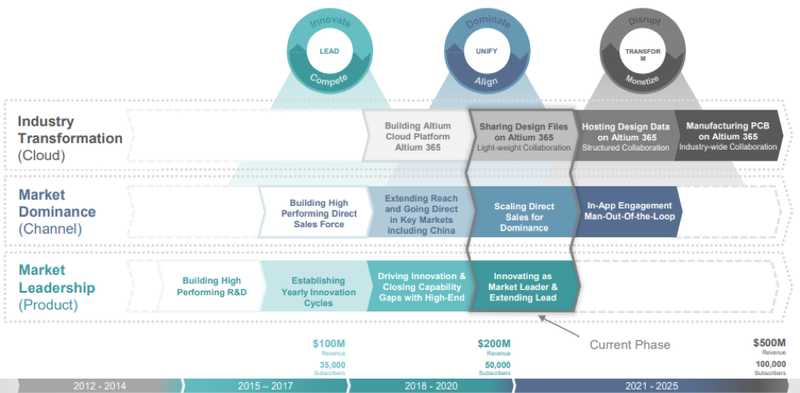

Altium 365 is a core enabler of its strategy of industry transformation through market dominance, and it supports the company’s drive to 100,000 subscribers by 2025.

Touching on the issue of remote access that we referred to earlier, Mirkazemi said, ‘’Altium 365 is particularly relevant to the circumstances that are unfolding under COVID-19, as it allows engineers to work from anywhere, and connect with anyone.

"We are also accelerating the rollout of our online/high volume selling approach, which will dramatically extend our inside sales capacity to support our drive through the fourth quarter and beyond.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.