WCN confirms high grade gold and large tonnage copper resources in Central Asia

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Cliff Minerals Ltd (ASX:WCN) has confirmed abundant gold and copper resources at its Chanach precious metals project in the Central Asian Kyrgyz Republic.

WCN’s Chanach project covers 83km2 and is focused on a main porphyry style deposit split into two areas – the Aucu epithermal high grade gold deposit and the large tonnage Chanach copper deposit.

Following an extensive drilling campaign at both sites, WCN has confirmed a maiden JORC Inferred resource for the Aucu gold deposit of 1.15Mt at a grade of 4.2g/t, and a maiden JORC Inferred resource for the Chanach copper deposit of 10Mt.

Both resources are open at depth and along strike, and WCN will conduct exploration later in the 2015 field season with the ambition to double their sizes.

The company says the widespread mineralisation can support open cut mining operations that could deliver high-grade gold ore at a low cost – a potential growth driver for the company which is currently valued under $5M AUD.

High and low – gold and copper to drive WCN

WCN owns 89% of the Chanach Project in the Central Asian Kyrgyz Republic and will focus on developing the gold resources there with a view to establishing a low cost, high-grade open cut gold mining operation.

The area of the Kyrgyz Republic that Chanach is located in has modern access roads and is within 200km of a railway network. It’s close to the operating gold and copper mines of Terek Sai, Bozymchak and Ishtamberdy, and WCN can draw on a low-cost yet highly skilled workforce.

WCN hold strong project tenure of Chanach valid until December of 2015 with two 2-year extensions available that can be converted into a 25 year long mining permit.

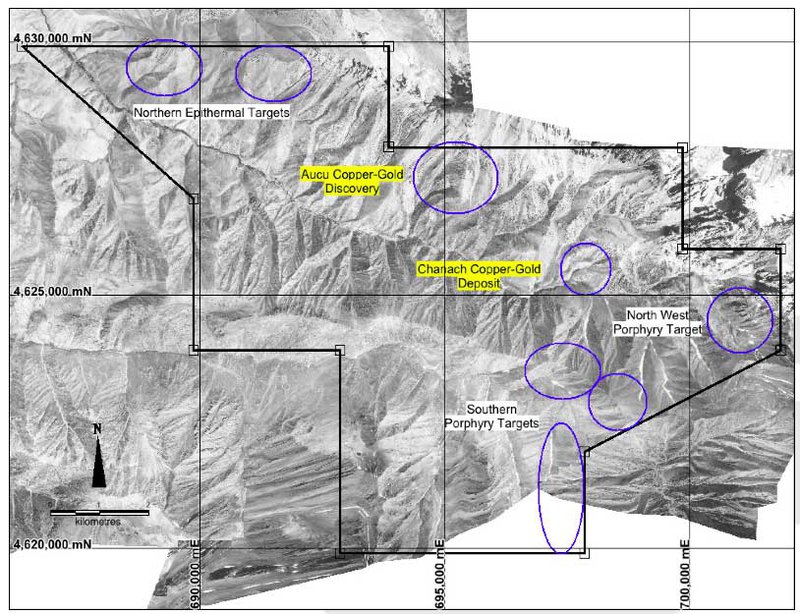

In addition to the Aucu Gold discovery and the Chanach Copper-Gold Discovery, there are also multiple exploration areas for porphyry and quartz vein targets within WCN’s project boundaries.

White Cliff Minerals (ASX:WCN)’s targets and discoveries for copper and gold in Central Asia

For now though, the maiden resources WCN has just had confirmed are the priority for development and enlargment through exploration.

