1st Available sees cash position almost double in FY2016 results

Published 31-AUG-2016 17:54 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australian online health services company 1st Available Limited (ASX:1ST) has released its results for the twelve months ending 30th June 2016.

The year can be summed up as a period of consolidation and growth for 1ST, seeing revenues jump to $2M, up from $300,000 in the prior financial year.

This was largely driven by the signing of new commercial agreements, including the full year impact of the 2015 acquisitions of GObookings, Clinic Connect and DocAppointments.

The group monthly recurring revenues increased 55% to $177k, representing an annualised recurring revenue of $2.1M, excluding variable revenue ranging between $500-750k per annum.

The old adage that cash is king still rings true today and with $6.6M on hand as of 30th June 2016 and in zero debts 1ST finds itself in a strong position financially.

This is almost double the cash position of the previous year of $3.4M.

There is no guarantee however that these results will continue for the company and its shareholders so please seek professional financial advice before making any investment decision.

Part of the strong cash position was due to two separate capital raisings during the financial year of a $1.2M placement in November, followed by a placement and non-renounceable rights issue in June for $6.35M.

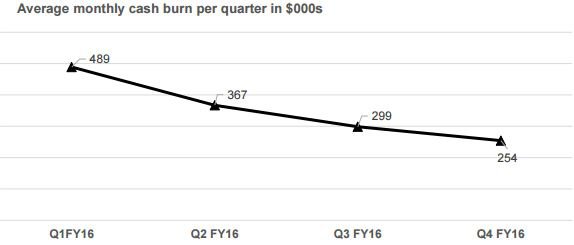

New sales revenues and operational efficiencies have seen the average monthly cash burn improve over the last four quarters from $489k to $254k:

However, operating losses before non-recurring and non-cash expenses was $2.7M, a yearly increase of 43%.

The increase in expenses was primarily due to higher employee benefits as a result of consolidating activities and business acquisitions ($1.3M), operational operations and administration expenses ($1M), and initial marketing and advertising costs ($0.2M).

Non-cash items were impacted by $1.1M from impaired assets that were written off, historical technology capitalisation in the Private Practice Cash Generating Unit. A further $1.5M was lost due to depreciation and amortisation expenses.

The year also saw the launch of a number of new products occurred towards the back end of the year, such as Self Check0In Apps, Kiosks, Patient Clipboard Apps, Recalls and Feedback Apps. These new products are designed to drive additional revenues from both existing and new clients in FY2017.

1ST has kicked off FY2017 with the acquisition of online appointment booking group OzDocsOnline (subject to due0diligence), a deal which will see 1ST expand its product offering for GPs whilst also allowing for greater consumer engagement and cross selling opportunities.

Additionally, 1ST has expanded into the pet-care market through a distribution partnership deal with the Australian Veterinary Association (AVA), the exclusive three-year deal will see the promotion on 1ST’s online services and booking platform to AVA professional members.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.