Uptick in fertiliser prices works in Minbos' favour

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Minbos Resources Limited (ASX:MNB) has provided an update on phosphate market conditions, discussing the sharp increase in the global phosphate fertiliser price and the potentially positive economic impacts on the company’s Cabinda Phosphate Project.

The company plans to produce Enhanced Phosphate Rock (EPR), the Cabinda Blend, with the product retaining a unique natural economic hedge.

The value of EPR is proportional to the price of competing Water-Soluble Phosphate (WSP) fertilisers, but at the same time approximately half the production costs of the Phosphate rock/WSP Cabinda Blend are attributed to WSP.

As WSP fertiliser prices increase, EPR operating margins are anticipated to increase, however, if the WSP price drops, the production cost of EPR will also fall, delivering some protection against market variation.

These metrics are fleshed out in the company’s scoping study that was released in August last year.

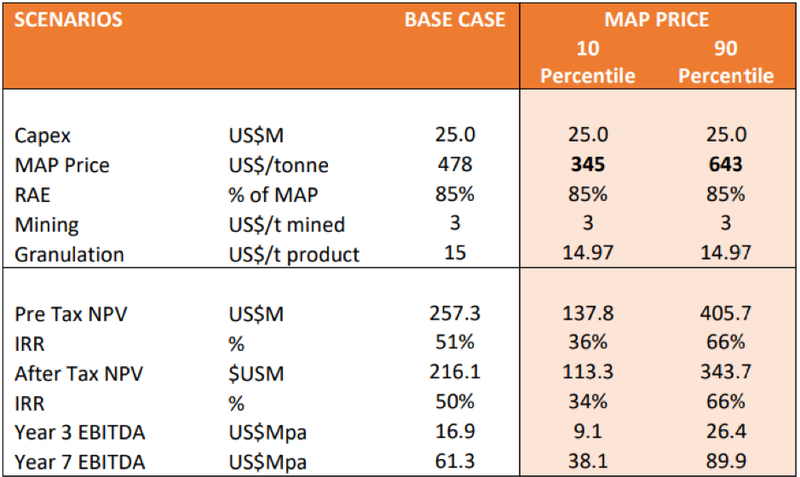

The following example indicates the sensitivities relating to the MAP price with the base case assumption of US$478 per tonne pointing to a pre-tax net present valuation (NPV) of US$257.3 million and a year three EBITDA of $16.9 million.

The next column is based on a much lower MAP price of US$345 per tonne which would result in a significantly lower pre-tax NPV of $137.8 million and EBITDA of $9.1 million.

The third column provides the greatest clarity in terms of the current situation as it uses MAP assumptions of US$643 per tonne, well above the base case (US$478 per tonne).

The commonly reported reference price for WSP fertilisers is ‘DAP’ fob Tampa (Diammonium Phosphate free on board Tampa, USA).

The Cabinda Phosphate Project plans to granulate a blend of approximately 85% Phosphate Rock with 15% MAP (Monoammounium Phosphate) - MAP trades near parity with DAP.

As at February 2021, DAP had hit a seven-year high of US$497 per tonne.

As indicated in the sensitivity table, a higher map price of US$643 per tonne would result in a substantially higher NPV (US$405.7 million) and EBITDA (US$26.4 million).

While the MAP price has a long way to go to reach US$643 per tonne, importantly it is heading in the right direction along the continuum as it sits 4% above the base case price.

MAP price provides natural hedge, minimising input related volatility

Management explains in detail the nature of the sensitivities in the scoping study, and it is worth noting that the MAP price provides a partial hedge for the project which assists in alleviating significant swings in project economics due to commodity input prices.

The following is an excerpt from the scoping study.

The project is sensitive to the price of MAP from which the sales price per tonne is directly derived, however the sensitivity of the project NPV to MAP as the revenue driver is muted because MAP also contributes approximately half of the operating costs.

The MAP price acts as a partial hedge for the project, as the cost of MAP input increases it is outpaced by the MAP derived sales price.

Benefits of local supply may increase demand for Cabinda Blend

DAP prices were expected to increase after a long period of depressed prices due to production capacity additions, the USA-China trade war and reduced plantings in the US due to adverse weather events.

The increase has been accelerated by counter veiling duties imposed by the US on other major producers, supply chain disruptions due to COVID and a sharp uptick in many agricultural commodities.

Commenting on the dynamics currently impacting the industry and their positive impact on Minbos, chief executive Lindsay Reed said, "The Cabinda Blend natural hedge means we can set higher margins for increased profitability and lower relative prices for customers.

"COVID has increased awareness of supply chain disruptions and food security.

"Localising agricultural inputs is a great strategy for Angola."

The project has been aligned with the recommendations of the International Fertiliser Development Centre (IFDC) which recommended MAP for the Cabinda Blend based on 40 years of experience.

MAP is the preferred WSP blending ingredient because it not only provides early phosphate availability for root development (the ‘starter effect’) but because it has a low pH of dissolution (acidic) it promotes the ‘enhancement effect’ to initiate the dissolution of the phosphate rock.

Minbos reaffirms its commitment to ESG

Another important development for Minbos was announced today with management saying it would be adopting a set of Environmental, Social and Governance (ESG) metrics and disclosures as ratified by the World Economic Forum (WEF) in Geneva, Switzerland.

It is worth noting that the group’s project in itself ticks many of the boxes in terms of its environmental and social outcomes.

The context in which Minbos operates has been transformed by climate impact, nature loss and social unrest around inclusion and working conditions.

This new global environment is challenging the traditional expectations of corporations and redirecting investment capital.

Global sustainable investment now tops $30 trillion, up 68% since 2014 and ten-fold since 2004.

Minbos is charting a course to build resilience, effectively enhancing its social licence through a greater commitment to long-term, sustainable value creation that embraces the wider demands of people and planet.

The Board has resolved to adopt the WEF ESG framework and instructed management to set up an impact measurement plan for each sustainability area which includes, but is not limited to, governance, anti-corruption practices, ethical behaviour, child labour, GHG emissions, land use, ecological sensitivity, water consumption, diversity and inclusion, pay equality and local tax payments.

To ensure that Minbos can measure, monitor, and report on its ESG progress, management has engaged an ASX-first technology platform to audit and streamline the outcomes measurement and reporting process.

The company’s goal is to demonstrate progress on its ESG scorecard, but more broadly, requires progress on a range of ESG benchmarks as set out by the WEF’s ESG White Paper.

Material operational and financial benefits from ESG already visible

While the Cabinda Phosphate Project is inherently impact positive, the adoption of the WEF framework has already paid ESG dividends.

Work on the Definitive Feasibility Study has de-risked the group’s ESG liability, including the potential integration of a solar plant to power the granulation facility, dramatically reducing water soluble phosphate application and the potential for carbon soil sequestration.

In underlining the importance of understanding the impact on communities in terms of building a better project and a better company Reed said, "The Cabinda Phosphate Project brings its own Social and Environmental advantages.

"The Governance task before us is the valuable distribution of those advantages to all stakeholders, so I am delighted our Board has adopted a framework to measure and report our ESG performance.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.