Western Mining reveals graphite game plan

Published 01-OCT-2015 09:23 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

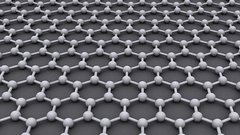

Western Mining Network (ASX:WMN) revealed how it aims to become a vertically integrated graphite player in the Asia-Pacific region – aiming to raise $1 million towards the construction of mini plants in Indonesia.

It told investors yesterday that it had come up with a game plan to mine graphite from its projects in Indonesia, and aim to sell both metallurgical graphite and high-end electrical graphite.

WMN unveiled a stepped strategy, saying that it intended to build two mini-plants in Indonesia which will be capable of producing five tonnes of graphite per day at Kalimantan and Sulawesi.

Prices for the finished graphite will vary, with low grades going for less than $US1000 ($A1424.81) to $10,000.

The production of lower-grade graphite, WMN said, simply requires more conventional beneficiation techniques including crushing, milling, agitation, and floatation.

The higher-end processing will be farmed out to its partners, including South Korea-based Carbon Nano Tech.

Its plan, WMN said, was to start small with two beneficiation plants producing smaller quantities of simple products.

However, it’s longer term play is to move further into the higher value processing at its Sulawesi and Kalimantan.

“This approach allows WMN to identify and prioritise the most attractive downstream opportunities and to use its capital more efficiently,” it said.

“The aim is to deliver value to you, our shareholders, through the exploitation of the entire carbon value chain rather than just simple mineral extraction.”

To get the ball rolling, however, it said that it would seek to raise $1 million from a placement. It did not say what pricing or conditions would be attached to the raise.

The placement will not be subject to shareholder approval, but any options issued under the placement will be announced.

The story so far

So far WMN has focused on its resource and tying up strategic partnerships, like the arrangement it has with Carbon Nano Tech.

In July, it announced a deal whereby it would gain 100% of PT Grafindo Nusantara in exchange for 25 million newly issued shares, with no cash outlay.

Western Mining Network’s Kalimantan Project in Indonesia

In return, WMN got its paws on two major tenements in Indonesia prospective for graphite, together the Kalimantan project.

This includes an inferred resource of nearly 8 million tonnes with mean total graphite content of 12.7%.

It also has a mining license for that resource valid until July 2023.

It has also gained a look into the downstream sector in recent times with a Memorandum of Understanding signed with South Korean graphene and graphene product manufacturer Carbon Nano-Material Technology Ltd (CMNT), with WMN to take a staged 51% stake in the company.

The stake gives WMN an insight into the whole value profit chain for graphite, with the company having a presence in the upstream segment via its Indonesian mining tenements and the downstream sector via the South Korean investment.

It also previously signed a heads of agreement with a South Korean consortium to take graphite from its Tamboli project, also in Indonesia.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.