Titan awarded full ownership of Jerusalem Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a major development for Titan Minerals Limited (ASX:TTM) the company has been reinstated by the Ecuadorian Ministry of Mines as owner of the of the Jerusalén Concession (Jerusalem Gold Project), situated in a highly prospective area of Ecuador in close proximity to multi-million ounce gold deposits.

Titan has been engaged with the Ecuadorian Ministry of Mines since the acquisition of Core Gold in May 2020 and had presented its case to successfully reinstate the concession.

The Jerusalem concession was formally validated and registered late last week, finally ratifying a succession of developments that occurred when the area was the subject of artisanal mining, during which time the government declared a force majeure.

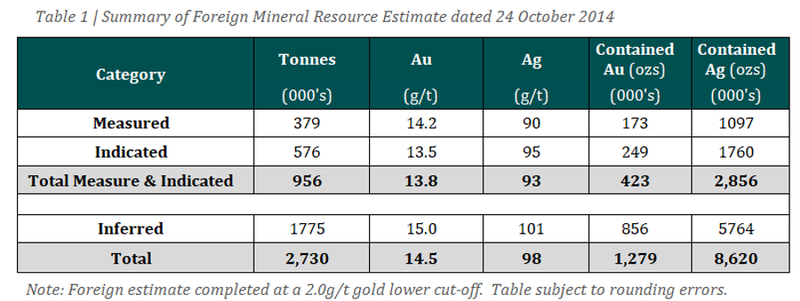

Titan is now in a position to progress the Jerusalem Project which boasts 1.3 million ounce of gold grading 14.5 g/t gold and 8.6 million ounces of silver grading 98 g/t (NI43-101) foreign estimate.

While not a JORC compliant resource, management believes that the Foreign Estimate is sufficiently reliable with estimation methodologies and data compilation work acceptable for methodologies used at the time of their estimation to provide the basis for a decision to deem the property to have merit for further exploration expenditure, but is not of a quality to underpin any economic reviews.

On this note, management confirmed that the categories of the mineralisation reported under NI 43-101 are similar to the JORC Code (2012) classifications and Titan considers the Foreign Estimate to be material to Titan, providing a basis to contribute funding for continued exploration activity and advancement of Jerusalem through additional desktop studies for the purpose of data validation and ranking of targets within the project area.

Close proximity to multi-million ounce deposits

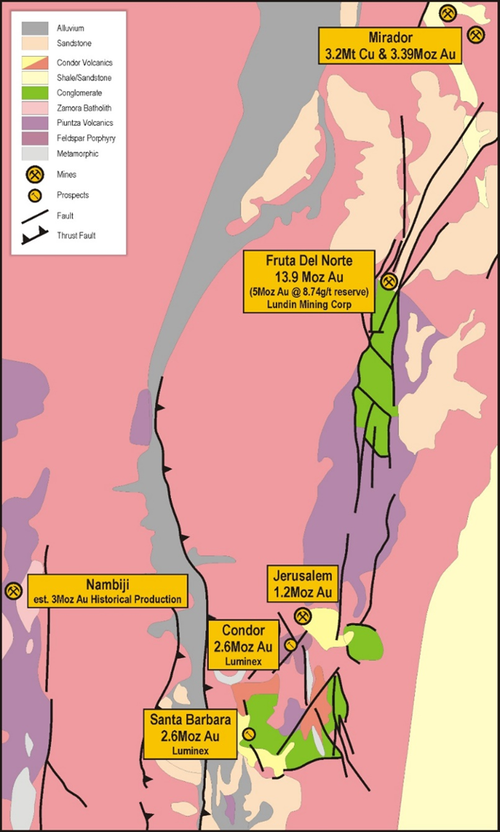

The Jerusalem Gold Project is hosted in the same Jurassic age terrane as the Mirador, Fruta del Norte and Condor deposits, situated between the latter two deposits approximately 40 kilometres south of Lundin’s Fruta del Norte Mine hosting over 13 million ounce gold resource.

As shown below, the concession is also contiguous with Luminex Resources’ Condor project to the south which hosts a 5 million ounce resource.

The Jerusalem Gold Project is a single concession located within 45 kilometres of the provincial capital Zamora in the Zamora-Chinchipe province.

The project area has been the focus of a number of exploration campaigns, reporting several mineral resource estimations since the late 1990’s and host to artisanal mining activity since the early 1980’s.

