White Rock Minerals kicks off airborne EM survey at Red Mountain

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) has provided an encouraging announcement from its Red Mountain VMS Project in Alaska.

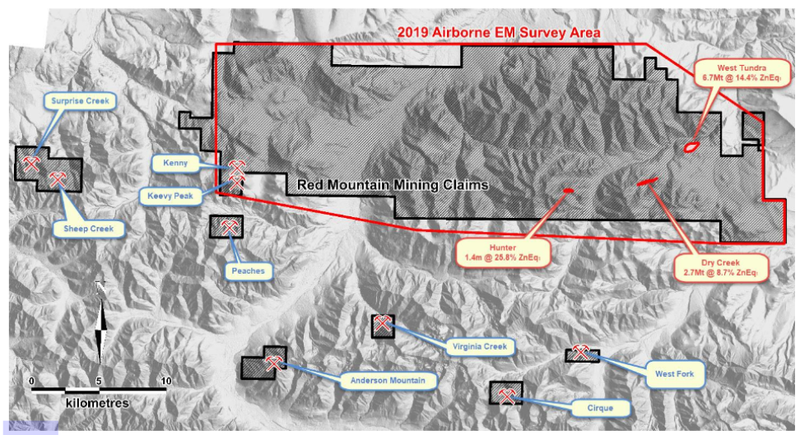

WRM, in conjunction with its JV partner Sandfire Resources NL (ASX:SFR), has commenced its comprehensive airborne electromagnetic (EM) geophysical survey on site.

The airborne EM survey signals the beginning of WRM’s extensive 2019 exploration program, which promises to be an exciting application of this modern technology.

The program is the latest step in identifying key drill targets at Red Mountain, after a successful drilling campaign in 2018 included intersections of 4.7m at 19.5% zinc, 7.8% lead, 466 g/t silver, 6.9 g/t gold and 1.5% cobalt.

WRM Managing Director Matthew Gill spoke on the announcement, “This is the first time that a modern technology time-domain airborne EM survey has been used at Red Mountain to explore for massive sulphide mineralisation.

“The previous survey done by the Alaskan government in the mid 2000’s used shallow looking frequency domain technology to map the surface geology.

“We are really pleased to be using a modern, high-powered technique over our 475km2 strategic belt-scale regional tenement package as the first step in our comprehensive exploration program for 2019,” he said.

The 3,000 line kilometres SkyTEM EM survey is capable of identifying conductivity anomalies to depths of 300 metres below the surface that could fast-track a significant new discovery.

The current exploration season will be the first in the JV partnership between WRM and Sandfire, with Sandfire having recently signed an earn-in and JV agreement to work with WRM on the dynamic Alaskan prospect.

Sandfire’s first year commitment includes a minimum of A$6M expenditure on the project, and a further A$14M over the following three years.

Gill said, “Having the technical and financial support of Sandfire Resources – a very successful explorer and developer of VMS deposits – is a strong endorsement to the quality and potential of our Red Mountain Project.

“The regional targets identified by this EM survey will form a key part of our comprehensive exploration program this field season. Other activities this season will involve using satellite spectral analysis, and on-ground geological reconnaissance and soil sampling.

“These activities will compliment planned electrical ground geophysics and a diamond drill program to follow-up the successful discovery at the Hunter prospect in 2018 and to test the best of the regional targets defined by this cutting edge multidisciplinary use of airborne EM.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.