Thomson poised to establish new mineral resource estimate at Conrad

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Thomson Resources (ASX:TMZ) has engaged leading mining consultants, AMC Consulting, to collaborate with the company’s technical and metallurgical consultants to deliver new JORC mineral resource estimates for its 100% owned Conrad, Silver Spur, Webbs and Texas projects (collectively referred to as the ‘’Tablelands Projects’’).

Conrad will be the first new mineral resource estimate by Thomson, anticipated to be delivered in the September quarter.

The objective is to produce new mineral resource estimates or re-estimates that are JORC 2012 compliant, leveraging existing drilling combined with innovative geological models, metallurgical technologies, mining methodologies and current metal prices.

As has traditionally been the case, the silver price has tracked higher in keeping with the gold price, and the end of March it has gained approximately 15% - it is worth noting that while Thompson is essentially a silver play it can greatly benefit from a buoyant gold price as this drives down the costs of production.

These metrics will feed into feasibility studies that come on the back of the new resource estimate.

The mineral resource estimates will focus on the core commodities of silver and gold, but also encompass the fuller suite of critical and new technology metals present in these deposits that have not been considered in previous resource estimates including zinc, lead, copper and tin.

There is also considerable exploration potential to test high-grade shoots that are open at depth in the Conrad mineral resource area, and to explore for concealed shoots to the south-west and parallel lodes adjacent to the Conrad lodes.

Management also plans to drill test a series of satellite prospects in the district for additional silver-critical metal mineral resources.

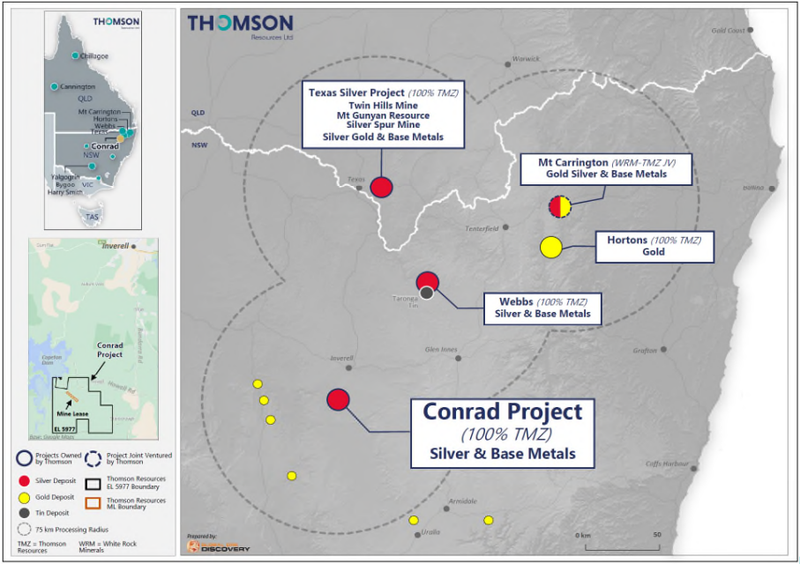

The following map shows the location of the assets that will be the subject of further exploration and recalibration.

What to expect from Conrad

The Conrad mine is the largest historic silver producer in the New England region of New South Wales, producing approximately 3.5 million ounces of silver at an average grade of 600 g/t with significant co-production of lead, zinc, copper and tin - not surprising then that Thompson has made it a priority in terms of establishing a new mineral resource estimate.

Recorded production from the Conrad Mine is 175,000 tonnes of ore at average grades of approximately 20,000 oz/tonne silver, 1.5% copper, 8% lead, 4% zinc, and 1.5% tin.

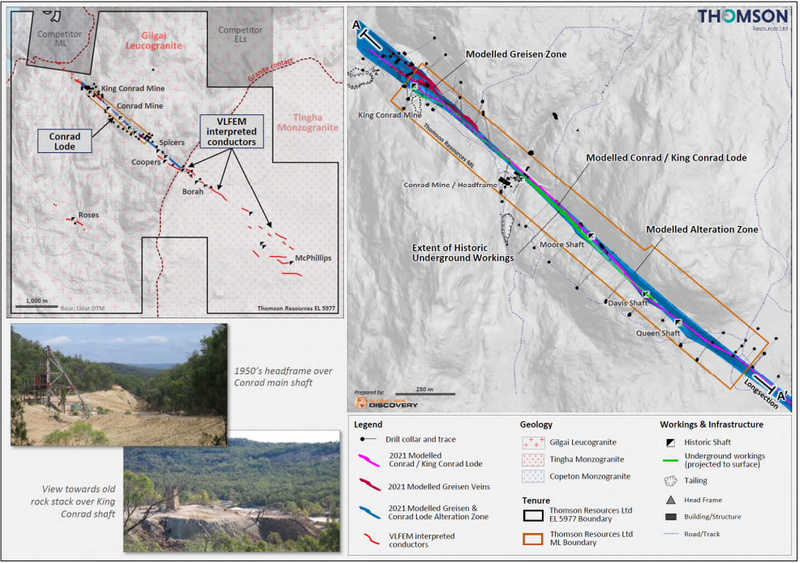

The following shows the Conrad lode system and mineralised trend.

