Vango is a rare find among gold juniors

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

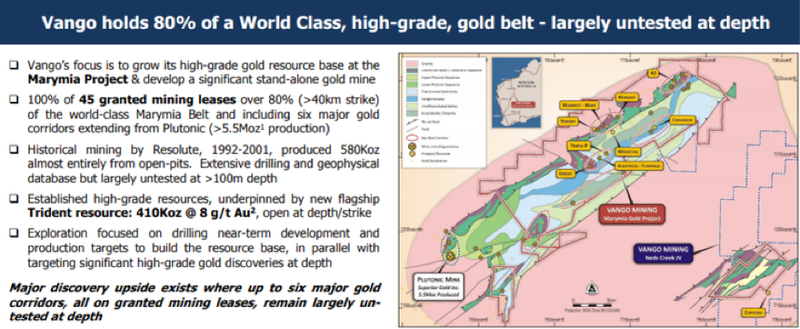

Gold exploration and development company Vango Mining Limited (ASX:VAN) would have to be viewed as one of the most promising junior players in the gold sector when you consider it has an established high-grade resource and is close to multi-million ounce mines, as well as having tenure in the midst of proven gold trends in the heart of mid-west Western Australian gold territory.

The company has an established high-grade resource underpinned by a new flagship Trident resource of approximately 1.6 million tonnes at 8 g/t gold for 410,000 ounces.

Trident is open at depth and along strike with immediate upside potential to significantly grow the resource.

Historical mining by Resolute Mining (ASX:RSG) between 1992 and 2001 produced 508,000 ounces, almost entirely from open pit mines, leaving the ground virtually untested at depths below 100 metres.

Interestingly, an examination of the ‘best hits’ from Trident to date, which featured 11 drill holes grading between 11 g/t gold and 36 g/t gold, showed that the top five (ranging between 15.5 g/t gold and 36 g/t gold) were from an average depth of 202 metres.

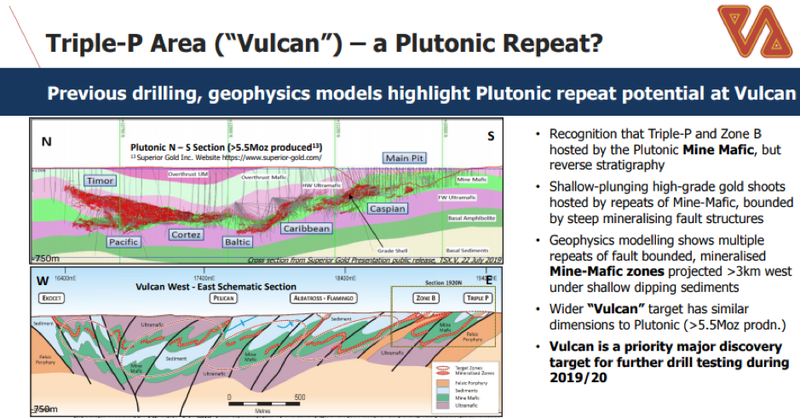

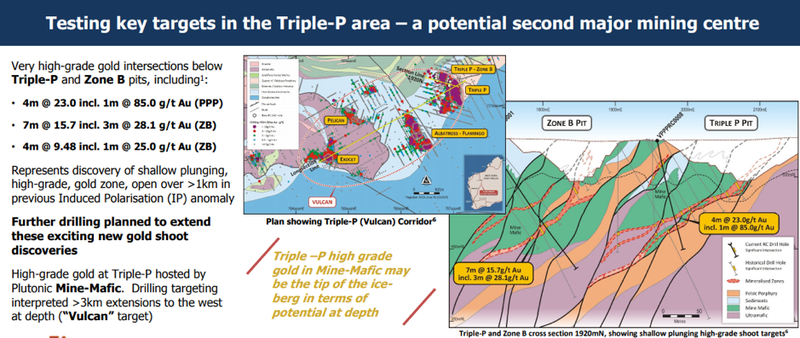

In what would represent further exploration upside, management is posing the question as to whether the Triple P area (Vulcan) is another Plutonic given that it is hosted by the Plutonic Mine Mafic, featuring shallow plunging higher grade gold shoots and bounded by steep mineralising fault structures.

Indeed, the wider Vulcan target has similar dimensions to Plutonic, making it a priority major discovery target for further drill testing in 2019/2020.

Multiple drilling success suggests this is the haystack, not the needle

Vango’s emergence as one of the hottest smaller cap gold stocks has not just resulted from a couple of lucky drill holes - the company has undertaken extensive drilling along various parts of the anticipated trend and they are all coming up trumps.

