White Rock rallies after first round of assay results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals Ltd (ASX:WRM) has revealed promising results from the first round of assays analysed for massive sulphide mineralisation intersected in two of the first three diamond drill holes at Red Mountain in Alaska.

As a backdrop, this project which is in central Alaska is wholly owned by White Rock and features volcanogenic massive sulphide (VMS) style zinc mineralisation from surface which is open along strike and down dip.

The project comprises the Dry Creek and West Tundra flats deposits with an inferred mineral resource of 678,000 tonnes of zinc, 286,000 tonnes of lead, 53.5 million ounces silver and 352,000 ounces gold.

Latest drilling reveals similarities with previous styles of mineralisation

Intervals recently intersected correspond with the visible sulphide mineralisation previously reported.

The diamond drilling results are part of White Rock’s maiden drill campaign at the Red Mountain project.

They are from infill drilling of the two existing deposits, Dry Creek and West Tundra, with a resource base of 16.7 million tonnes at 8.9 per cent zinc equivalent.

This includes a high-grade component of 9.1 million tonnes at 12.9 per cent zinc equivalent as defined in the maiden resource delivered in April 2017.

WRM does remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Best grade-thickness intersection at West Tundra

At West Tundra, an intercept from 60.6 metres to 63.1 metres downhole with an estimated true width of 3.4 metres represents the best grade-thickness intersection for any drilling at West Tundra.

This hole is some 75 metres from the nearest hole, indicating the sparse drilling of between 100 metres and 250 metres at West Tundra.

Management is of the view that this suggests the deposit is open to improvements in grade and thickness with infill drilling.

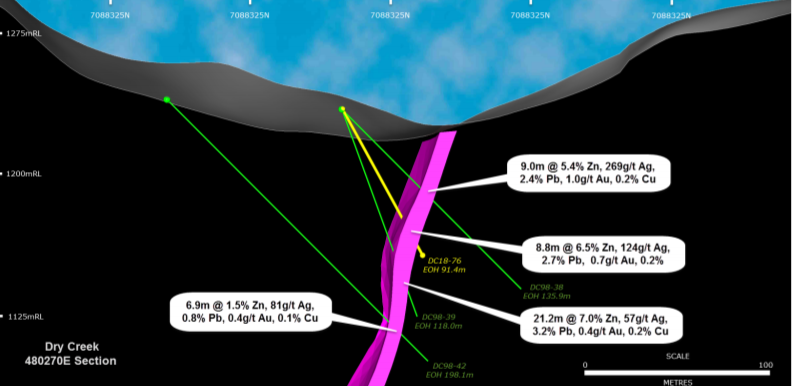

As demonstrated below, the DC18-76 intercept at Dry Creek is in line with surrounding drill intersections.

The high-grade mineralisation from 63.9 metres to 72.7 metres downhole has an estimated true width of 7.9 metres

This hole is some 20 metres from the nearest holes.

Management confident of adding to maiden resource in coming months

Commenting on these developments, managing director Matt Gill said, “These first drill assay results for the Dry Creek and West Tundra deposits validate our belief that these two deposits form part of a genuine high-grade zinc rich polymetallic VMS mineralisation system.

Our exploration program focus is to expand the maiden resource and to identify and test new targets to make the additional discoveries.

Initial drilling and surface mapping and sampling have allowed us to characterise the mineralisation at Red Mountain, providing the knowledge with which to identify, prioritise and test these new targets.

This is a great start to our 2018 exploration program and we are confident of adding to our maiden resource in a meaningful way over the next few months.”

Today’s news triggered a 12.5% spike in the company’s shares in early morning trading on Monday.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Preparing to drill high priority targets

On this note, field crews commenced their mapping and soil and rock chip sampling on the highest priority targets at the beginning of June prior to selecting targets for drill testing throughout the 2018 campaign.

The geophysics crew has commenced field surveys with initial orientation work across the known mineralisation at Dry Creek in progress.

Electrical surveys are expected to commence on new targets this week.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.