ZMI increases Kildare zinc and lead resource to 860,000t

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Zinc of Ireland NL (ASX:ZMI) has released an updated independent Mineral Resource Estimate for the Kildare Zinc Project, 40 kilometres south-west of Dublin, Ireland.

The updated resource ticks another important box for the group’s Kildare Zinc Project, with the contained zinc and lead resource inventory increasing to more than 850,000 tonnes.

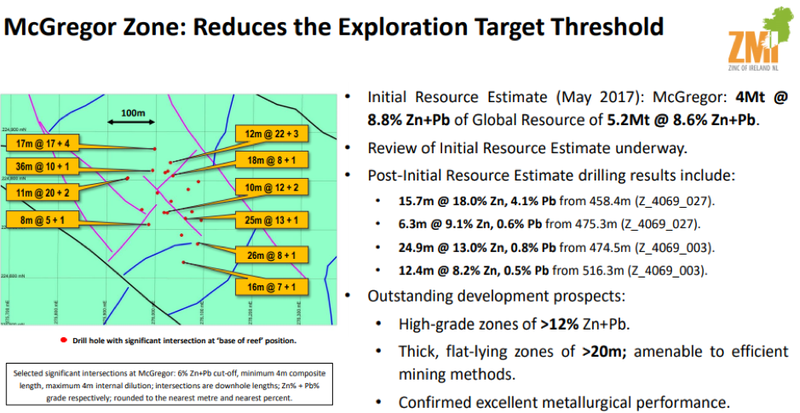

This significant improvement to the resources at Kildare greatly reduces the exploration risk threshold and provides a very strong foundation for ZMI’s ongoing exploration, which is seeking to discover new zones of mineralisation, while also expanding the known mineralisation.

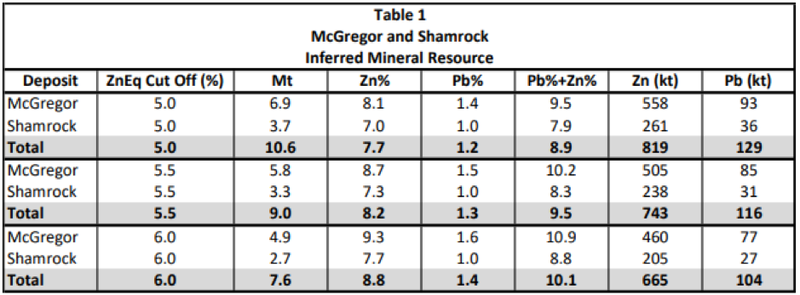

The Inferred Mineral Resource for the McGregor and Shamrock Zones of the Kildare Zinc Project using the preferred zinc equivalent cut-off grade of 5.5% is summarised in the following table.

The excellent results of ZMI’s recent metallurgical test work further reinforce Kildare’s value.

With an enterprise value of $9 million, the company is certainly punching above its weight with an inferred mineral resource of 9 million tonnes at 9.5% zinc and lead and multiple zones of mineralisation from near surface demonstrating 500 metres of vertical extent.

It is worth noting that the company has approximately $3 million in cash which will fund an ongoing and extensive drilling campaign that could well see the company in a position to make strong inroads into establishing a pre-development footprint in the second half of 2019

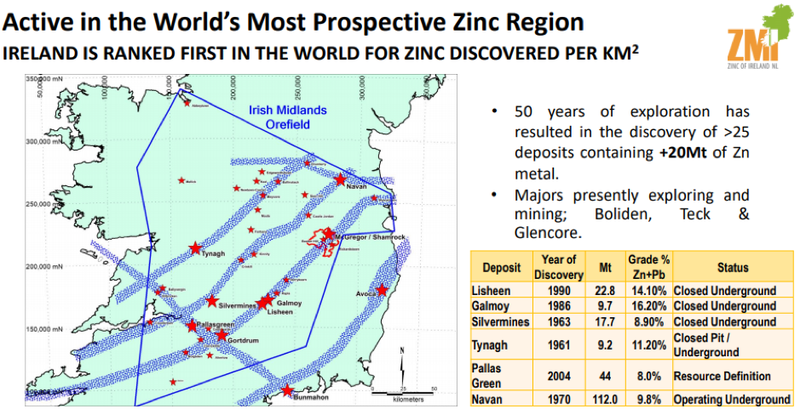

Good postcode, proven management

Ireland has a rich history of zinc mining as demonstrated by the profitable Lisheen and Galmoy mines which were also located within the Rathdowney Trend within 80 kilometres of Kildare.

