Titan collates target identification data for maiden drilling campaign

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

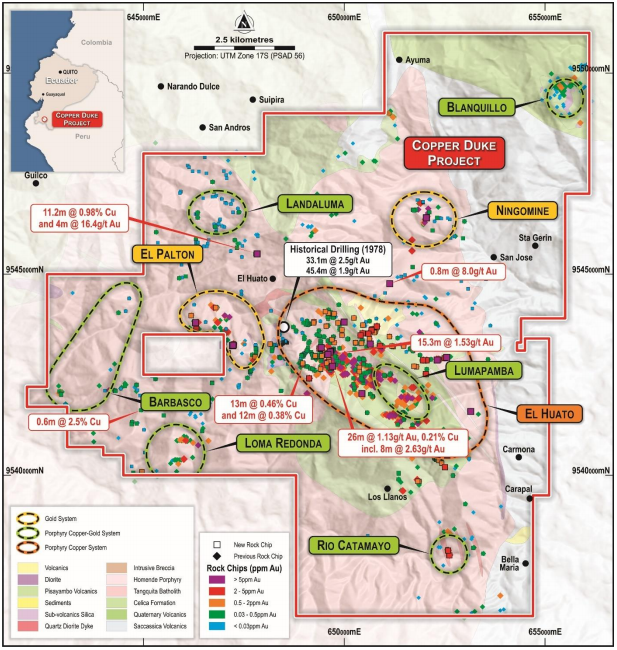

Titan Minerals Limited (ASX:TTM) last week informed the market that it has collected promising data from surface geochemistry sampling and aerial geophysical surveying conducted at the Copper Duke Project, located in the Loja Province of southern Ecuador, 18 kilometres east of the company’s flagship Dynasty Gold Project.

Reported assays included the initial results from an ongoing regional mapping and geochemistry campaign being completed prior to the anticipated maiden drilling next quarter on several priority targets.

The preliminary geological interpretation of the geophysics has been completed which allows for ranking of the multiple gold and gold-copper targets at Copper Duke.

The interpretation will also assist with prioritising the ongoing fieldwork designed to confirm interpretations and refine targeting for drilling planned in the 2021 field season.

Reported surface geochemistry at Copper Duke totals an additional 925 assay results incorporated into the database from the ongoing mapping and, concurrent validating and updating of recent exploration results.

The results continue to highlight significant extensions of known copper anomalism across the Copper Duke Project as the footprint of geochemical coverage expands, and the results identify several new high-grade gold-quartz veins that potentially represent additional exploration targets for evaluation.

This most recent update to the database represents the first time all geochemical and geology datasets for the Copper Duke Project have been systematically integrated into a single database structure.

Our team now has the unprecedented opportunity to fully examine all available data in a digital environment, in conjunction with the newly acquired aerial magnetic and radiometric data.

Potential for a wide two kilometre long gold and copper anomalism

Within the sampling corridor, several anomalous zones reported are within 1.2 kilometres of the historical United Nations drilling program completed in 1978.

The recent results indicate the potential for a 2 kilometre long north-west striking corridor of gold and copper anomalism of significant widths, extending south-east from the historical drilling where partially assayed diamond holes featured highly promising intersections, including 33.1 metres at 2.5 g/t gold, 154ppm copper, and 2.4ppm Mo, from a drill depth of 9 metres.

This can be seen towards the middle of the following graphic, south of Landaluma and east of El Palton.

The 2 kilometre long anomalous corridor in the north-west of the El Huato anomaly (see above) includes several zones of favourable anomalism associated with an interpreted intrusion contact mapped from the recent geophysical results.

Reported results are from over 800 linear metres of chip channel sampling from natural drainage exposure and road cuts that trend from south-west to north-east and best transect the anomaly highlighted in the geophysics.

Significant intercept results in this corridor, located 1.2 kilometres south-east of the UN drill location include 27 metres of linear sampling, with a mapped width at surface of 15.3 metres averaging 1.13 g/t gold.

Approximately 820 metres to the south-east of the UN holes along the geophysical feature referenced above, two zones of channel sampling returned 13 metres at 0.46% copper and 12 metres at 0.38% copper.

On a 1.5 kilometre step-out from historical drilling in approximately the same direction, a 26-metre interval on a road-cut delivered gold and copper mineralisation associated with quartz-magnetite stockworks in a hornblende porphyry unit returning 26 metres at 1.13 g/t gold with 0.21% copper.

The interval included 8 metres at 2.6 g/t gold associated with the higher vein density material reported in mapping.

With previous work focused on naturally occurring outcrops and existing road-cuts, follow-up work planned will include additional trench activity along mineralised trends highlighted in the surface geochemistry where additional sampling will transect the interpreted mineralised trend as supported by the geophysical datasets.

Soil sampling programmes for systematic geochemical coverage are also planned to commence in the coming month.

Rock chip sampling points to high-grade gold potential

The recent sampling also identified several new high-grade gold veins located at various locations across the project.

Additional sampling and detailed mapping will be required to assess the potential of these targets.

The significant extent of mineralised quartz veining in several areas across the project is encouraging for conceptually targeting large scale porphyry systems.

The density of veining in some areas also provides the potential for high-grade gold mineralisation targets within the porphyry field.

Reported intercepts include extensions to the El Huato and El Palton prospect with better results from veins not recognised from previous sampling activity, including 4 metres at 16.4 g/t gold on vein extensions to the north-west of the El Huato prospect.

Some silver was also identified in quartz veining with one intercept from an area more than one kilometre north-east of the El Huato prospect returning 0.8 metres at 8.2 g/t gold and 16 g/t silver.

Interpretive results for the aerial geophysical survey have been received for the Copper Duke Project.

Several high priority targets for immediate follow-up have been clearly defined, and follow-up work includes soil grids over geophysical anomalies to better assess scale and tenor of targets, concurrent with mapping projects to confirm updated geological interpretation.

The ongoing fieldwork will provide additional data for the ranking of targets for maiden drill testing.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.