Thompson Resources provides excellent exposure to rampaging silver price

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

We have only just covered gold’s rally to a multi-year high of US$1950, and as has traditionally been the case, silver is likely to follow suit.

Silver is currently priced at US$27.70 (AUD $35.72), a notable 22.6% increase from November lows of US$22.60 (AUD $29.13).

Yet, the price of this precious metal still remains below highs of US$29.26 (AUD $37.73) achieved in August 2020, suggesting we could see a sustained outperformance in the near to medium-term.

As COVID-19 induced volatility is likely to weigh on markets well into 2021, the precious metals are projected to remain a safe-haven target for investors.

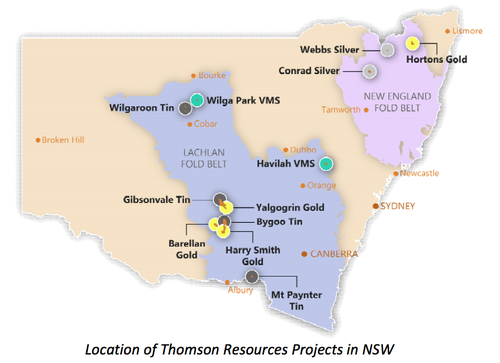

Thomson Resources’ (ASX:TMZ) dual exposure to gold and silver provides it with an impressive asset base, making it well worth considering in the current environment.

Thomson is a NSW focused explorer, with an existing gold portfolio and pending 100% acquisition of two transformational silver assets in the first months of 2021.

In a company update provided on December 24, Thomson advised that its exploration drilling programs for 2020 had concluded and the due diligence on the Webbs and Conrad Silver projects was nearing completion, with finalisation anticipated early January 2021.

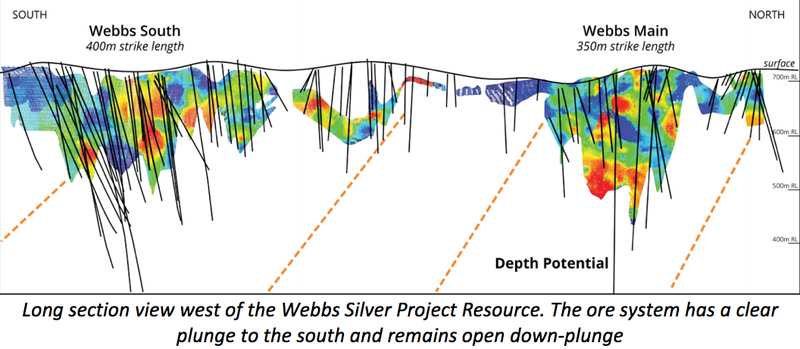

In November, Thompson announced it was to acquire a 100% interest in the Webbs Silver Project and Conrad Silver Project in the New England Fold belt in NSW, with the acquisition providing Thomson with a combined silver portfolio of about 33 million ounces.

The Webbs project is Australia’s highest grade undeveloped silver asset and will be complemented by the Conrad Silver Project.

Like Webbs, Conrad holds historical significance as it has a very large “in-ground value”; one which the previous owner demonstrated to have a value of almost $1 billion.

Both projects have seen historic silver production and have a resource defined compliant with the JORC Code 2004 as follows:

- Webbs: 1.5Mt @ 345g/t Ag Eq – 16.5 million ounces Ag Eq

- Conrad: 2.65Mt @ 206g/t Ag Eq – 17.5 million ounces Ag Eq

Thomson is aiming to further expand its silver resource base over the coming months, both organically and via acquisitions.

The company currently has a market capitalisation of about $40 million, and having recently raised $6 million, Thomson appears well-funded for near term exploration.

Aside from silver, Thomson has a number of quality intrusion related gold systems in NSW and Queensland, where it is undertaking extensive rolling drilling programs that build on previous high grade results.

Thomson is focused on building a strong silver resource base in 2021, whilst being supported by existing gold assets, clearly exhibiting the potential for share price upside in the coming year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.