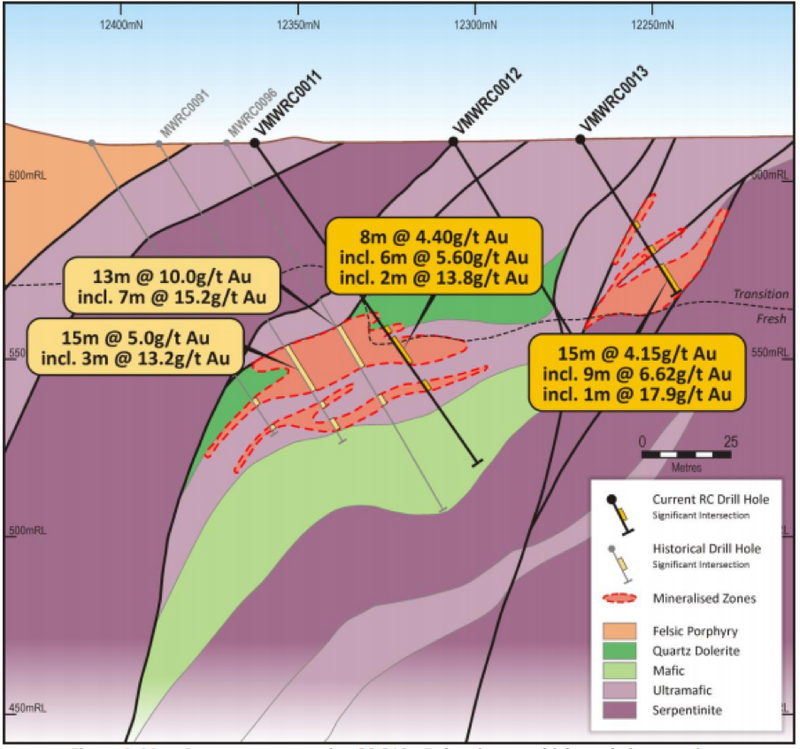

From relatively shallow reverse circulation holes through to deep diamond drill holes Vango continues to identify high-grade intersections.

The company first came under the microscope in April when it delivered bonanza high-grade gold intersections at the Trident gold deposit.

Diamond drilling results included 11 metres at 36.2 g/t gold from 213 metres and 3 metres at 15.5 g/t gold from 226 metres.

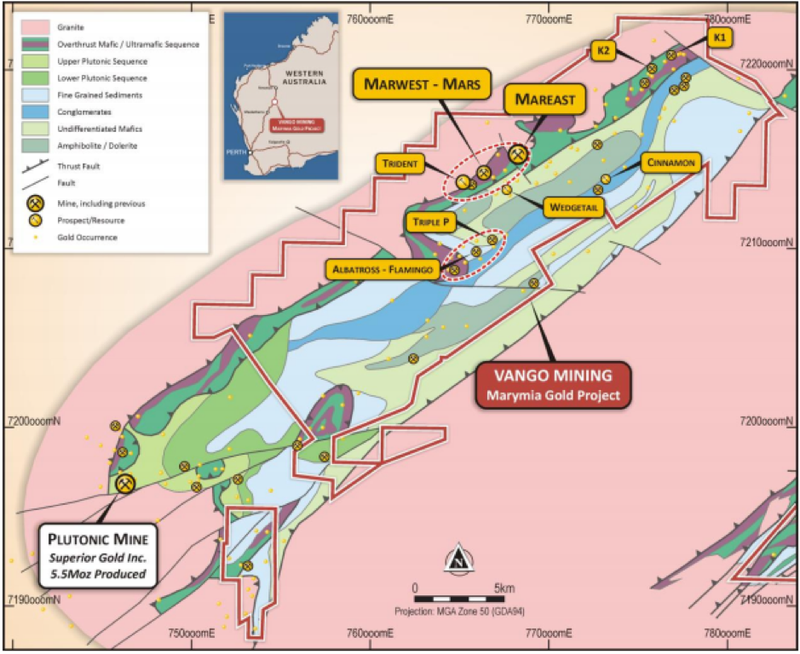

The high‐grade gold intersections at Mareast are hosted by a thick mafic unit interpreted to be analogous to the Mine‐Mafic that hosts the major Plutonic gold deposit, 30 kilometres to the south-west which has produced more than 5.5 million ounces of gold to date.