Several mineral resource estimations have been completed with two such estimates reported under the Canadian National Instrument 43-101.

As outlined below, the most recent technical report titled “Jerusalem Gold Project, Zamora Chinchipe – Ecuador” was released in October 2014.

The existing drill data sets for the project are reported to include 52 holes of drilling inside or intersecting the Jerusalem Gold project.

Titan has identified available files and assay logs for 47 diamond holes totalling 13,383 metres drilled, of which 30 holes are collared inside the Jerusalem Gold Project area.

The average length of the holes is 267 metres and the depth of the deepest hole collared in Jerusalén Concession is 614 metres.

Having in-depth data to work with should assist Titan in developing a focused exploration strategy at the project.

Commenting on Titan’s reinstatement as 100% owner of the Jerusalem Project, managing director Laurie Marsland said, “Return of the Jerusalem concession is a great result for our shareholders.

‘’Clearly, the concession adds significant value to our already exceptional portfolio of exploration and development assets.

‘’We look forward to placing boots on the ground to evaluate the full potential of Jerusalem and the opportunities it provides.

‘’A lot of work has been done since acquiring the Ecuadorian assets and I want to take this opportunity to thank all members of our team for their continued diligence and dedication to the task at hand.

‘’I think we will all look back on the acquisition of Core Gold as a remarkable opportunity.”

Dynasty remains Titan’s flagship project

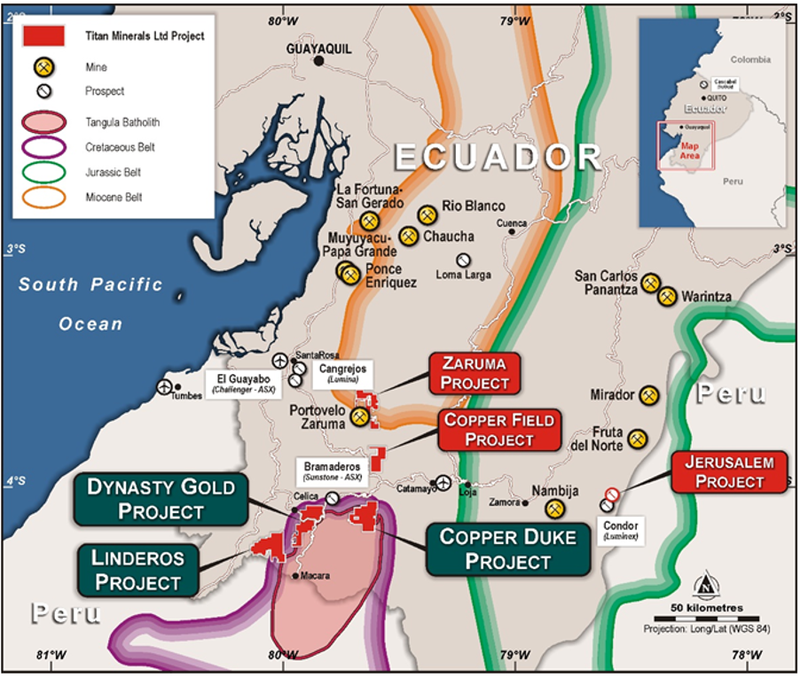

While the Jerusalem Project is an important asset for Titan, it is important to note that the group has a number of strings to its bow with the flagship Dynasty Gold Project also located in Ecuador, front and foremost.

The Dynasty Project consists of a Canadian NI 43-101 mineral resource estimate of 2.1 million ounces at 4.5 g/t gold.

Titan’s strategy is to conduct a drilling campaign across Dynasty and deliver a resource update in compliance with the JORC Code.

Titan also owns Copper Duke, which is a multi-phase, outcropping, gold rich porphyry copper project, exhibiting several encouraging characteristics.

The three projects can be seen on the following map with both Dynasty and Copper Duke lying to the west of the Jerusalem project.

Management has conducted an overhaul of Titan’s business in recent months, divesting non-core assets, as well as strengthening its balance sheet ahead of a much-anticipated drilling program.

Regards the latter, promising assay results were received in July, triggering a doubling in the company’s share price ahead of the drilling campaign.

The macroeconomic picture is also bright for Titan with the gold price still hovering in the vicinity of US$2000 per ounce, and silver settling around the US$27.50 per ounce mark over the last month after trading as high as US$29.83 per ounce at the start of August.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.