White Rock reinforces its progress at gold and VMS projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) has released its quarterly update to March 31, 2019.

During the quarter, several events took place, which included:

- WRM and Sandfire Resources (ASX:SFR) signing an Earn-In and Joint Venture Agreement to allow Sandfire to farm-in to the Red Mountain Project. As previously mentioned, Stage One will see Sandfire fund A$20M in exploration on the project over four years to earn 51%. For year one, the funding requirement is a minimum of A$6M

- As part of the above agreement, WRM and Sandfire formed a Management and Technical Committee, which developed and approved an A$6M budget for a 2019 exploration program

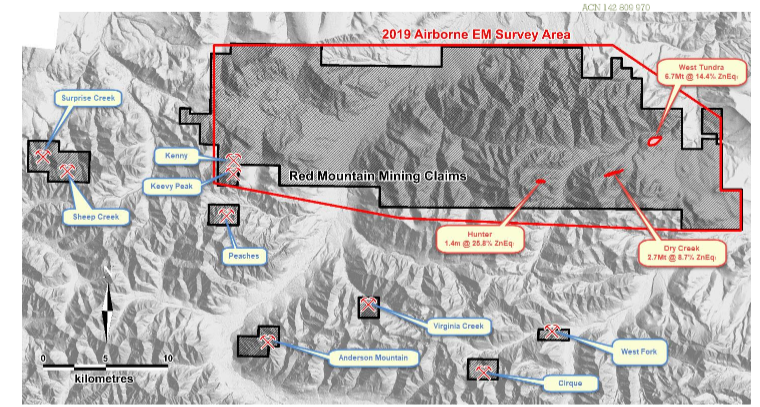

- Subsequent to the Quarter end, a 3,000KM SkyTEM airborne electromagnetic survey commenced.

Mt Carrington gold and silver project

WRM has also provided an update on its 100% owned Mt Carrington project in northern NSW.

A 2017 Pre-Feasibility Study (PFS) at the site declared a Maiden Ore Reserve of 3.47 million tonnes at 1.4g/t gold within a resource of 341,000 ounces of gold. The PFS confirmed Mt Carrington as a viable gold first project, with significant upside for subsequent silver production.

During the quarter, sustained strong Australian gold prices have encouraged WRM to explore avenues to expedite the development of the Mt Carrington tenement.

Red Mountain VMS Project

WRM and Sandfire have developed and approved an A$6M 2019 exploration program at Red Mountain. This program will include:

- 3,000 line km SkyTEM AEM survey – the first of its kind to be conducted at Red Mountain

- Satellite spectral analysis including the assessment of hyperspectral data, to identify and map alteration zonation ahead of field exploration

- Lithogeochemical analysis of tenement-wide rock chip samples collected in 2018, to assist in prioritising targets for detailed field exploration during 2019

- Extensive on-ground geological recon and soil geochemical sampling across regional target areas using portable XRF analysers

- Detailed electrical ground geophysics (CSAMT and MT) across the regional targets replicating the most rapid field acquisition technique that successfully mapped conductivity associated with mineralisation at Dry Creek and West Tundra

- A diamond drill program commencing late-May to follow up the successful discovery of new massive sulphide mineralisation at the Hunter prospect in 2018. This discovery has returned grades in excess of 17% zinc, 3% lead, 90 g/t silver and 1.5% copper, with only three drill holes completed to date

- A diamond drill program to test the best of the regional targets defined by this multidisciplinary use of airborne EM, 2018 stream geochemical anomalies, new satellite defined alteration, whole rock lithogeochemical alteration, on ground soil & rock geochemistry and on ground electrical geophysics

- Selective down hole EM surveys for follow up drill testing.

Corporate

As of March 31 this year, WRM had A$1.85M cash on hand.

On 14 January this year, it was announced that a new prospectus for the Kentgrove Equity Placement Facility was lodged as the previous prospectus had ceased. This new prospectus will expire on February 13 2020.

On February 22 it was announced that Ian Smith was resigning as a Non-Executive Director, effective February 28.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.