Management believes that Mareast may represent the surface expression or “tip of the iceberg” of a plunging corridor of mineralised Mine‐Mafic, potentially extending for over five kilometres under the Trident‐Marwest‐ Mareast Corridor.

$70 million project financing for Marymia

Importantly, this isn’t a project with unrealistic expectations, evidenced by a $70 million funding agreement recently struck with a Beijing based listed Chinese entity.

As a backdrop, just two days after announcing impressive drilling results at its Mars prospect, Vango entered into a Strategic Partnership Framework Agreement with China Nonferrous Metal Industry’s Foreign Engineering and Construction Co Ltd (NFC) which will assist in the financing and development of the Marymia Gold Project.

While the Mars results were outstanding as indicated in the following graphic, once again it is only part of a bigger picture that continues to yield strong results.

Back to NFC though, it is one of China’s leading construction and engineering groups and builds, owns and operates base metal mines, processing plants and smelters around the world.

The agreement is a significant milestone in the development pathway of the Marymia Project, and represents the formal starting point in Vango’s relationship with NFC for the financing and development of the project.

In effect, it is also an endorsement of the value that can be attributed to the project, suggesting that the group’s market capitalisation of approximately $100 million may be conservative.

Consequently, this development could provide share price momentum, at least returning the company to its 12 month high of about 22 cents.

Australian gold miners still netting $850 per ounce

On the share price front, the company traded strongly between March and September with its shares increasing from 12 cents to 22 cents, and it would appear that a slight retracement in the gold price could account for some profit-taking, whereby it now presents a buying opportunity.

However, slight is the operative word as far as Australian gold stocks are concerned, as the depreciation in the Australian dollar against the US dollar now sees the Australian dollar gold price sitting at approximately $2150 per ounce.

At the peak of the precious metal’s strong run between May and September, the Australian dollar gold price was only briefly more than $100 per ounce better than where it is at the moment.

To put gold’s recent retracement into perspective, the average production costs in Australia are in the vicinity of $1300 per ounce (some below $1000 per ounce), implying a healthy margin of $850 per ounce at current levels.

With NFC’s support arguably game changing both in the near term and in so far as the group’s ability to fully develop the Marymia Project it wouldn’t be surprising to see Vango rebound.

Exploration the key to establishing scale

In terms of taking Marymia to another level, management needs to focus on establishing a sizeable resource.

One of Vango’s key benefits is that companies often invest significant dollars into exploration and establishing a resource, only to find that gaining project funding is a stumbling block.

Already having the support of NFC is a definite positive that will become increasingly relevant as Vango builds investor confidence around the ability to transition from explorer to producer.

The very high‐grade Trident gold resource is open beyond the one kilometre strike length tested to date, and the area of resource drilling represents just 20% of the five kilometre strike length of the Trident‐Marwest‐Mareast Gold Corridor as shown below.

Targeting the Trident‐Marwest‐Mareast Gold Corridor

Vango is undertaking a focused drilling campaign within the Trident‐Marwest‐Mareast Gold Corridor, with the aim of delivering a significant upgrade to the existing high‐grade resource.

The shallow high-grade gold intersections at Mars that were reported on November 19 represented an important step in terms of achieving that goal.

As indicated above, the Mars deposit is located at the north-eastern end of the two kilometre Trident-Marwest zone which sits within the five kilometre structural/mineralisation gold corridor that continues from the very high-grade Trident resource through the Marwest/Mars prospects to the Mareast prospect.

The latest thick and high-grade intersections, reported in November are from shallow depth and further highlight the resource expansion potential of the Trident-Marwest-Mareast Gold Corridor.

The new gold intersections at Mars remain open to the south-west where the zone may link with the Marwest deposit and/or extend below Marwest to connect with the Trident resource, two kilometres to the south-west.

Confirmation of open pit resource estimates

Vango plans to confirm new open-pit resource estimates for Mars and Mareast, and it will make assessments regarding further drilling requirements in order to delineate these resources.

The new resources will be added to the Marymia Project’s existing resource inventory (eg. the high-grade Trident Mineral Resource) along with other new, high-grade, underground resource estimates planned to be defined via the company’s targeted ongoing drilling programmes.

This drilling will target Triple P - Zone B, Albatross-Flamingo and other areas, with the aim of delivering a significant upgrade to the resource base for the proposed stand-alone Marymia Gold Project.

These other areas can be seen on the above map lying only a short distance to the south of the Trident-Marwest-Mareast Gold Corridor.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.