When grade is king, could Ardiden be next in line to the gold throne?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

You only have to look at some major discoveries and exploration success by Australian juniors in the gold sector to appreciate how penny-dreadfuls can become the next big thing overnight.

In the last six months, shares in Spectrum Metals (ASX:SPX) increased more than ten-fold from less than 1 cent to a recent high of 12.5 cents on the back of its Penny West discovery in Western Australia.

Prior to this exploration success the historic reconciled production figures of the high-grade ore from the Penny West open pit were 121,000 tonnes at 21.8 g/t for 85,000 ounces, to a depth of just 82 metres or over 1,000 ounces per vertical metre.

Given the history, you could have said that this was a no-brainer, and those who threw some of their ‘hard earned’ at Spectrum before it started drilling are sitting on a 15 bagger.

Stepping outside of Australia, there are similar opportunities for those who see the potential for significant gains from moving early on projects where geological trends and historical mining activity tend to support the prospect of success.

Investors who adopt this strategy should examine Ardiden Limited (ASX:ADV), a company targeting a high-grade gold region in Ontario Canada.

When the company released its Maiden Mineral Resource Estimate of 790,000 tonnes at 4.3 g/t gold for 110,000 ounces earlier in the month its shares hit a 2019 high, implying a 60% increase in a matter of days.

Rubbing shoulders with the big guys

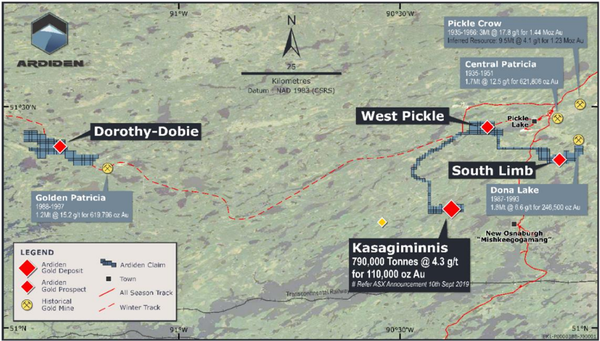

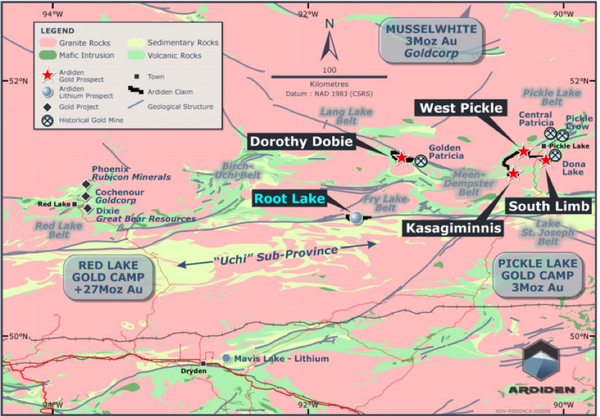

Ardiden’s high-grade Kasagiminnis Gold Deposit lies within its Pickle Lake Gold Project where there are a number of prospects including South Limb, West Pickle and Dorothy-Dobie.

The Pickle Lake Gold Camp has produced over 3 million ounces of gold since 1935 from four underground operations.

Newmont-Goldcorp is currently operating the Musselwhite gold mine, 125 kilometres north of Pickle Lake.

While the names are colourful, the area’s reputation for delivering large high-grade gold deposits precedes it.

As indicated in the map below, Pickle Crow just to the north delivered 3 million tonnes at 17.8 g/t for approximately 1.4 million ounces gold, and central Patricia, 1.7 million tonnes at 12.5 g/t for 620,000 ounces of gold.

As the saying goes, grade is king, and Ardiden’s projects could be next in line to the throne.

Certainly, plenty of the majors believe in the area.

The Kasagiminnis Gold Deposit is only 35 kilometres from First Mining Gold Corps (TSX:FF) processing plant and underground mine, eight kilometres north-east of the Pickle Lake township.

Additionally, Tri-Origin Exploration (TSX-V:TOE) holds an option with the US$33 billion Barrick Gold Corp (NYSE:GOLD) over the gold deposit located 12 kilometres south-west and directly along strike of Kasagiminnis.

Ardiden’s South Limb prospect also abuts onto Metals Creek Resources’ (TSX-V:MEK) Dona Lake Gold Project, and it has an option agreement with Newmont-Goldcorp over the nearby historic Dona Lake underground gold mine.

With this significant amount of activity in the region, Ardiden is investigating potential synergies with all companies active within the Pickle Lake - Red Lake region.

Modern exploration techniques unveil new mineralisation

Establishing a Maiden Mineral Resource Estimate for the Kasagiminnis Deposit represents the first building block of planned gold resource upgrades as drilling recommences and exploration activities ramp up on site.

To remain conservative at this stage of evaluation, the Mineral Resources have been reported only above a 3.0 g/t gold cut-off grade to reflect current commodity prices and likely extraction by underground mining methods.

There are numerous potential down dip and along strike extensions of the ore zones that remain untested.

Consequently, there is the potential for further market moving news as Ardiden progresses its exploration program.

Putting this recent development into perspective and providing some insights into the region and its ability to benefit from modern exploration, Ardiden’s chief executive Rob Longley said, “The Pickle Lake Greenstone area has been overlooked and under-loved since the 1980’s, but now there is renewed interest from numerous mining and exploration companies in both the dormant underground mines and adjacent extensions of mineralised areas.

‘’A higher gold price and much improved exploration techniques has made this Gold Camp ripe for re-evaluation.

‘’Kasagiminnis is only a small part of our Pickle Lake Gold Project and following a recent site visit, I am encouraged by the prospectivity of the district in terms of mineralisation, opportunity and stakeholder willingness to advance these projects.’’

Ardiden has commenced planning for additional drilling, including negotiations with First Nations groups and approvals aimed at extending the resource along strike and at depth at Kasagiminnis.

The company is meanwhile planning geophysical surveys, compiling historical data and evaluating drill targets with the aim of also building Project Mineral Resources at the South Limb, West Pickle and Dorothy-Dobie prospects at Ardiden’s Pickle Lake Gold Project.

As indicated below, to the south-west of Dorothy Dobie lies another major gold bearing region, the 27 million ounce Red Lake Gold Camp.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.