White Rock ready to explore at Alaskan zinc project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals Ltd (ASX:WRM) has updated the market on its plans to conduct a comprehensive exploration program at its 100% owned zinc VMS project at Red Mountain, Alaska.

The company has now completed the mobilisation of the major items necessary for its planned exploration program, with the diamond drill rig and camp accommodation, as well as support infrastructure, now at the camp site alongside the airstrip at Newman Creek.

Mobilisation of the drill rig and camp accommodation at Red Mountain.

Last month it announced it had awarded the drilling contract to Frontier Exploration, just days after Canada’s oldest and largest independent research firm, Fundamental Research Corp, started covering the small-cap. FRC’s coverage represents the third independent valuation, with DJ Carmichael and Independent Investment Research releasing reports about WRM last year.

In the report, FRC values the Red Mountain Zinc-Silver VMS Project at A$42.6 million, equivalent to 5 cents per WRM share. The company’s share price is currently $0.009.

The company’s upcoming field exploration work is planned to include:

- a targeted diamond drilling program aimed at

in-fill and expansion of the high-grade maiden Resource;

- on-ground orientation EM and possibly

geochemistry exploration across the two already identified deposits;

- regional application of the best geophysics

and geochemistry exploration tools determined from the on-ground orientation

work, and

- a follow-up diamond drilling program on the

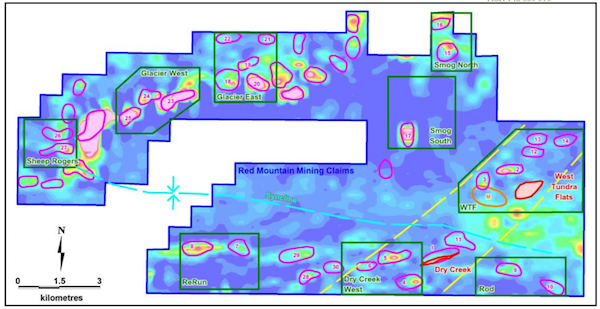

best of the more than 30 already identified exploration targets.

At the same time, WRM is currently undertaking a share placement and entitlement offer, with the aim of raising a total of A$5.2 million to fund exploration activities at Red Mountain.

It should be noted that WRM is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

Plans for the Red Mountain drilling campaign

Depending on weather, the initial drilling campaign is set to commence in late May or early June, with the key objective of infilling and extending the maiden Resource which already has two identified deposits — Dry Creek and West Tundra Flats.

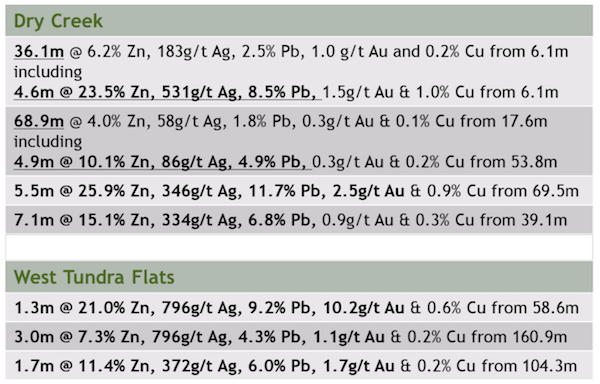

Red Mountain already has a Resource base of 16.7Mt at 8.9% zinc equivalent including a high-grade component of 9.1Mt @ 12.9% zinc equivalent. The last round of drilling undertaken at Red Mountain was in the 1990s, and returned the following intersections:

WRM Managing Director and CEO, Matt Gill commented on today’s announcement:

“The company is very excited about the potential for its globally significant high-grade Zinc VMS Project at Red Mountain, and the news flow that should come from a successful exploration program here. The company announced an Equity Raising of up to $5.2 million through a Placement and Entitlement Offer on 21st March.

“We have successfully closed the Placement component, heavily over-subscribed, raising A$1.6M (before costs). Existing eligible shareholders now have an opportunity to participate through the 1 for 3 partially underwritten pro-rata non-renounceable entitlement offer of fully paid ordinary shares and 1 for 2 unlisted options, to raise up to $3.6 million. The first A$1.6M of this Entitlement Offer is underwritten by DJ Carmichael.

“The funds raised from the Equity Raising (after costs) will be used to fund White Rock’s exploration activities at its globally significant high-grade zinc VMS Red Mountain Project in Alaska and for general working capital purposes. It is planned that approximately two thirds of this will go directly into the ground at Red Mountain, either from the drill program, or the on-ground geochemistry and geophysics work programs.

“This two-pronged exploration approach should generate significant news flow as we drill to infill and expand the existing high-grade maiden Resource and identify the next round of drill targets that should come from the more regional geophysics and geochemistry exploration programs planned.

“Since acquiring the Red Mountain project in early 2016, we have expanded our strategic footprint 10-fold, to 143km2, and have also released a maiden Mineral Resource that immediately placed the Red Mountain Project in the top quartile of undeveloped high-grade VMS (zinc, silver, gold) deposits globally.

“Importantly, the two deposits identified within the company’s extensive land holding immediately placed the Red Mountain zinc project as one of the highest grade and more significant deposits of any zinc company listed on the ASX and an important VMS asset within a global context. Our drill program for the 2018 summer field season aims to further build on our geological knowledge of the mineralisation, increase confidence in the Resource base, expand the already globally significant Resources at the existing deposits and discover new deposits.

“We will, in parallel with the drilling program, also be conducting on-ground geophysics and geochemistry, testing many of the 30 already identified exploration targets developed from historic shallow EM and historic surface geochemistry, and explore the system for VMS related gold potential. We plan to drill the best of these regional targets towards the end of this drilling campaign.”

High priority conductors (pink) on a conductivity depth slice at 40 metres below surface from the 1D inversion of airborne electromagnetics at Red Mountain.

It’s worth noting here that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.