Vulcan confirmed as Europe’s largest JORC Lithium Resource

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy Resources Ltd. (ASX:VUL | FRA:6KO), today announced the completion of the maiden JORC (2012) Mineral Resource Estimate for its Ortenau licence within the Vulcan Zero Carbon LithiumTM Project, in the Upper Rhine Valley of South-West Germany.

The company also announced its dual listing on the Frankfurt Stock Exchange, increasing its exposure to German and European markets.

Vulcan is now the largest JORC-compliant Lithium Resource in Europe by a considerable margin and a globally significant lithium brine resource.

The total Inferred Mineral Resource for the brine has been calculated at 13.2 Mt of contained Lithium Carbonate Equivalent (LCE), at a lithium brine grade of 181 mg/l Li.

The company note that this Maiden Mineral Resource Estimate was calculated on just one of the five licence areas within the Vulcan Project, where the majority of exploration licence areas remain as future “upside”.

Vulcan’s Inferred Mineral Resource Estimate of 13.2 Mt of contained LCE, at a lithium brine grade of 181 mg/l lithium (Li), average porosity of 9.5% and lower cut-off of 100 mg/l Li compares very favourably to other JORC-compliant lithium resources in Europe. These include European Metals’ Cinovec at 7.17 Mt LCE, Rio Tinto’s Jadar at 6.24 Mt LCE, Infinity Lithium’s San Jose at 1.68 Mt LCE and Savannah Resources’ Barroso at 0.71 Mt LCE, all of which are hard-rock projects.

While the EU currently produces no battery-quality lithium hydroxide, there is already a severe battery-quality lithium supply shortfall in Europe with slated battery and EV manufacturing.

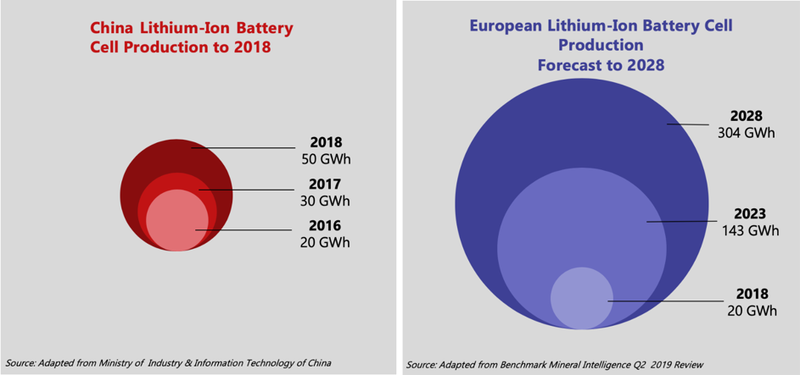

This is not unlike China in the 2010s, which experienced the world’s highest growth in lithium-ion battery production for electric vehicles. It caused a lithium supply shortage in China and a 300% lithium price spike.

In the 2020s, the same is forecast to happen in Europe, albeit on a much larger scale:

Vulcan is aiming to be the world’s first Zero Carbon LithiumTM producer, and strategically located to provide the only zero carbon lithium product to the burgeoning European EV and Li-ion battery markets.

Fast-track development of the project is under way, with the Resource Estimate being incorporated into a Scoping Study that’s due in the first quarter of 2020 and the company targeting production of lithium hydroxide by 2023.

Managing Director, Dr Francis Wedin commented: “Vulcan’s Maiden Mineral Resource Estimate, on just one of the licence areas within the Vulcan Project, elevates us into becoming a globally significant lithium project. It also shows the potential for the Vulcan Project to be a primary source for the burgeoning European battery industry’s lithium hydroxide needs, via a low-impact, Zero Carbon LithiumTM process powered by and sourced from geothermal wells.

“This comes at an opportune time, as we enter a period where Europe is forecast to dwarf China’s growth in demand for lithium hydroxide in Europe as part of the transition to electric vehicles, but with currently only high carbon emission sources of lithium hydroxide available to cathode and battery manufacturers.”

Vulcan lists on Frankfurt Stock Exchange

Vulcan today announced the dual listing of the company’s shares on the Frankfurt Stock Exchange, under the code “6KO”.

The dual listing widens Vulcan’s investor reach and increases the company’s exposure to German and European markets, where the Vulcan Zero Carbon Lithium Project is located.

The Frankfurt Stock Exchange is the world’s third largest exchange-trading market, behind the New York Stock Exchange and NASDAQ. More than 50% of the total trades on the Frankfurt Stock Exchange are conducted through investors in countries outside of Germany.

Given that the ASX is a Frankfurt Stock Exchange approved exchange, the dual listing was possible without primary listing procedures or significant cost to the company.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.