White Rock to drill targets at Arete Prospect

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals Ltd (ASX:WRM) continues its quest to expand what is already a globally significant high-grade zinc and precious metal resource at the group’s Red Mountain Project in central Alaska.

Management provided an update on its 2019 exploration program today as White Rock looks to build on its high grade deposits which have an inferred mineral resource of 9.1 million tonnes at 12.9% zinc equivalent for 1.1 million tonnes of contained zinc equivalent.

Summer field exploration activities commenced in late May with on-ground activities including surface reconnaissance mapping, surface geochemical sampling (soils and rock chips), ground electrical geophysics, downhole electromagnetic (EM) surveys and diamond drilling.

Final data from the 500 square kilometre airborne electromagnetic (AEM) geophysical survey, which was flown in April and May this year, has now been received and is being integrated with surface geochemistry to prioritise a number of identified VMS targets for drill testing.

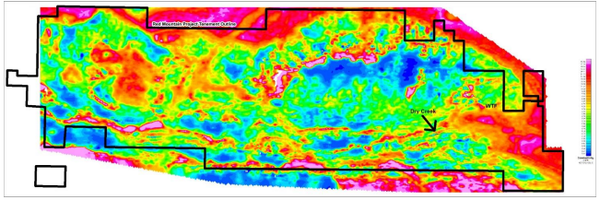

The survey below shows conductivity features associated with volcanogenic massive sulphide (VMS) mineralisation at the Dry Creek and WTF deposits.

More specifically, results from the AEM survey showed a signature conductivity response at both of the two known high-grade massive sulphide deposits at Dry Creek and WTF.

The graphitic unit at the base of the Sheep Creek Member is a distinctive marker horizon along the northern limb of the targeted syncline representing an equivalent horizon to that hosting the high-grade WTF massive sulphide mineralisation, where the Inferred Mineral Resource for WTF stands at 6.7 million tonnes at 6.2% zinc, 2.8% lead, 189 g/t silver and 1.1 g/t gold for a grade of 14.4% zinc equivalent.

Drill rig ready to test Arete Prospect

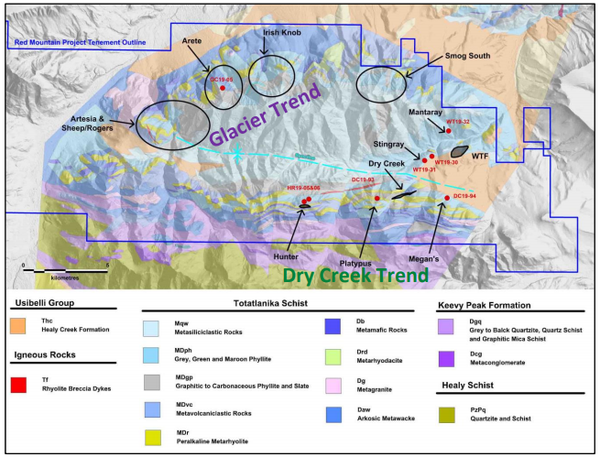

Prospecting of the northern limb along the Glacier Trend, a spatially extensive alteration zone with 10 kilometres of strike length, has identified sulphide accumulations, chert and iron formations, all believed to be proximal to horizons prospective for base metal rich massive sulphides along strike and down dip.

Additional rock chip data collected is being assessed in conjunction with conductivity responses from the AEM data to assist in drill targeting.

The drill rig has now moved to test the first of these new targets at the Arete prospect which is featured on the following map.

The target at Arete is the down dip projection of a massive sulphide outcrop that exhibits a distinct conductivity response in the AEM that has similarities in geometry and strength to those at the Dry Creek and WTF deposits.

Consequently, the much anticipated drilling results could be the forerunner to unveiling a materially significant deposit.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.