With a substantial resource inventory, significant exploration upside, excellent metallurgical performance, and additional de-risking activities ongoing, the Kildare Project remains well-poised on the pathway to development.

Prior to completing the updated resource estimate, ZMI technical management and its specialist consultants undertook a multi-phase data acquisition programme in order to materially increase the level of knowledge and understanding of the Allenwood Graben, a highly prospective area of approximately eight square kilometres located within the greater Kildare Project.

This included sampling and assaying of approximately 4100 metres of previously unsampled drill core, structural and geochemical review of the entire Allenwood Graben, exploration drilling and metallurgical test work.

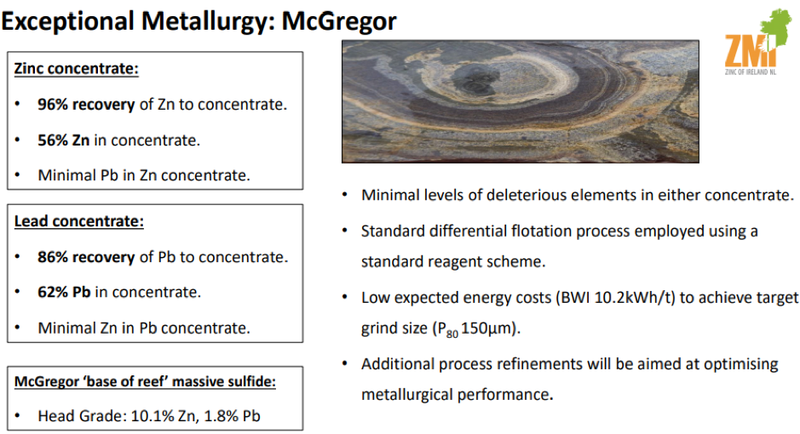

Excellent metallurgy

The latter has been particularly important in terms of establishing a zinc equivalent cut-off grade for use in resource reporting.

The metallurgical test work was carried out at a course grind size using a standard differential flotation process and a standard reagent regime.

This is a highly technical part of assessing the commercial viability of the ore which will be part and parcel of determining the economic credentials of the project, and in ZMI’s case the bottom line clearly delivered promising metallurgical results.

These included an overall 96.4% recovery of zinc to the concentrate was achieved, with a 56% zinc grade in the concentrate and with minimal lead of less than 0.5%.

The lead concentrate achieved 86.4% recovery with a 62% lead concentrate grade and minimal zinc of less than 3%.

Management has gone to exhaustive lengths in all aspects of developing the project, including the retrieval of historical data, exploration outside of known mineralisation and extensive deeper drilling based on well researched targets.

ZMI’s approach to arriving at a zinc equivalent formula was just as intricate with the group applying average prevailing zinc and lead prices over the last five years.

Consequently, the data underpinning the resource estimate appears sound, providing an accurate foundation for further resource expansion.

Expansion of resource proximal to McGregor and Shamrock

The Phase 1 exploration drilling campaign is ongoing in the Allenwood Graben with multiple rigs targeting areas with the potential to host additional zones of mineralisation similar to McGregor and Shamrock.

The planning of the Phase 2 drilling campaign is also being advanced, with particular focus being on the significant potential to expand the resource proximal to McGregor and Shamrock.

Allowances will also be made to follow up areas of priority from the Phase 1 drilling.

Parallel activities such as environmental, ESIA and additional metallurgy work will also be undertaken with a view to further de-risking the Kildare Zinc Project, such that any formal economic and development studies to be undertaken in the future can be expedited.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.