Zinc of Ireland targeting new zone at Kildare

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Zinc of Ireland NL (ASX:ZMI) has released promising drilling results from areas adjacent to the McGregor and Shamrock deposits that form part of its Kildare Zinc Project in Ireland.

Diamond drill hole HZDD004 intersected 6 metres at 12.5% zinc+lead (11.7% zinc, 0.8% lead) from 400 metres downhole depth and 10 metres at 9.1% zinc+lead (8.2% zinc, 0.9% lead) from 418 metres downhole depth at the base of Waulsortian Reef position.

With regard to establishing parameters, management used a 5.5% zinc equivalent cut-off, four metre minimum intersection width and four metre maximum internal dilution.

Before looking more closely at the results released today, it is worthwhile gaining an appreciation of ZMI’s strategy leading into the drilling campaign as it outlines both the geology of the area and management’s expertise in targeting certain zones.

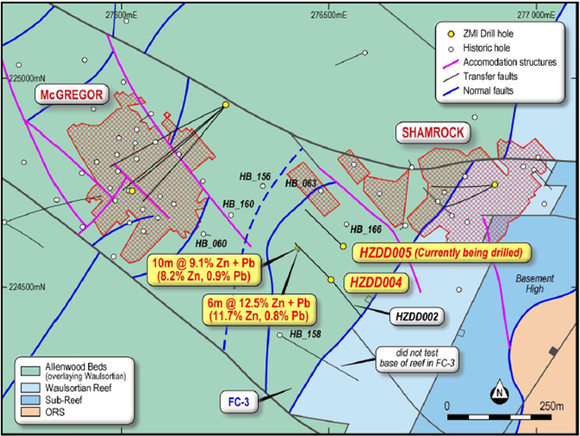

The following map will assist in providing an understanding of the areas being targeted by ZMI as it shows where the drilling is being conducted relative to established mineralisation.

Following the drilling of HZDD002, the management recognised the potential for FC-3 (fault compartment) to host base of reef style zinc-lead mineralisation and subsequently HZDD004 was completed from the same drill pad, targeting the centre of FC-3.

HZDD002 did not test the base of reef in FC-3 due to faulting but a range of very encouraging indications were encountered, leading the company to drill HZDD004.

The higher grade intersections were contained within a larger mineralised zone of 37 metres at 6% zinc+lead (5.5% zinc, 0.5% lead) from 390 metres, and using a 4% zinc equivalent cut-off, four metre minimum intersection width and six metre maximum internal dilution.

This indicated promising potential for additional zinc mineralisation within FC-3 which lies approximately 250 metres east of the McGregor zone and 200 metres south-west of the Shamrock zone.

FC-3 has a surface area of just over 100,000 square metres.

Providing an insight into how large this resource could be, the fault compartments which host the McGregor and Shamrock components of the resource (9 million tonnes at 9.5% zinc+lead) are approximately 160,000 square metres and 127,000 square metres respectively.

Mineralisation open in all directions

As indicated above, HZDD004 intersected the base of reef position approximately in the centre of FC-3.

Mineralisation is open in all directions, including 300 metres to the south before the bounding accommodation fault structure and transfer fault are encountered.

As such, drilling around HZDD004 will step out towards the faults to test the extent of mineralisation within FC-3.

HZDD004 was drilled at 75 degrees towards the north-west and intersected the expected stratigraphy with the Waulsortian Reef encountered at 184 metres until entering into the subreef at 420 metres.

Executive director, Patrick Corr explained the significance of the broader mineralised body in saying, ‘’It is of note that HZDD004 also intersected zinc mineralisation higher in the stratigraphic sequence between 219 metres and 237 metres (diluted overall intersection of 18 metres at 1.8% zinc, including 4 metres at 4.4% zinc from approximately 230 metres).

‘’In addition, the reported larger mineralised zone (from 391 metres to 428 metres down hole) is surrounded by a wide zone of lower grade zinc and lead mineralisation (from 365 metres to 468 metres down hole), which suggests that a volumetrically significant mineralised system has been intersected.’’

All intersections have been reported as downhole widths, which given the drill hole orientation and the overall low angle of bedding towards the south east, would mean that reported intervals are close to true widths.

As a point of reference, a 10% zinc grade within the McGregor zone would have a bulk density of approximately 3.3 tonnes per cubic metre.

Further drilling underway

Drilling of a follow-up diamond drill hole HZDD005 has commenced.

The drill hole is targeting the base of reef position approximately 90 metres to the north from the HZDD004 intersection within FC-3.

Exploration drilling continues within the Allenwood Graben with two diamond drill rigs.

One drill rig will continue to test the potential of FC-3, while the second drill rig will continue to test the next highest ranked fault compartments.

ZMI’s shares spiked 50% in July as the company began drilling at the Kildare Project and released an updated Mineral Resource Estimate.

With continued exploration results being released in the near term there is the prospect of maintaining this share price momentum.

While the zinc price has retraced from peak levels earlier in the year, it is still hovering around the midpoint of its long-term range.

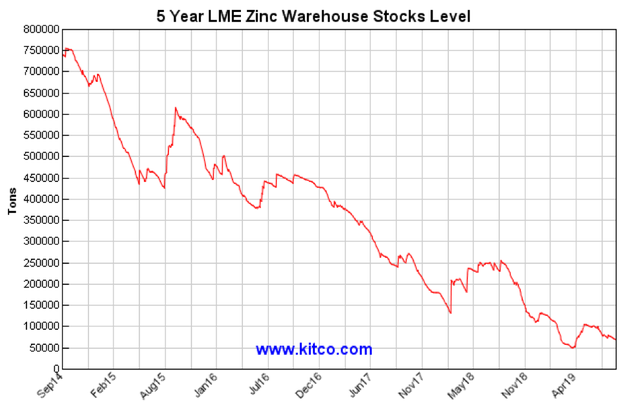

Furthermore, support appears to be building just above the US$1.00 per pound mark, and this could well be the platform for a rally given that five-year London Metals Exchange zinc warehouse stock levels are at a near record low.

It is worth noting that the steep fall in 2016/2017 as indicated in the following chart underpinned a strong rally in the zinc price which saw it increase from around US$0.70 per pound to US$1.60 per pound during that period.

Industry dynamics should work in ZMI’s favour given there is an anticipated reduction in the supply of zinc concentrate of approximately 400,000 tonnes by 2021 which can partly be attributed to the closure of multiple zinc smelters across North America and a decrease in production from China.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.