The last round of systematic exploration at Conrad was conducted by Malachite Resources NL (now Pacific Nickel Mines, ASX:PNM) between 2002 and 2010, drilling 138 drill holes (mostly diamond holes) totalling 28,890 metres.

Mineral resource drilling was conducted over a 2.2 kilometre strike length with most holes intersecting the lodes between surface and a depth of 300 metres, although the deepest hole intersected the Conrad lode almost 500 metres below surface.

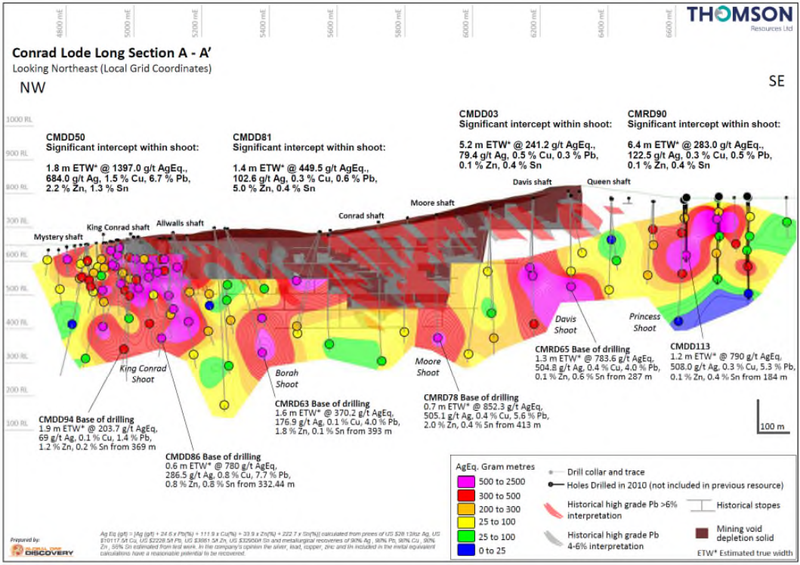

A number of the lodes remain open at depth as illustrated below.

Analysis of the drill hole data reveals a broad metal zonation along strike of the Main Conrad structure, with silver-lead-zinc mineralisation at the north-west end in the King Conrad and Conrad lodes and silver-copper-tin towards the south-east in the Princess lode.

The development of steeply plunging 0.2 to 6.5 metre wide ore shoots is an important feature of the Conrad deposit, with silver equivalent grades x lode width contoured along the Conrad long section indicating that high-grade mineralisation for most metals is hosted within spaced, south-east plunging shoots that are typically 50 to 300 metre strike length.

High-grade ore shoots within the Conrad lode system have currently been identified beneath the Conrad and Davis Shafts and a new shoot not previously mined (Princess shoot), which have returned high-grade intersections in exploration drilling and extend beyond the area of remnant mining voids.

These shoots remain open and untested to depths of more than 300 metres below surface and represent priority mineral resource extension drill targets.

Suffice to say, Thomson has plenty to work with at Conrad, suggesting that there is the potential for an impressive new mineral resource estimate to be delivered in the next few months.

Such a development would be a significant milestone for the company in terms of elevating its broader profile, but the implications could likely extend beyond the Conrad Project to speculation regarding what may be achieved at the other Tablelands projects.

Analysis to assist in identifying central processing hub

Discussing these upcoming developments, executive chairman David Williams said, “Thomson continues to advance the Fold Belt Hub and Spoke Strategy at pace.

"We have now initiated a systematic process to deliver new mineral resource calculations over the coming months, incorporating a fuller suite of metals and outlining the very attractive exploration prospectively of all our 100% owned Tablelands projects.

"Thomson is very pleased to be able to leverage the quality historic exploration from Malachite Resources NL, making Conrad the first “cab off the rank” where we anticipate a positive outcome from the new mineral resource calculation, encompassing silver as well as a suite of critical metals, such as zinc, copper, tin and lead.

"This work has also highlighted a number of exciting exploration targets and mineral resource extension targets that we will be pursuing.

"In parallel, we are advancing systematic analysis of the existing metallurgical test work of each project.

"This analysis will identify knowledge gaps and include a high-level processing pathway analysis to define, at a conceptual level, the process options for a potential central processing hub that would be at the heart of the Fold Belt Strategy.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.