Rapid growth potential for Aucu gold deposit

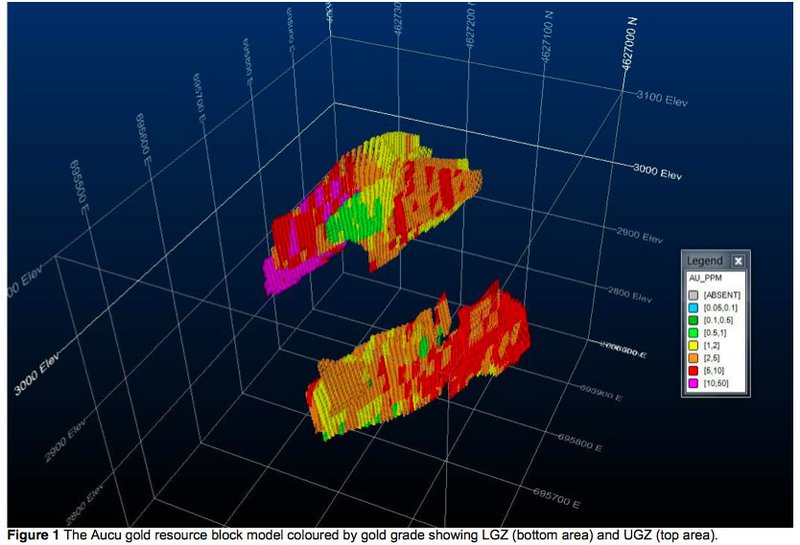

The Aucu gold deposit that WCN has confirmed as a JORC Inferred resource of 1.15Mt at a 4.2 g/t grade that is split into two areas – the Upper Gold Zone (UGZ) and the Lower Gold Zone (LGZ).

White Cliff Minerals (ASX:WCN)’s Aucu gold resource model

Aucu is a structurally controlled Permian aged lode-gold deposit that’s linked to the northern part of the Tian Shan Gold belt, a rich corridor of mineralisation that stretches from western China to western Uzbekistan.

Gold mineralisation occurs along shear zones and is predominantly hosted in sandstone and granodiorite – the type of rocks found at Aucu.

A campaign of reverse circulation and diamond drilling there by WCN returned strong gold readings from both the UGZ and LGZ of the deposit. Mining industry consultants Optiro Pty Ltd then used this data to form JORC 2012 compliant Inferred Mineral Resource estimates.

The results show the maiden inferred resource for the Aucu gold deposit above a cut-off grade of 1g/t gold to be 1.15 million tonnes grading 4.2g/t gold for 156,000 ounces of contained gold.

White Cliff Minerals (ASX:WCN) drilling in Central Asia

In addition, the drilling by WCN shows the deposits are open at depth and along strike. WCN’s Managing Director, Todd Hibberd, says these areas will be explored this year.

“There is excellent potential to significantly expand the resource in 2015 via additional drilling along strike in the near‐surface, open pittable environment as well as targeting extensions down‐dip and down‐plunge of the higher grade sections of both the Upper Gold Zone and Lower Gold Zone mineralisation,” he says.

“Mineralisation has been mapped across adjacent hills and links up with structures crossing the Chanach Copper deposit 2.5km away. The potential of the Aucu gold system is exceptional and the company is currently planning extensive exploration activities for the 2015 field season.”

Chanach copper deposit offers diversity

The second part of WCN’s Chanach Project is the Chanach copper deposit – which has been confirmed to have a maiden JORC inferred resource of 10Mt at 0.41% Copper for 40,000t of contained copper.

The Chanach copper deposit is located 2.5km to the southwest of the Aucu gold deposit and is a Permian aged multiphase intrusive porphyry system with shallow mineralisation in wide shear zones.

WCN has conducted an extensive drilling campaign using reverse circulation and diamond drill holes to gather samples supporting the JORC estimate of 10Mt.

Just like at Aucu, WCN has discovered the Chanach copper deposit is open at depth and along strike, and has the potential to be extended through additional exploration programmes planned for the remainder of 2015.

Australian nickel and gold plays enhance WCN

In addition to the Chanach high-grade, low cost copper and gold project WCN holds in Central Asia, the company also has an extensive portfolio of precious metals projects in Australia, all 100% owned.

WCN’s Merolia Project near Laverton in Western Australia contains extensive ultramafic sequences prospective for nickel-copper sulphides including three mafic – ultramafic intrusions prospective for nickel and copper sulphides. Several nickel sulphide targets have just been defined by electromagnetics and drilling will be conducted shortly.

The project also contains extensive basalt sequences that are prospective for gold mineralisation, including the Ironstone prospect where historical drilling has identified 24m at 8.6g/t gold.

WCN’s Bremer Range Project covers over 127km2 in the Lake Johnson Greenstone Belt, which contains the Emily Ann and Maggie Hayes nickel sulphide deposits with 140,000t of contained nickel between them. WCN’s nearby play is prospective for both komatiite associated nickel sulphides and amphibolite facies high-grade gold mineralisation.

Finally, the Laverton Gold Project covers 136km2 of tenement applications prospective for gold in the Laverton Greenstone belt, while the Mount Remarkable Project near Kalgoorlie holds the historic gold mining centres of Mt Remarkable and Yerilla which consists of several old workings.

This clutch of gold and nickel projects represent a solid base of holdings for WCN, which can be used to support its long term vision for creating a low cost, high grade gold and copper mining operation in Central Asia.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.